The inability of the US Mint to meet public demand for gold and silver bullion products was discussed at a recent House Financial Services Subcommittee hearing. Testimony by industry experts revealed that the US Mint was losing an estimated one-third of potential bullion sales because they cannot meet demand.

The inability of the US Mint to meet public demand for gold and silver bullion products was discussed at a recent House Financial Services Subcommittee hearing. Testimony by industry experts revealed that the US Mint was losing an estimated one-third of potential bullion sales because they cannot meet demand.

For the past several weeks the US Mint sales figures for Silver Eagle bullion coins have been essentially flat. The US Mint sells its bullion products in bulk to authorized purchasers (AP’s). The AP’s resell the bullion coins to dealers who then sell the products to the public. The US Mint has been rationing the 2011 Silver Eagle bullion coins to AP’s, leaving one to conclude that the flat sales of Silver Eagles have been the result of Mint production constraints or supply shortages, rather than flat or reduced market demand.

On past occasions, the US Mint has cited the lack of adequate supplies of silver planchets as the cause for the continuing rationing of silver bullion coin sales. Earlier this year, the Royal Canadian Mint admitted that they were having significant problems in sourcing silver since huge demand was outpacing silver supply.

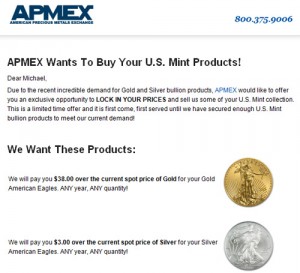

Combine rationing and surging demand and the obvious result is a severe shortage of physical gold and silver bullion products. Confirming this situation, American Precious Metals Exchange (APMEX), announced yesterday that they were seeking to purchase US Mint bullion products from their customers in order to meet “recent incredible demand for gold and silver bullion products”.

APMEX, one of the country’s largest precious metals dealers, offered to purchase American Gold Eagles and American Silver Eagles at generous premiums over spot prices in order to secure inventory. Despite the increase in the price of gold and silver, public demand obviously remains incredibly strong.

The American public has been provided with plenty of evidence that out of control deficit spending and money printing policies by the Federal Reserve are destroying the value of the paper dollar and they are acting accordingly (see Why There Is No Upside Limit To Gold and Silver Prices). A loss of confidence in paper money is fueling the rise in gold and silver prices as people seek to protect their wealth. Any pullbacks in precious metal prices should be viewed as another major buying opportunity.

The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million.

The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million. Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date.

Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date. After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week.

After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week. Amidst increased demand for physical gold and silver investment products, the United States Mint achieved record revenue from the sale of bullion coins during their 2010 fiscal year. Annual sales totaled $2.86 billion, which yielded net income of $55.2 million for the segment.

Amidst increased demand for physical gold and silver investment products, the United States Mint achieved record revenue from the sale of bullion coins during their 2010 fiscal year. Annual sales totaled $2.86 billion, which yielded net income of $55.2 million for the segment.