The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million.

The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million.

The United States Mint sells bullion products through a network of authorized purchasers. This small group of primary distributors may buy the coins directly in bulk quantities, based on the market price of the metals plus a mark up. The coins are then resold to other dealers and the public for broader distribution.

At the current time, the available products include one ounce Silver Eagles; one ounce, half ounce, quarter ounce, and tenth ounce Gold Eagles, and one ounce Gold Buffaloes. The 5 ounce America the Beautiful Silver Bullion Coins are expected to be released in late April. The status of the Platinum Eagle coins remains uncertain.

US Mint Bullion Coin Program Sales 3/16/2011 (ounces)

| Prior Week | Month to Date | Year to Date | |

| American Silver Eagle | 748,500 | 1,417,000 | 11,079,000 |

| American Gold Eagle | 24,000 | 42,500 | 268,500 |

| America the Beautiful Silver | 0 | 0 | 0 |

| American Platinum Eagle | 0 | 0 | 0 |

| American Gold Buffalo | 21,500 | 0 | 21,500 |

Total ounces of gold sold for the week ending March 16, 2011 was 45,500. This consisted of 24,000 ounces of American Gold Eagles and 21,500 ounces of the newly released 2011 Gold Buffalo coins. The latter are only available in one ounce size and are struck in 24 karat gold.

In the past week, the US Mint recorded sales of 748,500 ounces of American Silver Eagles. This is up from the sales of 668,500 reported for the previous period. Sales levels for silver bullion continue to be restrained as the US Mint imposes its allocation program, which rations the available supply amongst the authorized purchasers.

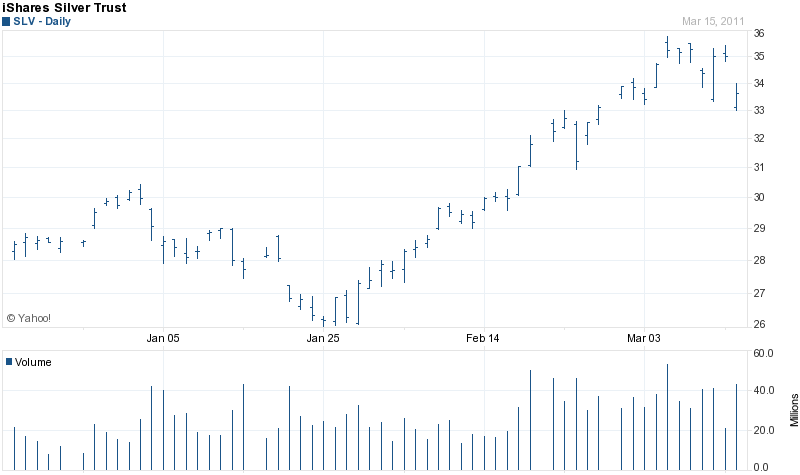

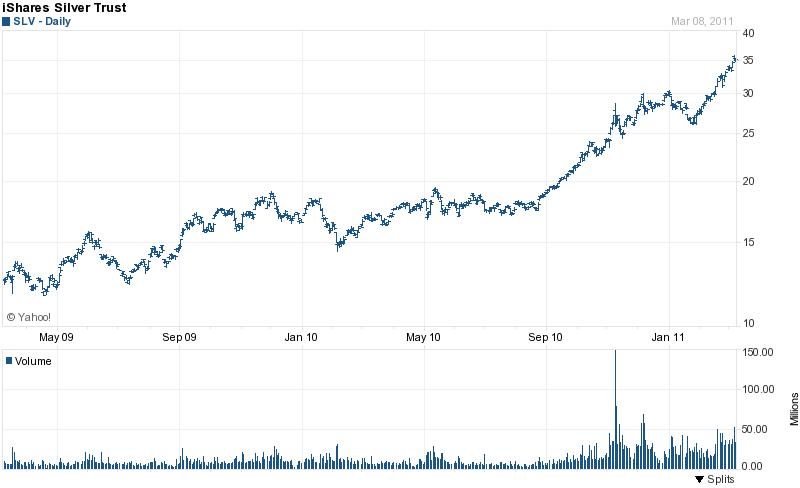

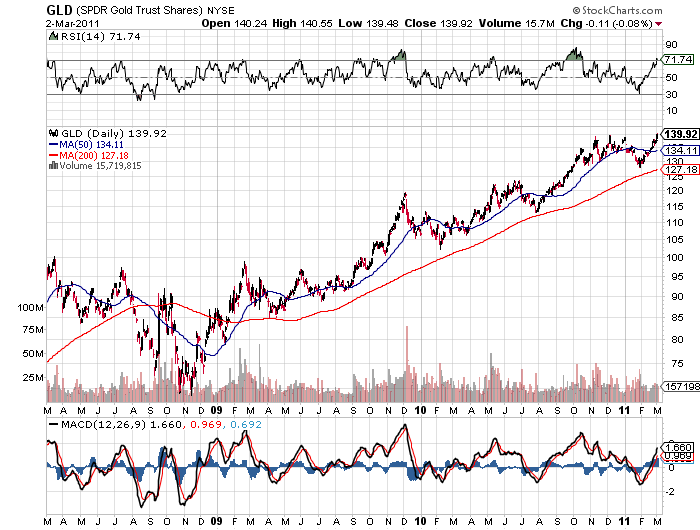

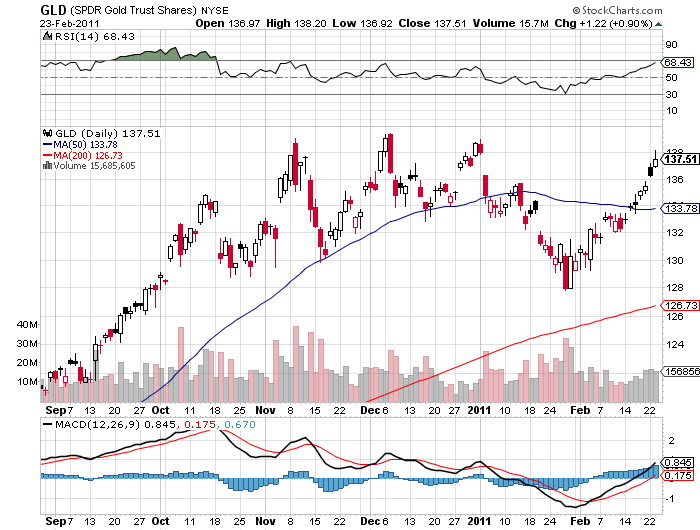

Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.

Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.

Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date.

Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date.

The pace of United States Mint gold and silver bullion coin sales picked up in the prior week. The US Mint currently has available one ounce American Silver Eagles in allocated quantities and unrestricted quantities of American Gold Eagles.

The pace of United States Mint gold and silver bullion coin sales picked up in the prior week. The US Mint currently has available one ounce American Silver Eagles in allocated quantities and unrestricted quantities of American Gold Eagles.

In the past week, the United States Mint sold 833,500 ounces of silver bullion and 31,500 ounces of gold bullion. Available products included the American Silver Eagle in one ounce size and the American Gold Eagle in one ounce or three fractional sizes.

In the past week, the United States Mint sold 833,500 ounces of silver bullion and 31,500 ounces of gold bullion. Available products included the American Silver Eagle in one ounce size and the American Gold Eagle in one ounce or three fractional sizes.