Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.

Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.

Silver holdings declined by a modest 28.85 tonnes since last week, after seeing increases of 209.54 tonnes and 189.29 tonnes in the previous two weeks. The year to date holdings in the SLV have increased by 23.64 tonnes. The value of silver held is valued now $12.22 billion based on holdings of 351.9 million ounces of silver.

Despite collapsing stock markets, a devastating earthquake in Japan, increased turmoil in the Middle East and a wild escalation of money printing by the Bank of Japan, gold and silver moved lower over the past week calling into question the safe haven status of precious metals.

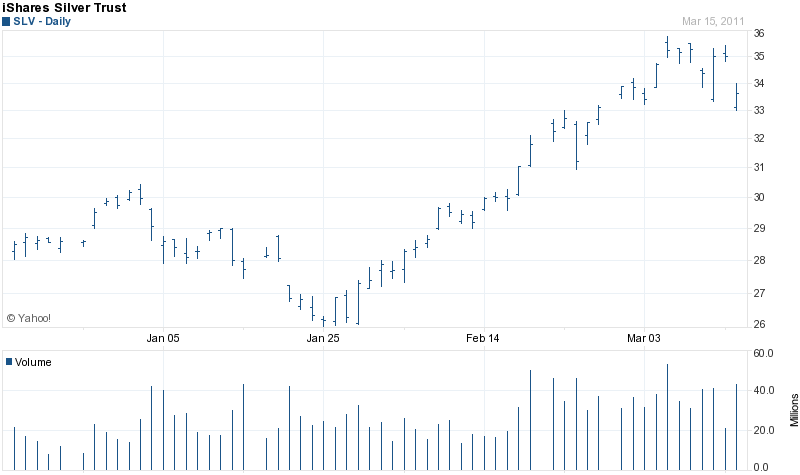

After a huge run up in the price of silver over the past year, it is not unusual to see a correction in prices. Since consolidating in January, silver prices had run up almost 40% over the past two months from $26 to $36 per ounce. Aside from normal profit taking after such a huge increase, some of the selling pressure in silver may be due to margin calls. Investors who have leveraged positions in the market may be liquidating positions to reduce overall exposure until markets stabilize.

Another factor that has ironically made the precious metals markets more volatile is the manner in which the SLV and GLD are structured. Fast rising prices of gold and silver attract speculators who do not have a long term commitment. The SLV and GLD allow effective ownership of the metals without the cost and inconvenience of taking physical positions. Although speculative purchases help to push prices up, the opposite will occur when the fast money crowd decides to take profits at the first sign of price weakness. Since last week, the price of silver based on the London Fix price, has declined by $1.44 or 4%.

SLV - courtesy yahoo finance

Asian stock futures are down virtually across the board as the situation in Japan deteriorates and spot gold and silver prices are also showing declines.

GLD and SLV Holdings (metric tonnes)

| 16-March-11 | Weekly Change | YTD Change | |

| GLD | 1,217.30 | +0.00 | -63.42 |

| SLV | 10,945.21 | -28.85 | +23.64 |

Holdings in the SPDR Gold Shares Trust (GLD) remained unchanged from the prior week at 1,217.30 tonnes with a year to date decline of 63.42 tonnes. The GLD currently holds 39.14 million ounces of gold valued at $54.86 billion.

Gold has been unable to mount a strong rally since hitting an all time intraday price of $1,440 in early March. It may be just a question of time before gold resumes rallying based on continued weakness in the U.S. dollar and virtually unlimited money printing operations by central banks worldwide. The supply of currencies can be increased with virtually no limit as sovereign governments bump up against the limits of debt expansion. The supply of gold and silver is limited and will always hold intrinsic value without counter party risk. The choice will become apparent to more investors as economic conditions continue to deteriorate.

Speak Your Mind