Ten years ago, one ounce silver bullion coins could be purchased for around $7 each. This reflected market silver prices below the $5 level. As recently as one year ago, the prices for one ounce bullion coins had risen to around $18 each. Following the dramatic rise in the silver price experienced in the last five months, newly minted one ounce silver bullion coins from a major world mint are now priced around $39, assuming a purchase in quantity.

Silver has been called “poor man’s gold”, but after the significant rise in price, even the traditionally smallest sized coins are becoming expensive. Thus, it was only a matter of time before smaller sized coins would be introduced.

Last month, the Perth Mint of Australia began selling one-tenth ounce Silver Koala coins. Previously, this series had been offered in sizes ranging from one-half ounce to 1 kilo. Other numismatic and bullion coin offerings from the Perth Mint have also been available in sizes starting at one-half ounce, but this seems to be the first instance that a one-tenth ounce size has been available.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

The Perth Mint’s website shows the one ounce 2011 Silver Koala priced at US $41.88, reflecting a premium of $5.57 or 15.34%. The one-tenth ounce version is priced at $13.76, reflecting a premium of $10.13 or 279%! (All prices at time of post.)

Obviously when purchasing silver for investment purposes, it makes sense to pay the lowest premium possible. That way, you will get more silver for your money and won’t risk seeing contraction of premiums offset gains.

The move by the Perth Mint to smaller sized silver coins is certainly an interesting one. How long will it be before other world mints follow suit?

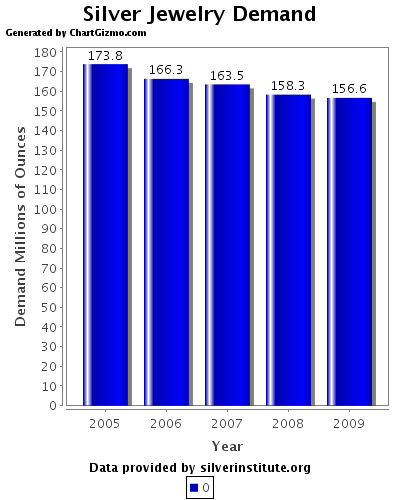

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

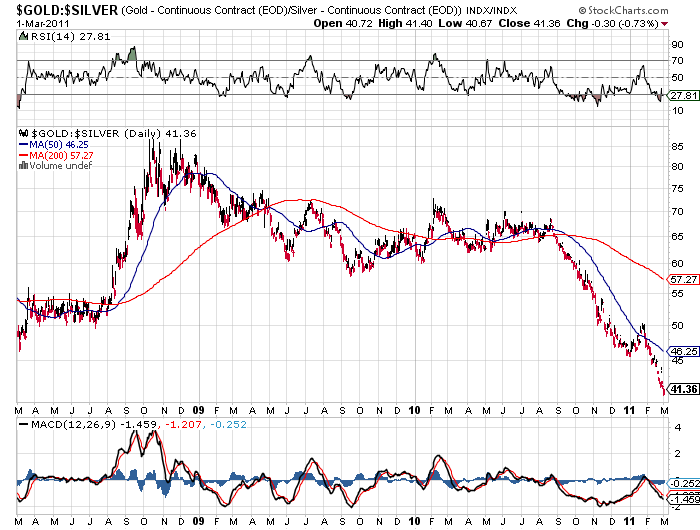

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

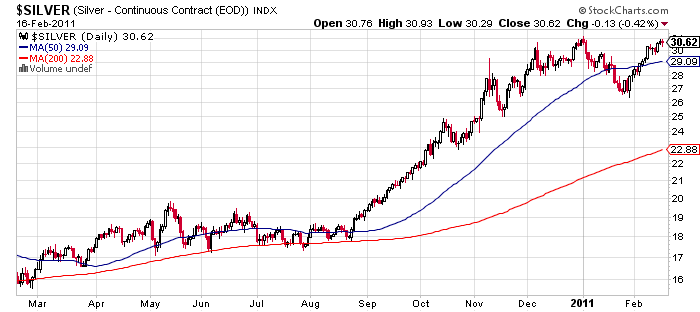

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

The pace of sales for the United States Mint’s American Gold Eagle and American Silver Eagle bullion coins jumped in the past week. This propelled silver bullion sales far into record territory for the month of January.

The pace of sales for the United States Mint’s American Gold Eagle and American Silver Eagle bullion coins jumped in the past week. This propelled silver bullion sales far into record territory for the month of January. For much of the past three years, the United States Mint has struggled to keep up with the boom in demand for physical precious metals. Although they have been required to mint and issue American Gold and Silver Eagle bullion coins in quantities sufficient to meet public demand, they have often fallen short of this mandate, resorting to sales suspensions and rationing programs.

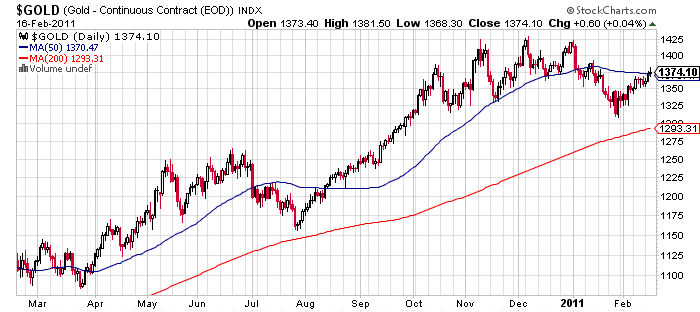

For much of the past three years, the United States Mint has struggled to keep up with the boom in demand for physical precious metals. Although they have been required to mint and issue American Gold and Silver Eagle bullion coins in quantities sufficient to meet public demand, they have often fallen short of this mandate, resorting to sales suspensions and rationing programs. Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver. Sales of the 2011 Silver Eagle bullion coins will begin on Monday, January 3, 2011. This will mark the first day that authorized purchasers may place orders for the coins with the United States Mint.

Sales of the 2011 Silver Eagle bullion coins will begin on Monday, January 3, 2011. This will mark the first day that authorized purchasers may place orders for the coins with the United States Mint. Nine out of eleven of the US Mint’s authorized purchasers have decided to go along with the new terms and conditions covering the distribution of the America the Beautiful Silver Bullion Coins.

Nine out of eleven of the US Mint’s authorized purchasers have decided to go along with the new terms and conditions covering the distribution of the America the Beautiful Silver Bullion Coins.