Yup, that is the story. The following arguments explain why Charles and I think gold will plummet to around $500 per ounce. Also, after my luncheon date with Elvis, I have a large bridge for sale. If you are interested and willing to make a SERIOUS OFFER, see below.

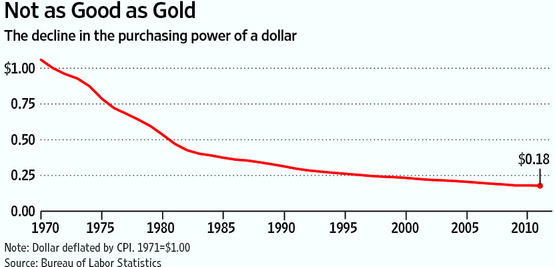

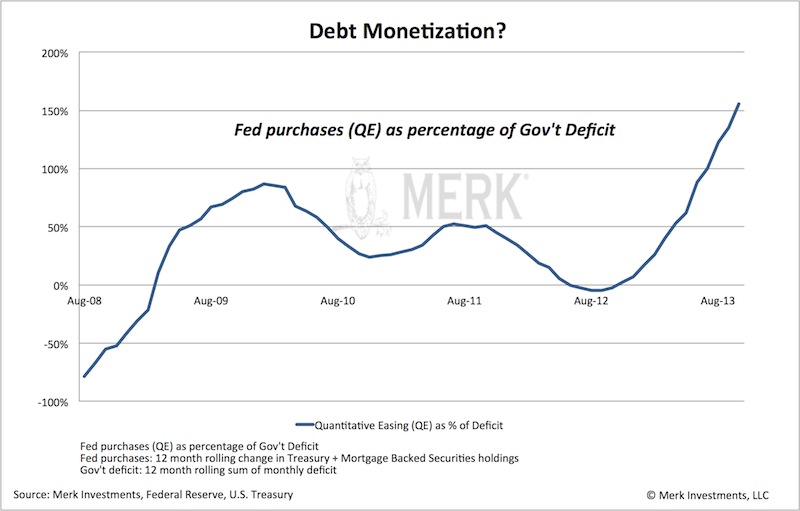

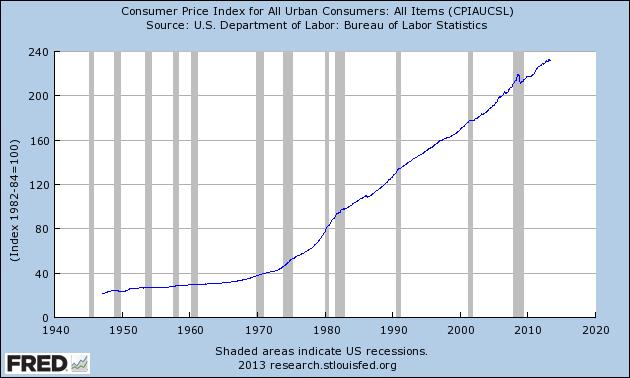

The price of gold has roughly followed (up, up, and away) the growth of the U.S. national debt since 1971. The national debt is rising like 8% per year or like $1,000,000,000,000 per year. But don’t jump to the conclusion that gold prices will continue rising along with the debt! Charles Ponzi and I have faith in congress, lobbyists, and the sincerity of the budget process. We believe the national debt will rapidly fall due to the positive economic stimulus from ObamaCare, from actual budget cuts, and therefore gold should drop to new lows. Mr. Ponzi thinks it could go real low – like $450 or $500.

courtesy: www.michaelianblack.net

The other day an out-of-work economist friend and I had lunch. He is a bright guy and he used to work for one of them central banks, or maybe a rating agency, or the IMF. Anyway, the subject of economic forecasting came up, he got this “far-away” look in his eyes, and he started babbling. Perspiration formed on his forehead, and his left eye started twitching. The mood was weird, like really, really strange. I ordered a fourth martini for each of us and gently suggested, “Show me how it is done.” He pulled out a handful of bones from his coat pocket and tossed them onto the table. He babbled something about magic Emu bones from the 19th century. Then his eyes bugged open wide and he started panting. He studied the bones for at least a minute and then pronounced, with a slur in his raspy voice, gold will drop to $496 by the end of 2014. Now folks, that was the most compelling forecast I have ever heard. Gold is going much lower, say to $496, fairly soon. Believe it!

It has been widely reported that nearly 50,000,000 people in the U.S. are receiving food stamps or, as it is now called, the SNAP program. I figure those people need the program to help buy food, and that means their job market is still weak. No jobs, no excess cash. No excess cash, no gold purchases by food stamp recipients. No gold purchases, and the price drops. Simple! This is one more reason why the price of gold will drop much lower – back down to the $450 – $550 range.

I read that the recent agreement with Iran was a breakthrough in middle-east politics – sort of a win-win for all parties involved, except for maybe the native tribes of northern Canada. I checked my perception with a bartender friend who works in D.C. where congressional staffers get drunk and hustle lobbyist funding. Based on what he overheard from staffers, he agreed. But I needed confirmation, so I called the White House and read several editorials in liberal newspapers and they all confirmed the triumphant break-through. Stay with me here! If the mid-east problems are solved and the political premium on the price of crude disappears, then gasoline will be a lot less expensive, people will have more confidence in the economy, and, like totally obviously, they will sell gold and buy lots more stuff. I figured I had another big winner – sell gold, sell oil company stocks, and buy consumer stocks. This new mid-east agreement is another big reason why I think gold will drop below $550 per ounce in the upcoming year.

Congressional approval ratings are so bad that I bet I can find more people who have had lunch with Elvis than who think congress is doing a bang-up good job. I figure it is high time for Elvis to make a comeback national tour and for congress to better manage the economy and the dollar. Hence, gold should drop to new lows. Look for $450 – $500 and a new Elvis love song.

Everybody knows the Chinese have been buying all the gold they can grab for the past several years. Even with all their buying, the price of gold has dropped a bunch. Now this is simple – if the price dropped when the Chinese were aggressively buying, how much further will it drop when they slow their buying or totally stop buying gold? Why do I think the Chinese will stop buying gold? Simple – they have bought so much in the past five years, they gotta stop soon – the world might even run out of gold. I figure 2014 is the year they give up on gold purchases and that will cause the price of gold to plummet, maybe even below $400.

I also saw an article in a newspaper called the “D.C. Rag” about a new gold rush. The story ranted on about this scandal of insider democrats buying land in California. They didn’t want the land but they wanted the massive deposit of gold that had been recently discovered there in a shallow mine. The “Rag” mentioned that the only problem was the area was overrun by the native Sasquatches, but I’m confident those congressmen will figure something out and get the gold. More gold mined, more supply, lower prices! This stuff is not difficult. Gold is going down!

So there you have it! Gold is gonna drop hard in 2014. Why? Simple! The national debt will go down because Charles Ponzi believes ObamaCare is a good plan and that congress will cut the budget and actually produce a surplus, a weak job market is limiting gold purchases by the people on food stamps, an economist predicted that gold will drop to $496 in 2014, we expect peace in the mid-east, the Chinese will reduce their purchases of gold in 2014, and a new supply of gold has been discovered in the Sasquatch zone of California. I figure it is “an open and shut case.” Gold prices are going through the floor, and I just proved it, with help from Elvis, Charles Ponzi, my economist and bartender friends, and simple logic.

Now, about that bridge I have for sale, I can give you a 30% discount if you act today. Serious offers only! Send your information requests to:

GE Christenson

aka Deviant Investor

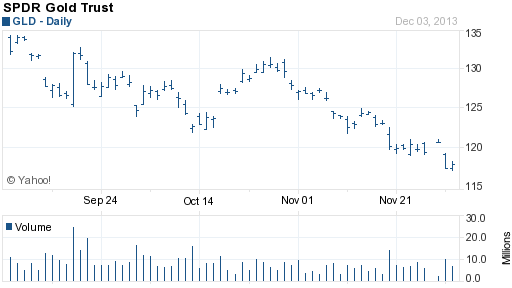

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.

By: GE Christenson

By: GE Christenson