Let’s back away from the “smaller” questions like:

Let’s back away from the “smaller” questions like:

- Will the Fed taper or not?

- Is Obamacare a disaster or just a huge problem?

- Is the S&P 500 index due for a correction?

- Is the U.S. economy improving?

- Why is most of the rest of the world angry with the U.S.?

- If inflation is so low, why are my expenses increasing so rapidly?

- Is the NSA spying on everyone’s cell phone and computer?

Let’s look at the really big picture!

- The Fed wants higher stock prices. The Fed serves the needs of the wealthy and the wealthy have a large chunk of their wealth invested in stocks.

- The Fed wants low interest rates, which keep bond prices high, because the wealthy are heavily invested in bonds.

- The Fed and the U.S. government need low interest rates so the U.S. government’s debt service costs remain low, real estate is attractive, credit is inexpensive, and investors are forced to reach for yield, buy stocks, and maintain the bond and dollar bubbles.

- The U.S. government wants to spend money, lots of money, and avoid the consequences. Congress lives to buy votes, increase their power, and collect “contributions.” Lobbyists want a piece of the action for themselves. Corporations want to “influence” legislation to increase their profits. Business as usual. Spend. Spend. Spend!

- Central banks, especially the Fed, and western governments want lower gold prices, so their unbacked paper money still appears valuable, so the U.S. dollar retains relative value against other currencies, and so the world will continue sending goods and commodities to the U.S. in exchange for paper dollars and T-bonds.

Can the Fed and the U.S. government manage the markets to achieve low interest rates, higher stocks, low inflation, low gold prices, and a strong dollar, all while spending much more than revenues support and thereby running the national debt up to insane levels? My assessment is NO!

What does the data indicate?

- Assume that the world changed around the 9th month of 2001. Stocks had peaked and crashed, the Twin Towers came down, government expanded, and the U.S. declared a War on Terror. There were bubbles to be inflated, massive debts to be incurred, no-bid contracts to be awarded, huge profits to be generated, and stories to tell.

- Assume that the spending, increasing debt, bubble blowing, and military-industrial profit generating machine have been operating more intensely since 2001.

- Assume that “this time is NOT different” and that our current fiscal and monetary trends will continue for several more years.

Gold and the S&P 500 Index

Graph 1 shows 25 years of the smoothed* monthly price of gold divided by the smoothed value of the S&P 500 index. The ratio went down from the 1980s to about 2001 and rose thereafter. Until 2001 investors wanted financial assets more than real assets like gold and silver. Since then the price of gold has risen more rapidly than the S&P 500 index. The Fed wants the S&P to keep rising and so we should expect QE will continue in the hope that it will levitate the stock markets. Unless this time is different, gold will continue to rise.

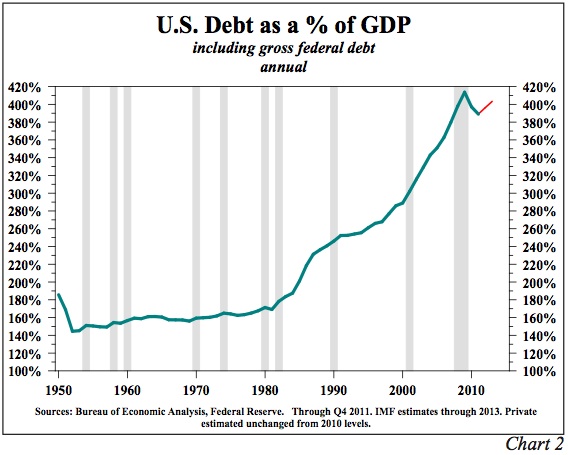

Gold and the National Debt

Graph 2 shows 25 years of the smoothed* monthly price of gold divided by the official national debt in tens of $Billions. The ratio went down from the 1980s to about 2001 and then started rising. Even though debt has been increasing rapidly since 9-11, the price of gold has increased even more rapidly since its bear market lows in 1999/2001. Knowing that politicians, corporations, and banks need the spending and debt to continue increasing, we should expect massive deficits and ever-increasing national debt – growing about 10 – 12% per year. Unless this time is different, gold will also continue to rise.

Gold and the Dollar Index

Graph 3 shows 25 years of the dollar index multiplied by smoothed monthly gold prices. In broad terms a higher dollar usually goes with lower gold prices (when priced in dollars) and vice-versa. The product removes most of the currency variation and shows the big picture trend for gold. Since about 2001 the trend has been upward. Unless this time is different, gold will continue to rise.

The Fed has incentive to continue QE – to levitate the stock and bond markets and keep interest rates low. But QE will eventually weaken the dollar with excess supply, reduced demand and reduced value. Expect gold to rise in price.

The politicians want to spend money, lots of money, and will borrow and print until they can’t. The national debt and the price of gold will increase.

Summary

Unless the financial world has materially changed, we can expect that an increasing S&P index will correlate with higher gold prices, and an increasing national debt will correlate with higher gold prices. Similarly, continued QE will correlate with a lower dollar and higher gold prices.

They say “don’t fight the Fed” and “don’t fight the administration.” Even if it looks like a train wreck during amateur hour, the incentives motivating both the Fed and the government all align with higher gold prices.

Maybe the Fed and the politicians can’t get everything they want, but we expect they will be happy with strong bond prices, higher stock prices, and more spending. Those conditions will co-exist with higher gold prices. Consequently we expect the Fed and the politicians understand that the price of gold must go much higher. Sacrifices, such as higher gold prices, must be made to maintain the “full steam ahead” status of our national train wreck in progress – deficit spending, ever-increasing debt, QE-forever, more wars and currency debasement.

Do you own a sufficient quantity of physical gold and silver?

More Thoughts:

Created Currencies…Are NOT GOLD

GE Christenson

aka Deviant Investor

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

The

The  Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

In an

In an

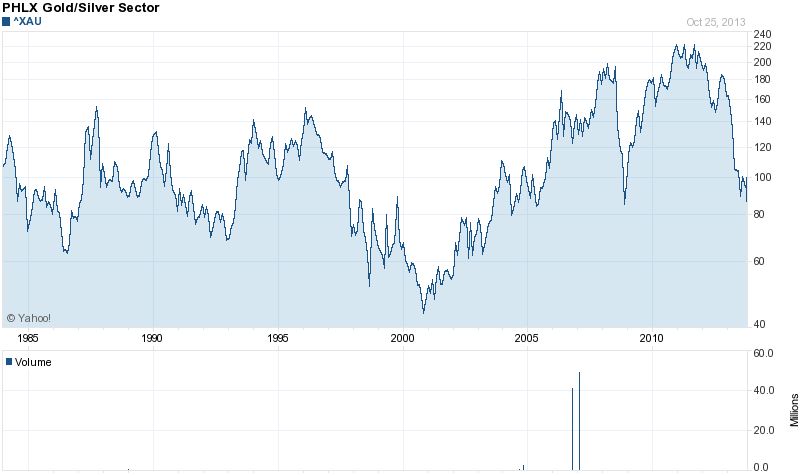

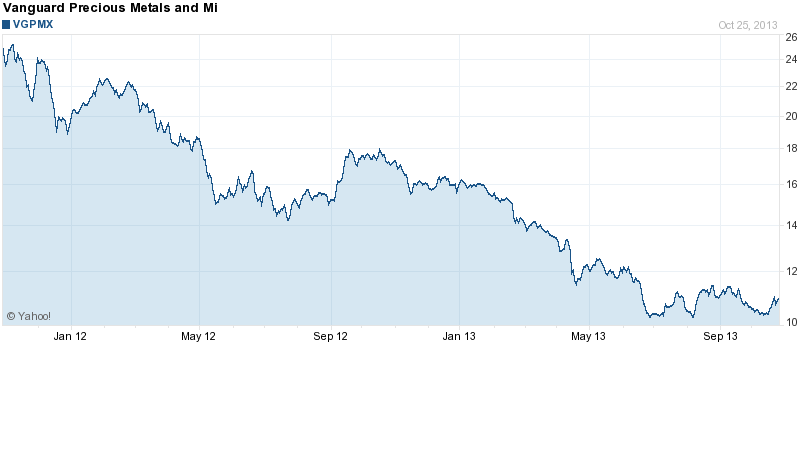

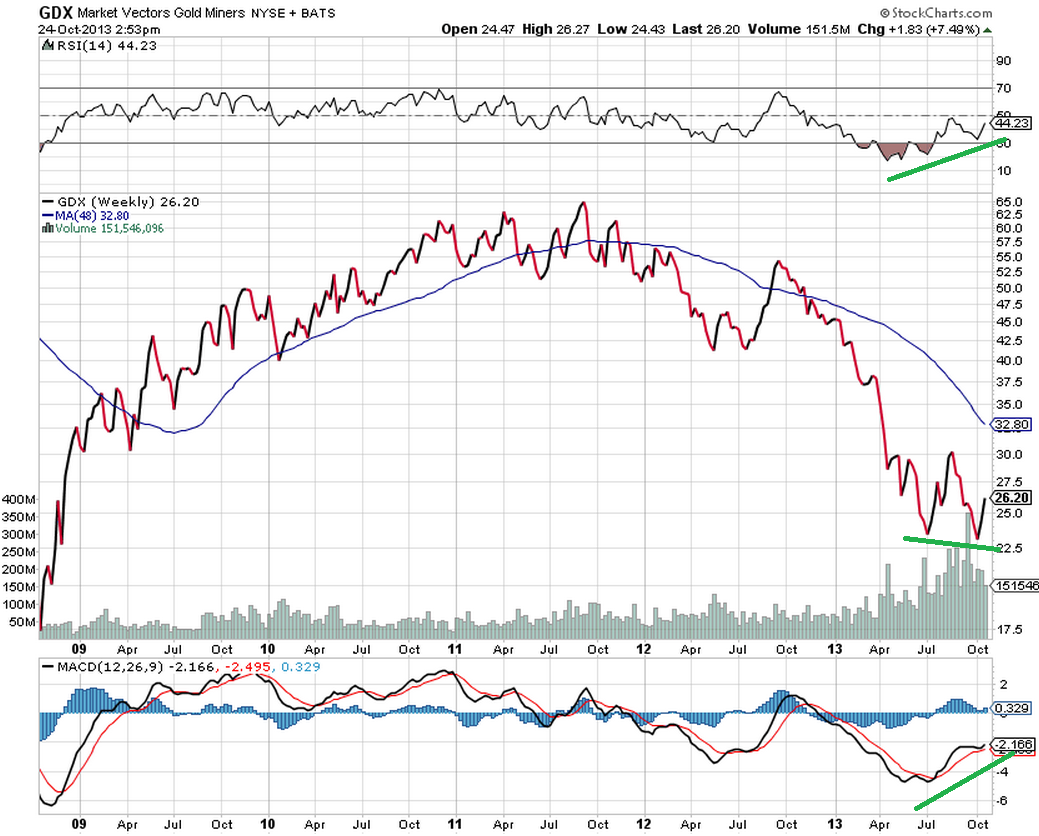

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

By: GE Christenson

By: GE Christenson

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.