Sales of the US Mint American Eagle gold bullion coins soared in June to 48,500 ounces from the previous month of May during which sales totaled 35,500. Demand for gold bullion coins, however, has been relatively soft compared to previous years.

Sales of the US Mint American Eagle gold bullion coins soared in June to 48,500 ounces from the previous month of May during which sales totaled 35,500. Demand for gold bullion coins, however, has been relatively soft compared to previous years.

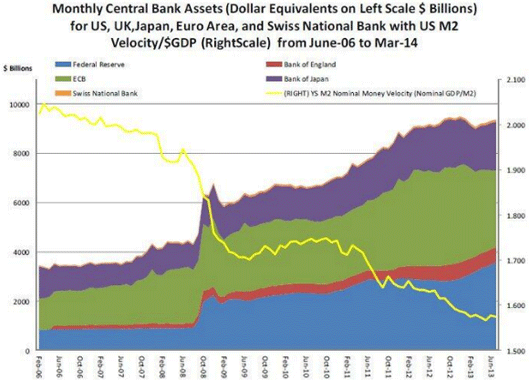

June sales of the gold bullion coins were down from the year ago period when 57,000 ounces were sold during June 2013. At the current sales pace 2014 annual sales of the gold bullion coins would come in at roughly 500,000 ounces down significantly from total sales of 856,500 ounces during 2013. Sales of the American Eagle gold bullion coins hit a record high of 1,435,000 ounces during 2009 when the financial system was still in intensive care and the Federal Reserve initiated a massive money printing campaign to “save” the world.

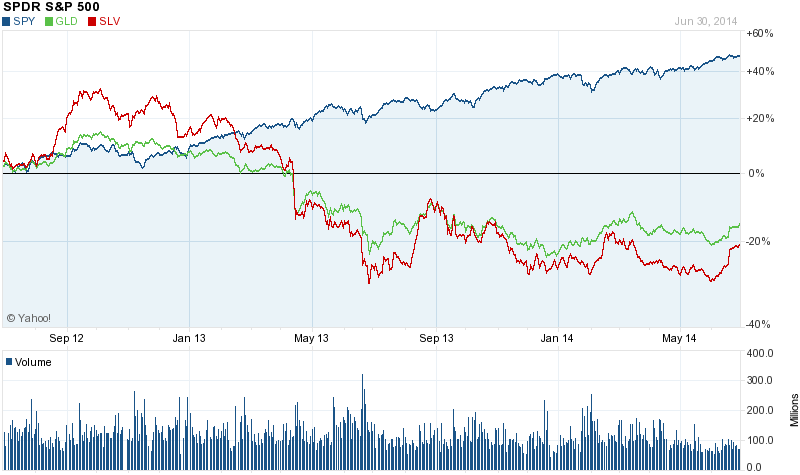

Gold should always have a presence in an investment portfolio but since mid 2011 stocks have become a powerful competing investment alternative to precious metals. The easy money policies of the Federal Reserve have served to inflate asset values of stocks and bonds to dangerously overvalued levels according to many analysts.

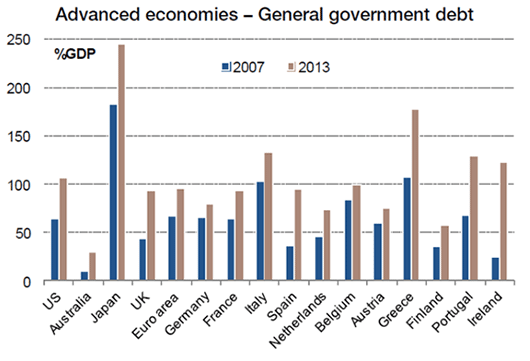

Will stocks and bonds continue to enjoy easy gains of 20 to 30 percent a year or will the entire house of cards built on easy printed money come tumbling down when the world least expects it? Just this week the Bank for International Settlements (a consortium of the world’s biggest central banks) issued an alarming warning about growing levels of debt and the dangerous unintended consequences of zero interest rate policies.

The report issued by the Bank for International Settlements (BIS) noted that “Overall, it is hard to avoid the sense of a puzzling disconnect between the markets’ buoyancy and underlying economic developments globally.” The head of the BIS’s economic department further noted that “Financial markets are euphoric, in the grip of an aggressive search for yield…and yet investment in the real economy remains weak while the macroeconomic and geopolitical outlook is still highly uncertain.” The BIS noted the obvious when it cautioned that the ultra low levels of interest rate due to financial repression by central banks is encouraging further borrowing but an eventual rise in interest rates will amplify the problem of excessively high levels of debt, a consequence that no one seems prepared for.

So who needs gold when stocks are heading straight up and the consensus is that this wealth machine of easy money and asset inflation is unstoppable?

At some unknowable point in time and for some unpredictable reason the euphoria of the credit bubble created by the central banks will burst just as all bubbles in history have burst. The resulting financial chaos that ensues from the bursting of a central bank induced credit bubble will be calamitous since the situation could well become uncontainable by world monetary authorities. As the BIS notes, “keeping interest rates unusually low for an unusually long period can lull governments into a false sense of security” whereby they continue to borrow vast amounts of low cost funds to such excess that further expansion of government borrowings become impossible. Governments that are unable to finance additional borrowings when the next economic downturn comes will turn to their only savior – the central banks. Unable to stimulate the economy through rate cuts since rates are already at zero, central banks will be forced to monetize government debts on a monumental scale and when this day arrives we should all want to have a heavy percentage of our portfolios in gold.

The current mania for paper assets seems to have even infected China and India who have historically turned to gold as a safeguard against profligate governments and paper money backed only by the promises of lying politicians. According to the Wall Street Journal demand for gold is expected to decline in both China and India during 2014.

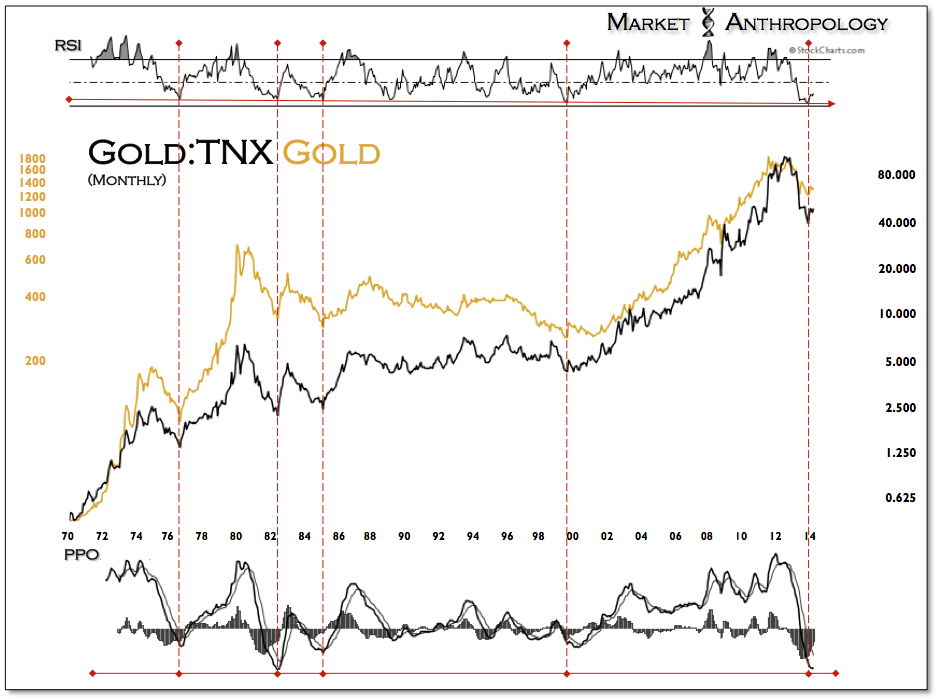

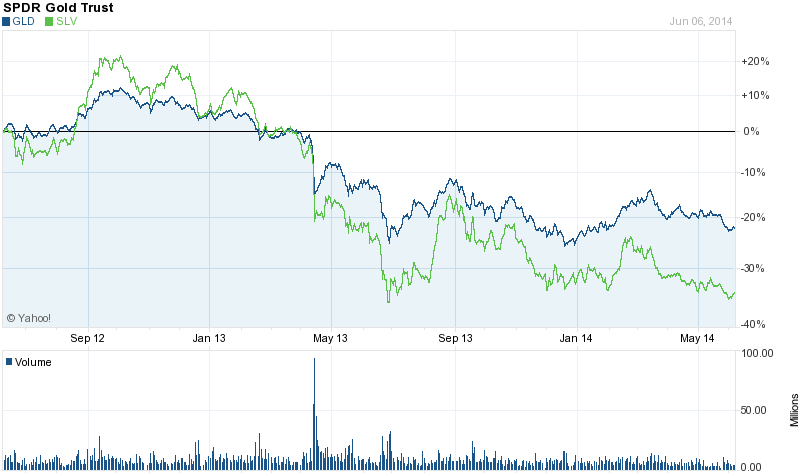

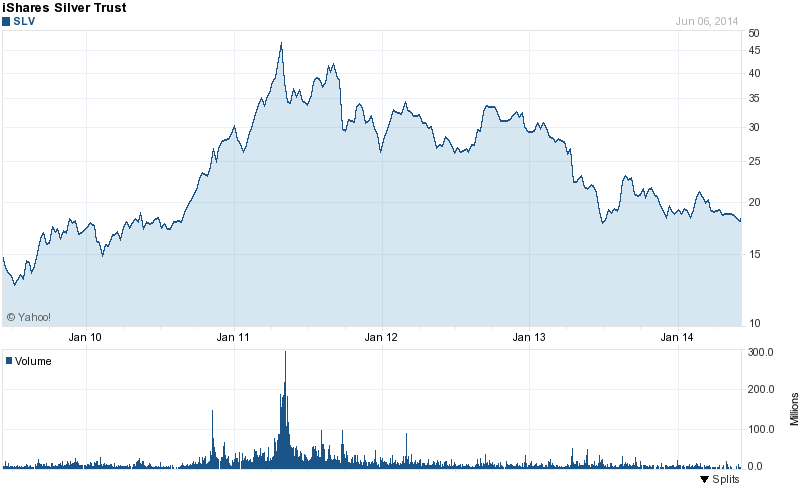

The crowd seems to be leaning heavily towards paper assets and away from gold, suggesting that a turnaround is probably forthcoming. Gold has already had its correction and is now on track for what will probably be a historic rally. Consider that despite widespread bearishness on gold, the price during 2014 has held its own and is actually up on the year. From a price of $1,225 per ounce at the start of the year gold has moved up to $1,326, not exactly a sign of weak demand.

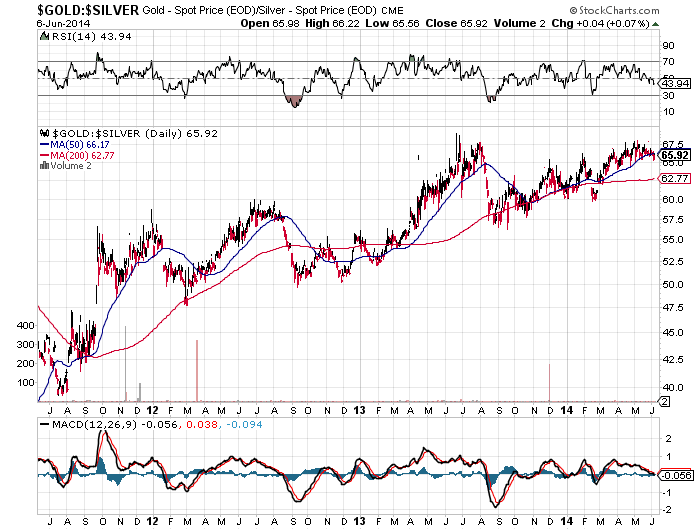

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.