As discussed in a previous post, sales of the American Eagle silver bullion coins were on track to post record sales volume in 2013. It’s now official – sales of U.S. Mint silver bullion coins surged past the old record set in 2011 and are track to hit a record high of 45 million ounces in 2013.

As discussed in a previous post, sales of the American Eagle silver bullion coins were on track to post record sales volume in 2013. It’s now official – sales of U.S. Mint silver bullion coins surged past the old record set in 2011 and are track to hit a record high of 45 million ounces in 2013.

According to the U.S. Mint year to date sales of the American Eagle silver bullion coins total 40,175,000. The previous record was set in 2011 when sales of the silver bullion coins came in at 39,868,500. Based on monthly sales volume, the U.S. Mint might sell an additional 5 million coins by year end.

The American public loves the American Eagle silver bullion coins and can’t seem to get enough of them. After an exuberant rise to almost $50 per ounce during 2011 silver has corrected in price to the low $20’s. Although the decline in silver has elicited numerous bearish commentary in the mainstream press, long term investors seem to be doubling down as the price of silver price has become irresistibly cheap. Yearly sales of the silver bullion coins have increased by almost 500% since 2008.

Total yearly sales of the American Eagle silver bullion coins are shown in the chart below with the 2013 total as of November 12, 2013.

2013-W Proof Silver Eagle

In addition to the silver bullion coins the U.S. Mint produces a proof silver eagle coin. According to the Mint News Blog the 2013-W Proof silver Eagle has already sold out and 2013 is the third year in a row that this popular product has sold out well before year end.

Sales for the 2013 Proof Silver Eagle originally began at the US Mint on January 24, 3013. Opening orders were slower compared to the prior two years, however the pace of orders remained brisk throughout the year. The coin typically represented one of the US Mint’s top sellers on the weekly sales reports.

Recently, weekly sales had spiked, with 29,613 units orders in the previous reporting period and an indication of 29,025 units ordered in the week just ahead of the sell out. Sales data shows total orders at 880,030 units. This is a bit higher than recent prior years.

In 2011, the individual proof Silver Eagle had sold out on November 22 after reaching sales of 850,000. In 2012, the sell out had occurred on November 13 when sales had reached 819,217.

The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

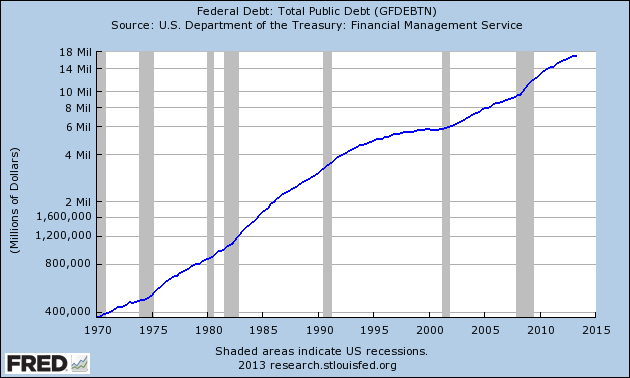

The U.S. Mint American Eagle silver bullion coins remain a popular method of building wealth with periodic purchases. The American public can’t seem to get enough of the bullion coins and the desperate actions of global central banks to keep the financial system afloat with a deluge of paper money can only cause more financial anxiety and more silver purchases going forward.

Let’s back away from the “smaller” questions like:

Let’s back away from the “smaller” questions like:

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records.

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records. The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs. Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

The

The  In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

In an

In an