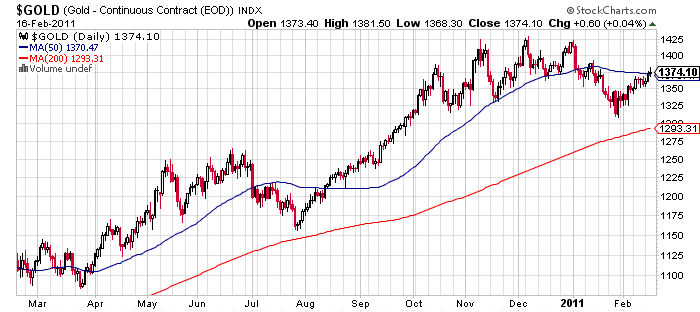

In the view of many, recent world events should have resulted in soaring gold prices as investors flocked to gold, the ultimate safe haven investment. Oddly enough, major sell offs in world stock markets due to turmoil in the Middle East and a massive earthquake in Japan did nothing to push gold above its all time closing high of $1,440 hit in early March.

In the view of many, recent world events should have resulted in soaring gold prices as investors flocked to gold, the ultimate safe haven investment. Oddly enough, major sell offs in world stock markets due to turmoil in the Middle East and a massive earthquake in Japan did nothing to push gold above its all time closing high of $1,440 hit in early March.

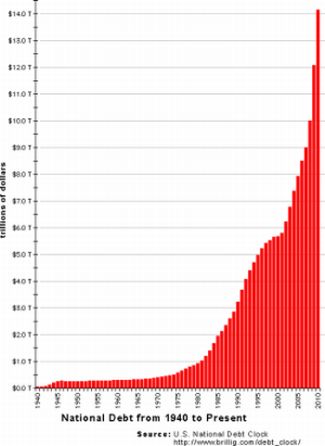

As if that weren’t enough, the Bank of Japan flooded its financial markets with yen equivalent to half a trillion U.S. dollars while the U.S. Federal Reserve continued its own money printing campaign to supplement its zero interest rate policy. In addition, many suspect that in order to prevent Ireland, Greece, Portugal and Spain from defaulting on their sovereign debt, the European Central Bank will have no option but to resort to the printing press.

Traditionally, gold is held in a portfolio due to its negative correlation with returns from more traditional investments such as stocks and bonds. Gold, as a safe haven investment, is supposed to offset the declines in other asset classes that occur during times of great economic distress. Exactly how did gold perform relative to the financial markets, using the Dow Jones as a benchmark?

The recent sell off in the Dow Jones Industrial Average resulted in a loss of over 550 points or a 4.5% decline from the yearly high reached in early February. The price of gold during this tumultuous period dropped by over $40 per ounce resulting in a loss of 2.9% from its all time high. Although the stock market experienced an intraday loss of 300 points earlier this week, a decline of 4.5% hardly qualifies as a financial panic, thus rendering moot the recent action of gold versus stocks.

The real test of gold as a safe haven asset needs to be examined at a time of extreme financial panic such as was experienced during 2008. Most people expect gold to perform the best during times of crisis or to be a hedge against a declining stock market. Unfortunately, those who expected gold to insulate them from losses during the financial meltdown of 2008 were disappointed.

Brutal selling hit virtual every asset class during the panic of 2008 and gold was no exception to the surprise of many. In late 2008, gold experienced a 30% drop from its yearly high in the $1,000 range to a low of $700 in November. Regardless of asset allocation, virtually every investor lost money during 2008. Why did gold decline so dramatically in 2008 instead of performing as a safe haven asset? It could be argued that gold’s sharp decline during 2008 was due to the fact that highly leveraged investors held large gold positions believing that this would reduce risk in their portfolios. As other asset classes were decimated, investors receiving multiple margin calls were forced to liquidate everything, including gold positions.

Looking further than the snapshot year of 2008, it can be argued that gold was in fact a safe haven since it outperformed stocks. At the low of $700 per ounce reached in late 2008, gold was still above its low of $615 reached during early 2007. Stocks by contrast fared much worse with the Dow Jones plunging 50% from its high of 14,000 reached during 2007. The Dow Jones is still over 2,000 points below its 2007 high while gold has more than doubled since 2007. As can be seen on the chart above, gold has outperformed the Dow by about 200% since 2006.

Will gold protect a portfolio during the next financial panic? Based on the above analysis, gold outperformed stocks during the financial panic of 2008 and significantly outperformed stocks since 2006. In an uncertain and volatile world, gold is one hedge that has worked quite well for long term investors.

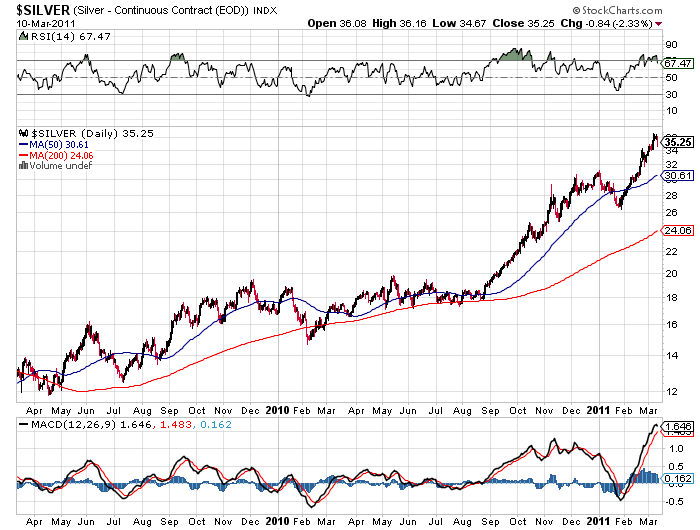

Gold and silver prices declined slightly on the week, as measured by the closing London PM Fix prices. Gold finished the week at $1,411.50 for a loss of $15.50 while silver declined fractionally by 33 cents to close at $34.10. However, as markets assessed the impact of a slowing world economy, higher inflation, higher oil prices and the massive earthquake in Japan, prices for gold and silver saw significant price improvement in late Friday New York trading. Gold moved up $9.20 to $1,421.30, while the silver price rose $.60 to $35.90.

Gold and silver prices declined slightly on the week, as measured by the closing London PM Fix prices. Gold finished the week at $1,411.50 for a loss of $15.50 while silver declined fractionally by 33 cents to close at $34.10. However, as markets assessed the impact of a slowing world economy, higher inflation, higher oil prices and the massive earthquake in Japan, prices for gold and silver saw significant price improvement in late Friday New York trading. Gold moved up $9.20 to $1,421.30, while the silver price rose $.60 to $35.90.

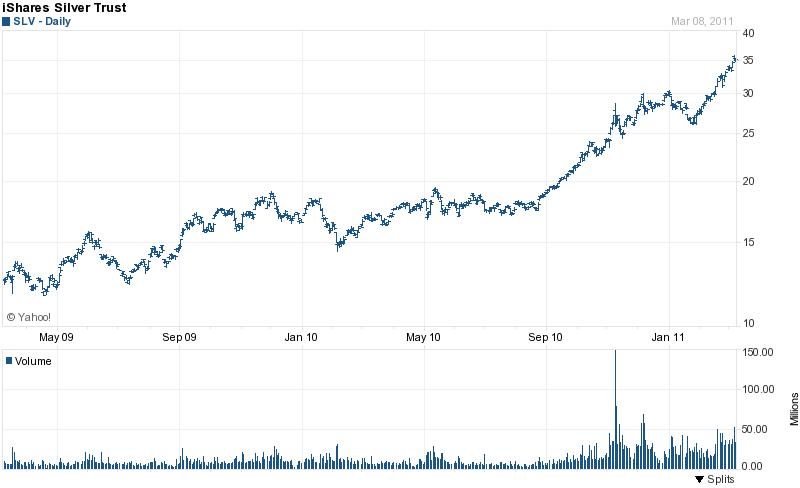

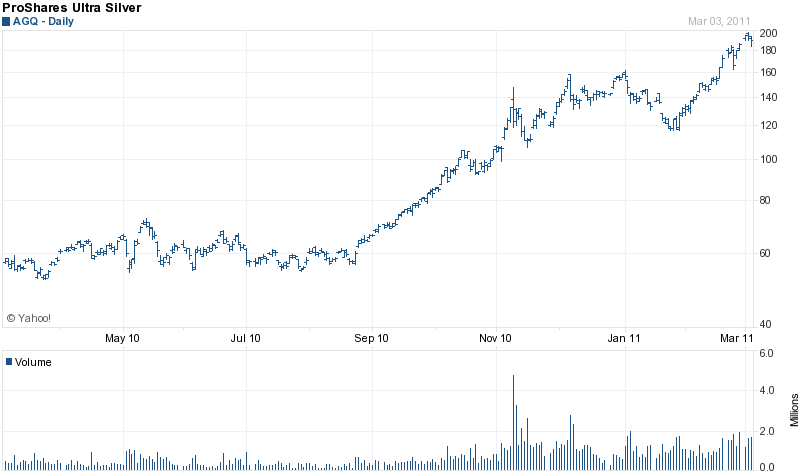

Silver holdings in the iShares Silver Trust (SLV) continued to skyrocket, while holdings of gold in the SPDR Gold Shares Trust (GLD) experienced a modest increase.

Silver holdings in the iShares Silver Trust (SLV) continued to skyrocket, while holdings of gold in the SPDR Gold Shares Trust (GLD) experienced a modest increase.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities. The Week in Precious Metals

The Week in Precious Metals

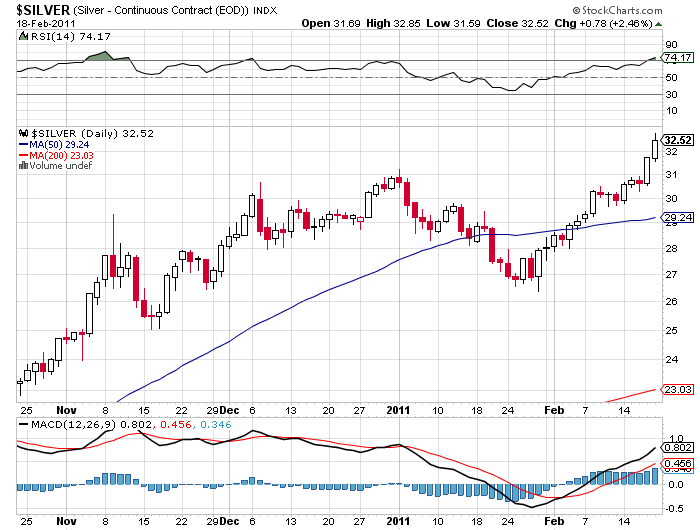

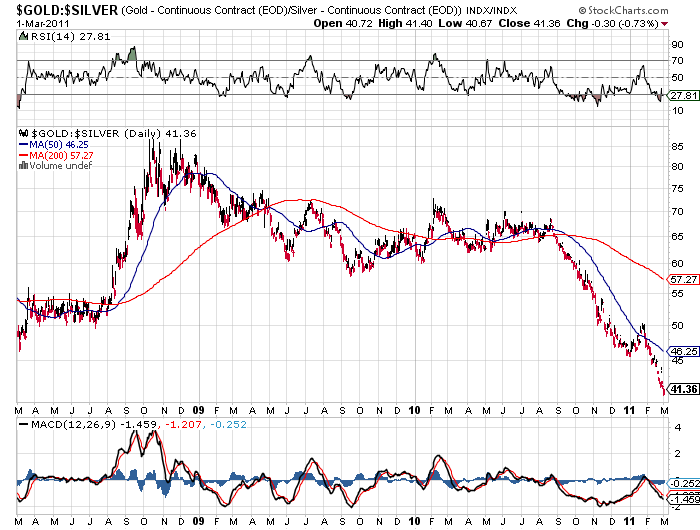

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

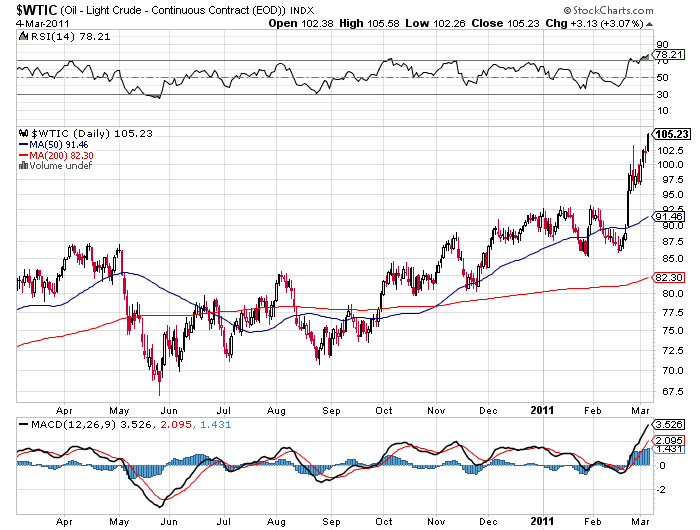

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

The US Mint utilizes a network of authorized purchasers (AP’s) to distribute bullion products to the public. This small group of private sector businesses are allowed to purchase bullion coins from the Mint in bulk quantities, and in turn resell them to the public. The price charged to the APs is based on the market price of the metal plus a mark up.

The US Mint utilizes a network of authorized purchasers (AP’s) to distribute bullion products to the public. This small group of private sector businesses are allowed to purchase bullion coins from the Mint in bulk quantities, and in turn resell them to the public. The price charged to the APs is based on the market price of the metal plus a mark up. Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

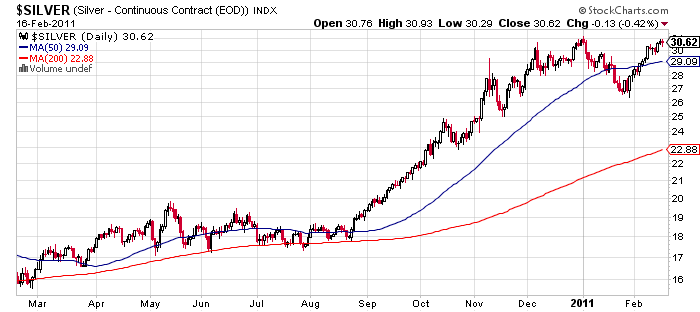

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.