In 2010, John Paulson personally earned $5 billion, vaulting him into the ranks of the world’s wealthiest persons. Incredibly, this was not a one time event precipitated by a heavily leveraged bet that just happened to turn out right. Mr. Paulson had previously made another brilliant call prior to the financial crisis. Based on his analysis of the subprime mortgage market, Mr. Paulson had the acumen to establish a major bearish position in mortgages, prior to the mortgage meltdown, that resulted in billions of dollars in profits.

In 2010, John Paulson personally earned $5 billion, vaulting him into the ranks of the world’s wealthiest persons. Incredibly, this was not a one time event precipitated by a heavily leveraged bet that just happened to turn out right. Mr. Paulson had previously made another brilliant call prior to the financial crisis. Based on his analysis of the subprime mortgage market, Mr. Paulson had the acumen to establish a major bearish position in mortgages, prior to the mortgage meltdown, that resulted in billions of dollars in profits.

It was how Mr. Paulson made $5 billion during 2010 that makes his every move the object of intense scrutiny by gold investors worldwide. Mr. Paulson believes that the Federal Reserve is determined to re-inflate every asset class possible, using whatever means necessary. Without the “benefit” of inflation, the crushing levels of national debt would eventually lead to massive defaults and an economic disaster. Based on this conviction, Mr. Paulson invested heavily in gold futures, the SPDR Gold Shares Trust (GLD), and other gold structured investments that resulted in his massive paycheck for 2010.

Last October, while speaking at the University Club in New York, Mr. Paulson predicted that the price of gold could easily reach $4,000 an ounce.

With Mr. Paulson’s track record, any change in his gold holdings would obviously be of great interest to gold investors worldwide.

Mr. Paulson directs most of his investments through his hedge fund, Paulson & Co, and is required to report major holdings to security regulators with 45 days after the end of each quarter. The latest regulatory Form 13-F filing shows that Mr. Paulson’s position in the SPDR Gold Shares Trust was unchanged for the latest quarter.

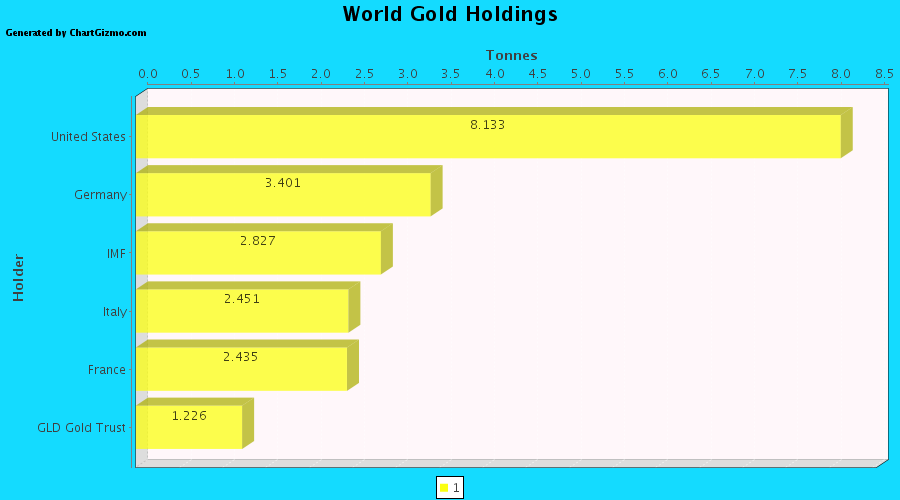

At December 31, 2010, Mr. Paulson’s holdings in the GLD amounted to $4.37 billion dollars or about 8% of the total value of the Gold Trust. The value of the GLD’s holdings are currently $53.95 billion.

Other big time successful investors also maintained or increased their holdings in the GLD. The Soros Fund Management at year end held $655 million of GLD while PIMCO (run by super star bond manager Bill Gross) had holdings of $307.7 million.

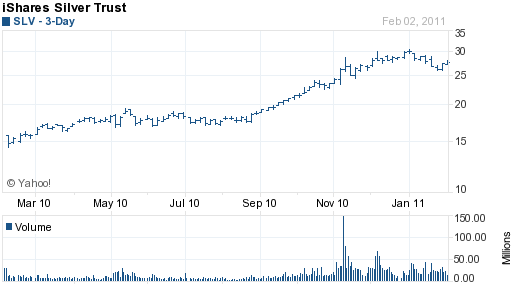

The SPDR Gold Shares Trust (GLD) holdings declined marginally on the week, while the iShares Silver Trust (SLV) increased its holdings by over 41 metric tonnes. As both gold and silver prices consolidate in a tight price range, both the GLD and the SLV have experienced a decline in bullion holdings since the beginning of the year.

The SPDR Gold Shares Trust (GLD) holdings declined marginally on the week, while the iShares Silver Trust (SLV) increased its holdings by over 41 metric tonnes. As both gold and silver prices consolidate in a tight price range, both the GLD and the SLV have experienced a decline in bullion holdings since the beginning of the year.

After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week.

After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week. Amidst increased demand for physical gold and silver investment products, the United States Mint achieved record revenue from the sale of bullion coins during their 2010 fiscal year. Annual sales totaled $2.86 billion, which yielded net income of $55.2 million for the segment.

Amidst increased demand for physical gold and silver investment products, the United States Mint achieved record revenue from the sale of bullion coins during their 2010 fiscal year. Annual sales totaled $2.86 billion, which yielded net income of $55.2 million for the segment. Gold and silver bullion coin sales at the United States Mint are showing exceptional strength. In the past week, authorized purchasers ordered 1,181,000 ounces worth of American Silver Eagles and 32,000 ounces worth of American Gold Eagles.

Gold and silver bullion coin sales at the United States Mint are showing exceptional strength. In the past week, authorized purchasers ordered 1,181,000 ounces worth of American Silver Eagles and 32,000 ounces worth of American Gold Eagles. For much of the past three years, the United States Mint has struggled to keep up with the boom in demand for physical precious metals. Although they have been required to mint and issue American Gold and Silver Eagle bullion coins in quantities sufficient to meet public demand, they have often fallen short of this mandate, resorting to sales suspensions and rationing programs.

For much of the past three years, the United States Mint has struggled to keep up with the boom in demand for physical precious metals. Although they have been required to mint and issue American Gold and Silver Eagle bullion coins in quantities sufficient to meet public demand, they have often fallen short of this mandate, resorting to sales suspensions and rationing programs. United States Mint bullion coin sales remained robust for the two available options. In the prior week, authorized purchasers ordered 1,322,000 ounces of American Silver Eagles and 25,000 ounces of American Gold Eagles.

United States Mint bullion coin sales remained robust for the two available options. In the prior week, authorized purchasers ordered 1,322,000 ounces of American Silver Eagles and 25,000 ounces of American Gold Eagles.