The case has been conclusively settled. All those paranoid people who have been claiming manipulation of the silver market are wrong according to the Commodities Futures Trading Commission (CFTC).

The case has been conclusively settled. All those paranoid people who have been claiming manipulation of the silver market are wrong according to the Commodities Futures Trading Commission (CFTC).

After a five year investigation and 7,000 hours of investigativing silver trading the CFTC says there is no “viable case” for charging anyone with manipulating the silver market. To prosecute a case the CFTC must prove the intention to manipulate prices along with proof of the actual trades involved in the manipulation.

Casting doubt on the CFTC’s decision was none other than CFTC Commissioner Bart Chilton who implied that even if there was manipulation, the standards for proving manipulation are so difficult that a lot of the bad guys are escaping justice.

CFTC Commissioner Bart Chilton, a vocal backer of the probe, said the decision shows it remains difficult to mount a case even after the Dodd-Frank financial overhaul eased some restrictions.

“It’s been the most frustrating and disappointing non-policy related item since I joined the CFTC in 2007,” Mr. Chilton said. “Our manipulation standard remains too high a hurdle for regulators to overcome; not enough bad actors are being punished.”

The CFTC has won recent acclaim for aggressive enforcement efforts in markets including interest rates, crude oil and platinum. But even with expanded powers to police derivatives markets stemming from Dodd-Frank, the agency has successfully concluded just one case–In the power market–from trial through appeal in its 39-year history.

The conclusion comes as policy makers reassess the banking industry’s role in commodity markets. The participation by firms such as J.P. Morgan and Goldman Sachs Group Inc. in businesses such as aluminum warehousing and power marketing have been the subject of congressional hearings and enforcement actions this year. The Federal Reserve is expected before 2013 ends to issue new rules governing banking companies’ participation in these markets.

Translation: Even though the too big to fail banks such as JP Morgan have been found guilty of manipulating everything from the LIBOR rate to the price of aluminum the CFTC can’t find any evidence to prove that they manipulated the price of silver.

For an alternate view on silver market manipulation see How the COMEX Crashed the Silver Market and How Wall Street Pros Made Huge Profits On Silver ETF Crash As Small Investors Sold

Most people can’t begin to comprehend

Most people can’t begin to comprehend

By: GE Christenson

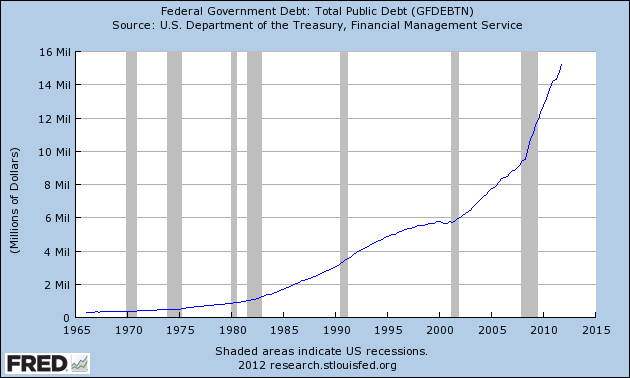

By: GE Christenson Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression. By: GE Christenson

By: GE Christenson

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

By:

By:  By: GE Christenson

By: GE Christenson

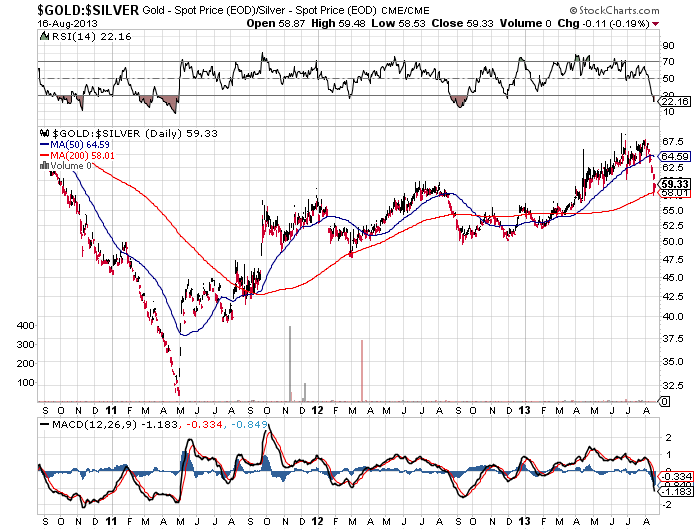

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low.

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low.