A Fun Look at Silver’s Looong Correction and a Positive Look Ahead

A Fun Look at Silver’s Looong Correction and a Positive Look Ahead

I remember it like it was yesterday…

It was the spring of 2011. It was exceptionally warm and glorious. All was right with the world. The air was sweeter, the sky bluer, the birds and bees were birdier and buzzier… it was all beautiful, man! Why? Because those were the weeks that found me becoming wealthier by the day. All of that bulky, heavy silver that I had purchased over the previous 10 years was turning me into an investing genius. There was a different look in my wife’s eye. What was it?… Joy? No… Love? Yeah, sure, of course, but there was something else… it was more like… respect. I was no longer the crazy man who hoarded silver metal. I was now that wise investor who was making our family rich… well, rich-er, at least.

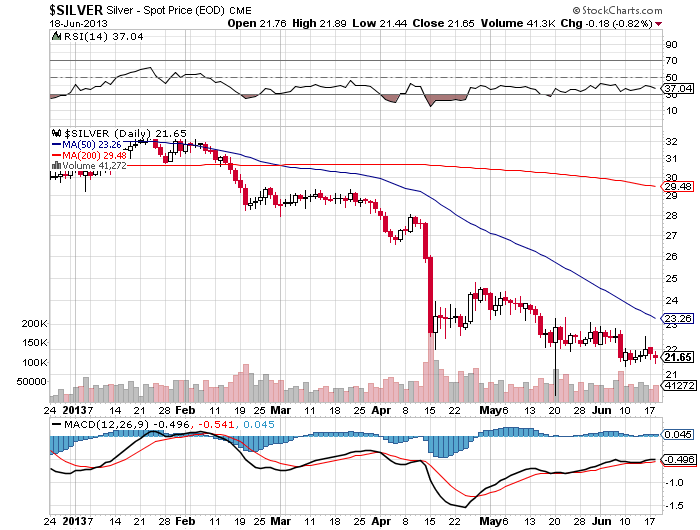

As those weeks passed, and I did my mental calculations several times a day in front of the computer, or CNBC, or anywhere else I could get my quote, I realized that price was going vertical and that it would be wise to sell a portion of my stack because I, and everyone else in the world, knew that the correction was coming. (pause for reflection and dramatic effect here) I won’t go into how or why I didn’t sell some of our precious, and I won’t say it’s been the most pleasant two years of silver holding. I will say, though, that the look in my wife’s eye is long gone. In case you haven’t been following the silver news, price has experienced a bit of a setback. “How much of a setback?” you ask. Well, (mumbling) it went from almost $50 to $18 or so. “What’s that you say? You’re mumbling. Speak up, please.” I say it crashed from $50 to $18. (pause here) When you are finished laughing and wiping your eyes I tell you that now is the time to buy. (yet another pause) When you get up from the floor from your ROTFLMAO’ing and you catch your breath you ask me how I can say that. Why is now the time to buy? I reply it’s because the price crashed from $50 to $18.

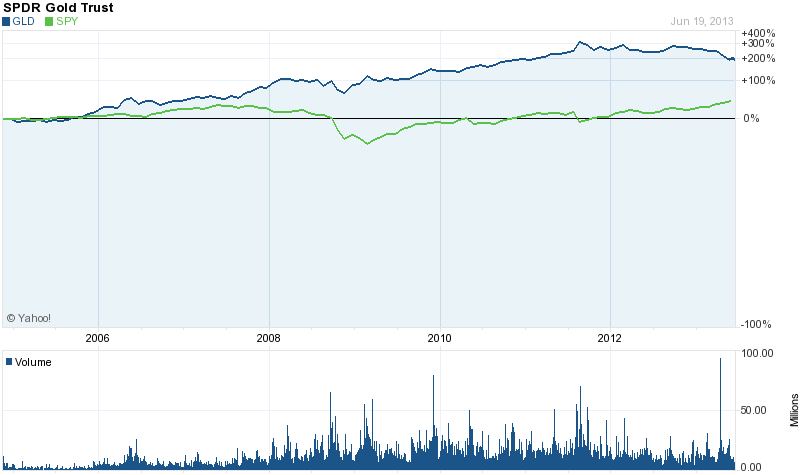

Maybe you’ve heard this one before, but there’s an old saying that goes “Buy low; sell high.” Well, my friends, relatively speaking, the price is low. Doesn’t that mean it’s time to buy? Well, the thing about that saying is that it’s not very clear how high is “high” or how low is “low.” Could the price go lower? Sure it could; in fact, it might. But if it does, it probably won’t go much lower. And even if it does, it’s gonna’ go up, and up, and up. How do I know? Well, I am not a financial advisor. I am not a silver salesman. I am merely looking around at this world of ours; at the shaky governments and economies; at the bail outs and imminent bail ins; at the real inflation around us (not the inflation rate that the government offers us); at the incessant printing of dollars and euros and most all currencies world-wide, and I know that we cannot continue like this. There are some rough times a’comin’ and when there is instability, people seek stability. In financial-speak, that means precious metals – silver and gold.

If my “gut instinct” isn’t enough for you. Check out just about any article written about the fundamentals of silver written over the last 10 years. Review some of the excellent articles written on the Gold and Silver Blog. When you look at them, ask yourself what has changed? I’ll tell you the one thing that has changed: The price of silver has gone down. That means that it’s even more of a screaming buy than it was back in 2011. If that’s not enough (and it probably shouldn’t be), here’s some more for you (in case you’ve forgotten):

- The demand for silver is high and growing every day; at the same time silver stockpiles are being depleted and there is much talk about an imminent financial and industrial silver shortage

- Silver is a very small market; when a few “big players” get involved, price will move rapidly upwards

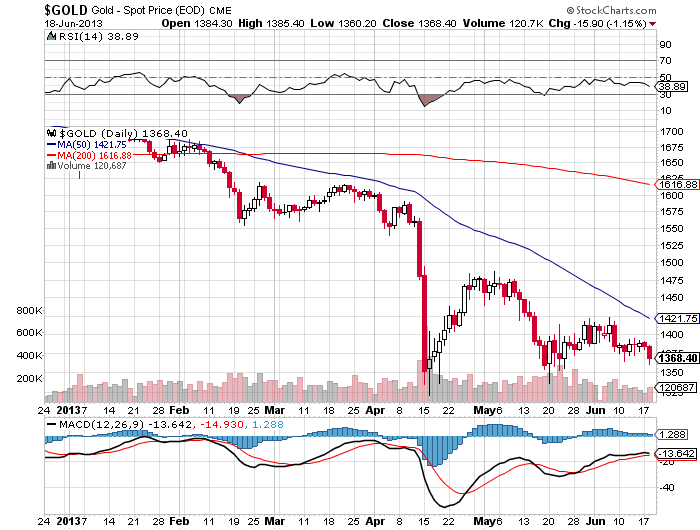

- Silver typically follows gold; and the fundamentals for gold are outstanding right now

- Many countries around the world, including China and India, are importing large quantities of silver and gold

- The silver/gold ratio is abnormally high (~60:1); it’s more traditional level is more like 15:1. That means that silver is probably a much better investment compared to gold right now. (But they’re both going to go up!)

- Many silver analysts are claiming that the bottom is in for this correction. Many claim that the next stop is in the $60 range; after that comes the $100 range. Some even claim that if our government keeps printing $85 billion every month, we may even see four-figure silver.

And If that’s not enough for you to go out right now and buy some silver, then I encourage you to stop for a moment, check the news, and do some more research; breathe for a minute and listen to your gut. The signs are all around us that challenging times lie ahead. Even if you’re not convinced, purchasing at least a little bit of silver or gold – maybe 5%-10% of your savings – would probably be a good idea. Personally, I’m looking forward to seeing that look in my wife’s eye once again… soon.

Joe (Silverheels) Paulson is a husband, father, teacher, and an avid silver follower and investor (for over 30 years – !) You can click here to find out more about different types of silver investing. Get more of his unique and fun perspective on silver investing at tobuyandsellsilver.com.

By:

By:  By: GE Christenson

By: GE Christenson

By: GE Christenson

By: GE Christenson

Precious metals analyst Suki Coper at Barclays takes a look at the silver market in an interview with Bloomberg Television.

Precious metals analyst Suki Coper at Barclays takes a look at the silver market in an interview with Bloomberg Television. By: GE Christenson

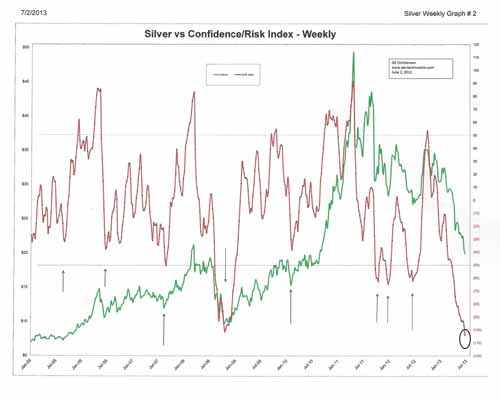

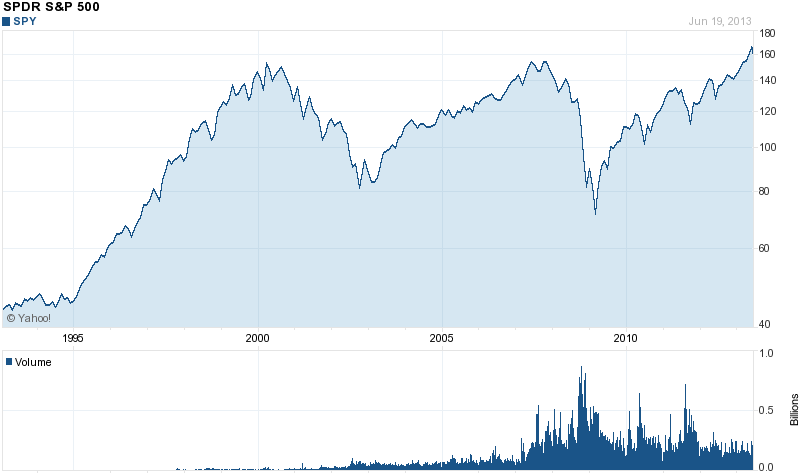

By: GE Christenson Its hardest to buy at bottoms since you never know where the bottom is. Equally hard to do is to buy when the sentiment is incredible negative as it was in early 2009 for stocks and 2000 for gold and silver.

Its hardest to buy at bottoms since you never know where the bottom is. Equally hard to do is to buy when the sentiment is incredible negative as it was in early 2009 for stocks and 2000 for gold and silver.

Is there any hope for a recovery in gold and silver prices by year end?

Is there any hope for a recovery in gold and silver prices by year end?