As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

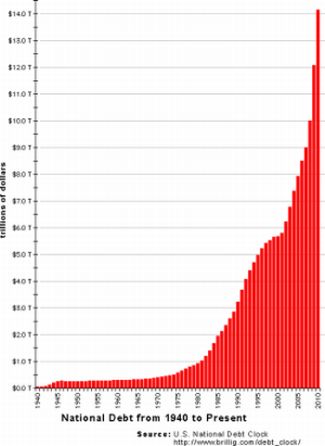

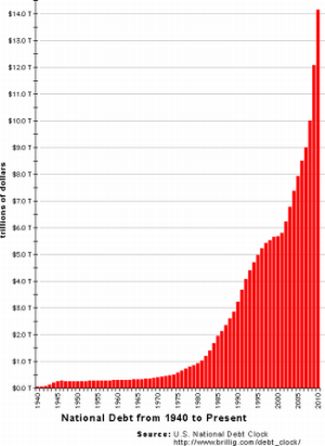

Gold has gained $86 during April and $185 from its January low of $1,319. The price acceleration in April comes in the aftermath of the government’s dismal failure to reduce deficit spending, even as S&P warned of a credit ratings downgrade for the U.S. The great budget compromise reached by both parties was soon exposed as a shameful hoax by the Congressional Budget Office, which said that government spending would actually be higher after the “budget cuts” due to gimmicks.

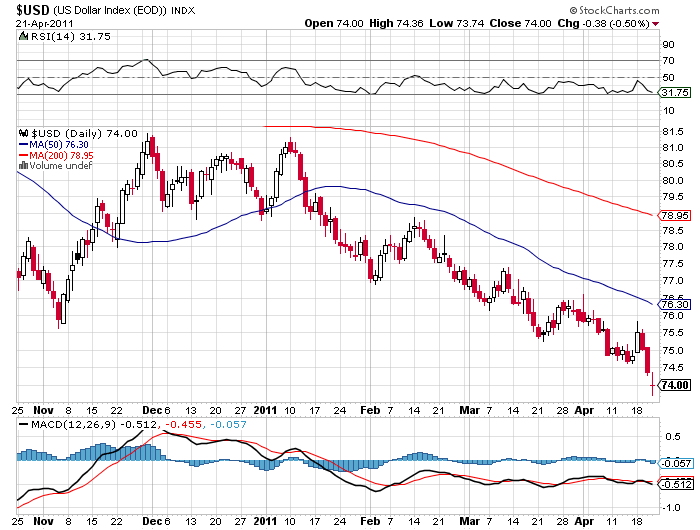

As unsustainable government debt continues to balloon and the Fed continues to print money, the dollar is getting trashed. Governments worldwide are taking steps to protect themselves from the Fed’s explicit policy of dollar debasement and this means selling dollars. The US dollar has fallen almost 10% since the beginning of the year. Gold and silver are becoming the de facto reserve currency, as the flight from dollars intensifies.

US Dollar- COURTESY STOCKCHARTS.COM

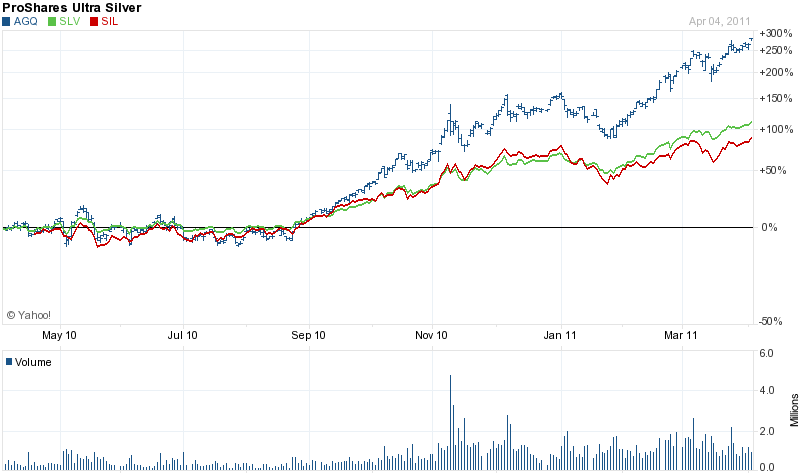

Silver has continued to confound the bears with another standout performance, gaining $3.65 or 8.57% on the week, after gaining $2.39 in the previous week. The closing price for silver as measured by the London PM Fix Price was $46.26. Silver is rapidly closing in on its all time closing high of $48.70 hit in January 1980. The current price momentum in silver could easily push silver into new all time highs next week.

The huge rally in silver prices has some wondering if there will be a pullback soon. Silver has gained $8.63 per ounce this month for a 22% gain. Since the January low of $26.68, silver has gained a spectacular $19.58 per ounce for a huge gain of 73%. The question is not one of if, but rather of when there will be a pullback – a routine event in every bull market.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,504.00 | +27.25 (+1.84%) |

| Silver | $46.26 | +3.65(+8.57%) |

| Platinum | $1,812.00 | +25.00 (+1.40%) |

| Palladium | $765.00 | -7.00 (-0.91%) |

But perhaps the bears will have to wait a while longer for the much anticipated pullback. The volume in put options on the silver ETFs has seen numerous days of record volume, implying that some big players are betting on a significant decline in silver prices. Does the record put buying on silver reflect speculators betting on a silver plunge or merely long time silver investors hedging long positions? Either way, the implication is that the expectations for a silver pullback seems to be growing, but markets rarely accommodate investors’ perceptions of when a market is truly overbought – expect higher silver prices to shock the put buyers in silver.

Long term, any price pullback in silver should be looked at as a gift. Financial players should never “fight the Fed” and in this case, both Federal Reserve and Government policies guarantee higher precious metals prices (see Why There Is No Upside Limit To Gold and Silver Prices).

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39.

Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39. Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.

Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.

Gold soared to new all time highs in Asian markets and silver pierced the $40 per ounce level as new demand continues to drive precious metal prices higher.

Gold soared to new all time highs in Asian markets and silver pierced the $40 per ounce level as new demand continues to drive precious metal prices higher. Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Gold and silver prices, as measured by the London PM Fix Price, were largely unchanged on the week. Gold slipped by $18 per ounce while silver declined modestly by $.05

Gold and silver prices, as measured by the London PM Fix Price, were largely unchanged on the week. Gold slipped by $18 per ounce while silver declined modestly by $.05