Here’s a really great book on how to buy gold and silver that came to my attention. I would recommend this book (“Stack Silver Get Gold”) to both long time gold and silver investors as well as those considering their first purchase. Best of all, the price is right. Author Hunter Riley has offered readers of the goldandsilverblog.com a free copy anytime between this Saturday, October 27th and Wednesday, October 31, 2012, offered through Amazon Kindle. After October 31st, the purchase price of the book will be $9.99.

Here’s a really great book on how to buy gold and silver that came to my attention. I would recommend this book (“Stack Silver Get Gold”) to both long time gold and silver investors as well as those considering their first purchase. Best of all, the price is right. Author Hunter Riley has offered readers of the goldandsilverblog.com a free copy anytime between this Saturday, October 27th and Wednesday, October 31, 2012, offered through Amazon Kindle. After October 31st, the purchase price of the book will be $9.99.

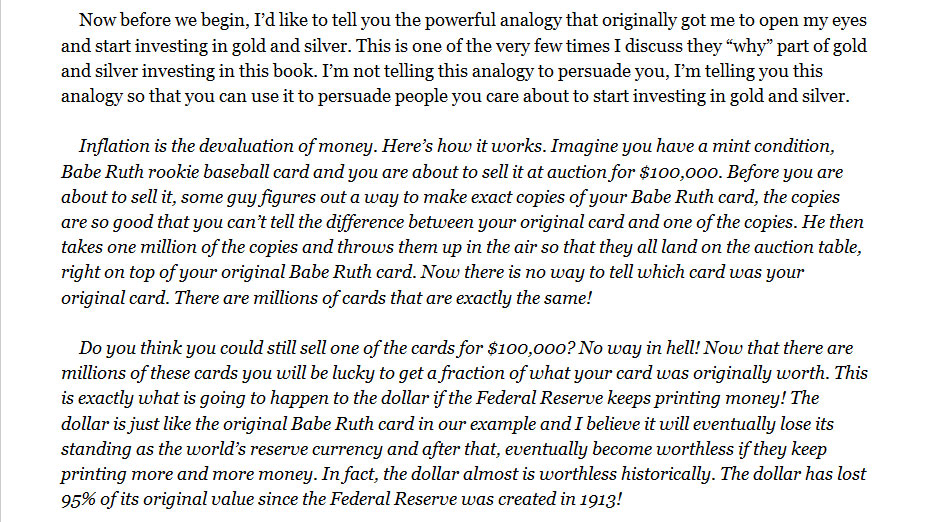

The short book covers the following essential topics:

– How to avoid dealers and con artists who will rip you off

– Coins, rounds, bars, numismatic coins and junk silver – what premium you pay for each form of metal, and the advantages of each type

– What is premium and spot price?

– What type of silver and gold should you buy?

– What forms of gold and silver investments should you avoid?

– What are the dangers of ETF’s?

– Fraudulent dealers selling gold and silver that they don’t possess!

– Gold and silver mining stocks – good or bad investments?

– Gold and silver pools and leveraged accounts

– Phone dealers, TV ads and commemorative coins

– Where should you store your silver and gold?

– What type of home safe should you invest in?

– Wan you ad physical gold or silver investments to your IRA?

– Which is better as an investment? Gold or Silver?

– How to profit as the dollar collapses.

– What are the best gold and silver investing newsletters?

– Where can you buy gold and silver online?

– Which are the most reputable companies to deal with?

Note: The Gold and Silver Blog receives no compensation for promoting this book. It is done solely to educate investors on investing in gold and silver.

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison.

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison. The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

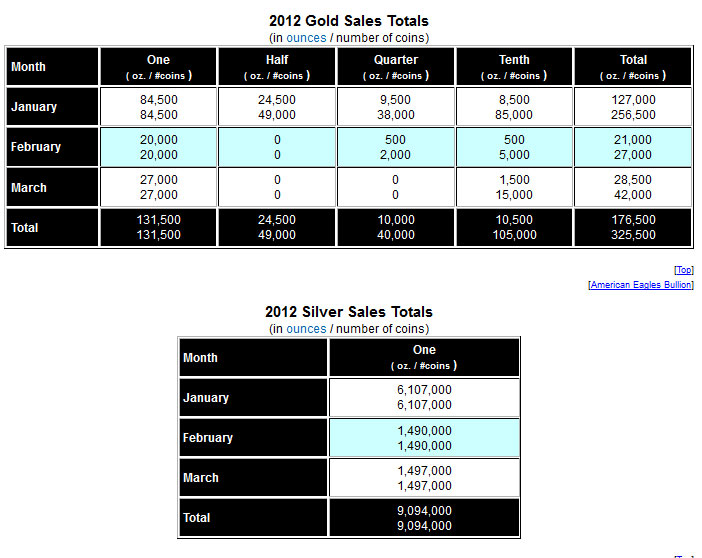

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

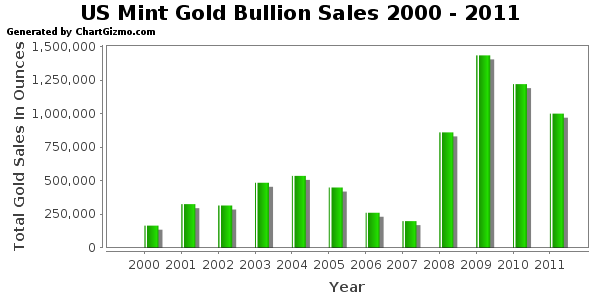

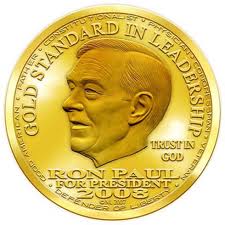

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

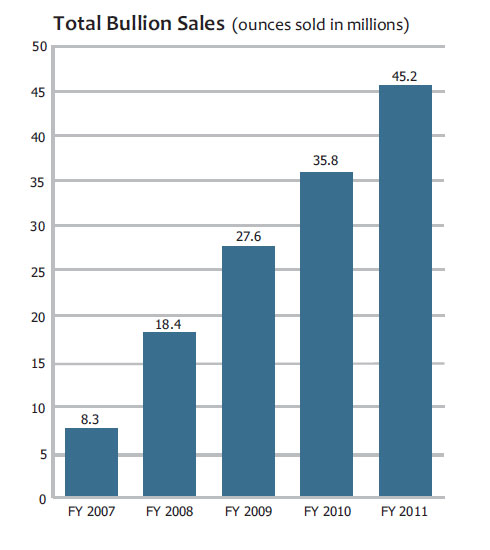

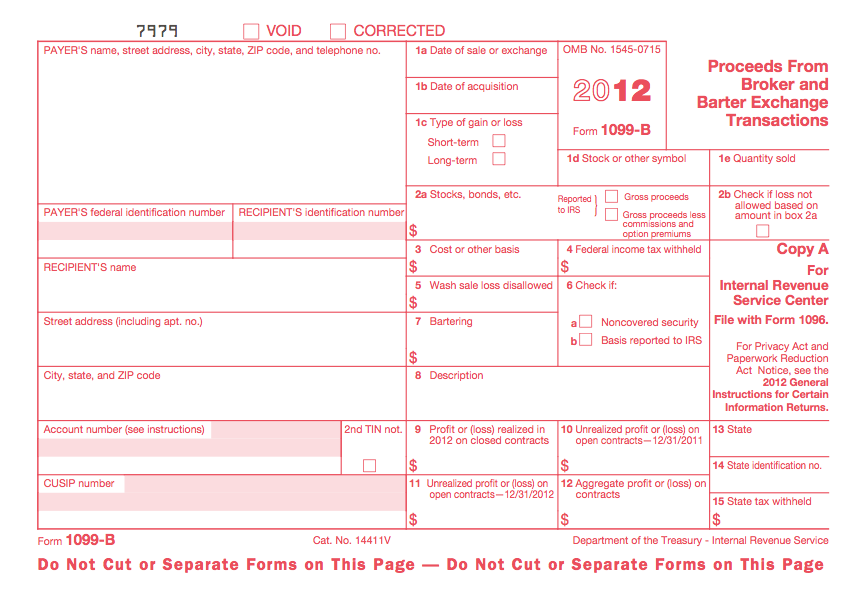

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.