With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

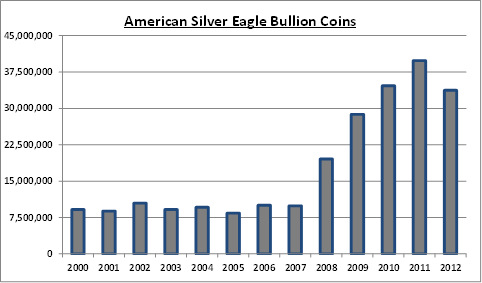

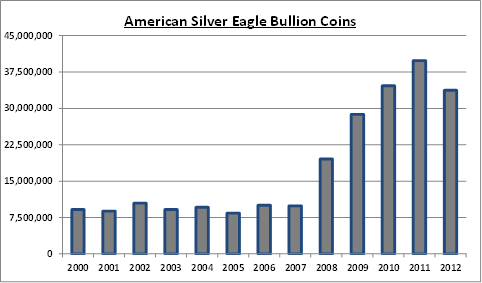

The public demand for silver seems insatiable. To put the unprecedented demand for silver into perspective, prior to the financial crisis of 2008, total yearly sales of the silver bullion coin averaged only about 9.5 million coins per year. With the Federal Reserve furiously printing money to keep the financial system glued together, investor demand for both physical silver and gold bullion is likely to increase dramatically.

The US Mint has been unable to keep up with the demand for American Silver Eagles for the past two months (see U.S. Mint Sold Out). During December, unexpectedly strong demand resulted in the suspension of silver bullion coin sales during mid December after the entire stock of 2012 coins was sold out. At the time the Mint announced that the 2013 American Silver Eagles would be available on January 7, 2013.

Opening day sales on January 7th for the 2013 American Silver Eagle bullion coins turned out to be the largest on record with sales of 3,937,000 coins. Demand for silver bullion continued to climb and by January 17th, the Mint once again announced that sales of the silver bullion coins would be suspended until the last week of January. When sales resumed this week, demand was again much higher than anticipated. Due to record demand, the Mint previously announced that they may have to institute rationing of the coins. Since the US Mint’s production schedule has been blown right out the window for two months running, it would not be surprising if rationing of the coins was implemented.

Sales of the American Eagle Gold bullion coins has also soared during the first month of the year. January sales to date of 140,000 ounces of gold bullion coins is the highest monthly sales since June 2010 when the Mint sold 151,500 ounces.

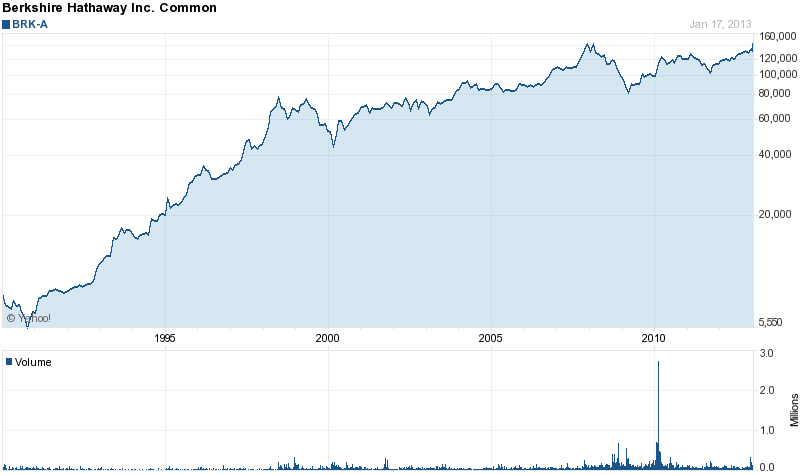

A lot of people probably won’t remember this event, but in February 1998 Warren Buffett announced that he had amassed a huge position in physical silver. Over the previous seven months Buffett had quietly acquired almost 130 million ounces of silver which, according to CPM Group, amounted to 37% of the world’s above ground raw silver stock.

A lot of people probably won’t remember this event, but in February 1998 Warren Buffett announced that he had amassed a huge position in physical silver. Over the previous seven months Buffett had quietly acquired almost 130 million ounces of silver which, according to CPM Group, amounted to 37% of the world’s above ground raw silver stock.

Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were

Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were

I think I am becoming a non-fan of infographics. Maybe it’s just me, but many infographics are getting way too long and complicated. With that in mind, the latest infographic on silver from the

I think I am becoming a non-fan of infographics. Maybe it’s just me, but many infographics are getting way too long and complicated. With that in mind, the latest infographic on silver from the

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold. The use of silver as a monetary asset in China goes back for centuries. As detailed in the latest report from the Silver Institute, China’s entire monetary system was based on a silver standard until 1935. Things changed dramatically after the Communists came to power in 1949 and effectively nationalized the entire silver stock. Private citizens were prohibited from owning silver or gold and private sales of silver and gold jewelry was banned.

The use of silver as a monetary asset in China goes back for centuries. As detailed in the latest report from the Silver Institute, China’s entire monetary system was based on a silver standard until 1935. Things changed dramatically after the Communists came to power in 1949 and effectively nationalized the entire silver stock. Private citizens were prohibited from owning silver or gold and private sales of silver and gold jewelry was banned. Here’s a great infographic from the

Here’s a great infographic from the

By

By