A lot of people probably won’t remember this event, but in February 1998 Warren Buffett announced that he had amassed a huge position in physical silver. Over the previous seven months Buffett had quietly acquired almost 130 million ounces of silver which, according to CPM Group, amounted to 37% of the world’s above ground raw silver stock.

A lot of people probably won’t remember this event, but in February 1998 Warren Buffett announced that he had amassed a huge position in physical silver. Over the previous seven months Buffett had quietly acquired almost 130 million ounces of silver which, according to CPM Group, amounted to 37% of the world’s above ground raw silver stock.

Buffett’s holdings were probably acquired under $6 since the price range of silver fluctuated between $4.22 and $6.26 during the last six months of 1997.

Buffett’s plunge into the silver market was an extraordinary event.

Prior to his silver purchase, Buffett had made his fortune by shrewdly purchasing common stock in undervalued companies. As usual, Buffett was ahead of the pack when he correctly foresaw the long term potential for huge gains in the price of silver. When asked why he purchased silver, Buffett replied coyly that the “equilibrium between supply and demand was only likely to be established by a somewhat higher price.”

What happened next in the Buffett silver saga was just as unusual as Buffett’s original purchase. Buffett is famous for saying that his holding period is “forever.” Yet, a mere eight years later, the silver position was gone.

In response to a question at the Berkshire Hathaway shareholders meeting in 2006, Buffett replied curtly – “We had a lot of silver once, but we don’t have it now—and we didn’t make much on our prior holdings. I bought early and sold early.” Not much of an explanation for a man who is usually at no loss for words. Even more curious, Buffett said that his silver hoard was sold for only $7.50 per ounce.

A quick look at the price chart of silver during 2006 raises an obvious question – how did Buffett wind up making such a small gain? The other big mystery is – why did Buffett liquidate his silver position in violation of his “forever” holding rule? Theodore Butler of Silver Seek has constructed an intriguing hypothesis that COMEX traders took Buffett to the cleaners.

Here’s what I think happened. Buffett didn’t sell his silver willingly, it was taken from him. He lost it. He lost it through speculation in derivatives of the very kind he publicly vilifies.

Those who have followed the silver market closely have come to know the incredible reliability of the pattern of tech fund/dealer buying and selling of silver futures on the COMEX. This pattern has been documented by the weekly Commitment of Traders Report (COT), which I have written about in countless articles.

I believe that Mr. Buffett (or his advisors) also came to appreciate the compelling logic and power of the COTs. I believe that Mr. Buffett (or his advisors) became a card-carrying member of the dealer silver wolf pack, skinning the tech funds for years. I also believe that Buffett’s involvement in beating the tech funds regularly ultimately ended with his silver being taken from him.

It worked like this. When the tech funds plowed onto the long side in silver as the price broke through various moving averages on the upside, Buffett (or his advisors) would sell short against his real silver holdings. When the tech funds finally sold as prices fell back through the moving averages, those shorts established by Buffett would be bought back., booking substantial recurring profits.

But what worked swimmingly for years, namely, the regularity of tech fund buying and selling at expected price points, stopped working about eight months ago. The tech funds plowed onto the long side back in September at around $7.50 and the dealers sold short aggressively. But instead of the price collapsing, as it always did in the past, the price of silver doubled. And it caught many, including me, off guard. I think it caught Buffett off guard as well. So much so that he had no choice but to turn over his real silver to cover his going short at $7.50 or so. He could have bought it back at $12 or $13 and booked a big loss while keeping his silver, but that disclosure might have been embarrassing.

This would explain how Buffett emerged from silver basically breaking even and selling too early.

Mr. Butler’s astute insights make sense to me and it’s probably the only time Warren Buffett ever got beat up on a position. But here’s where it gets intriguing for present day silver investors. Warren Buffett’s record of selecting long term winners is still intact – silver was a brilliant investment. Buffett’s original position of 130 million ounces bought in 1998 would be worth almost $4.2 billion today, a gain of $3.4 billion or 429% on his original cost of $780 million.

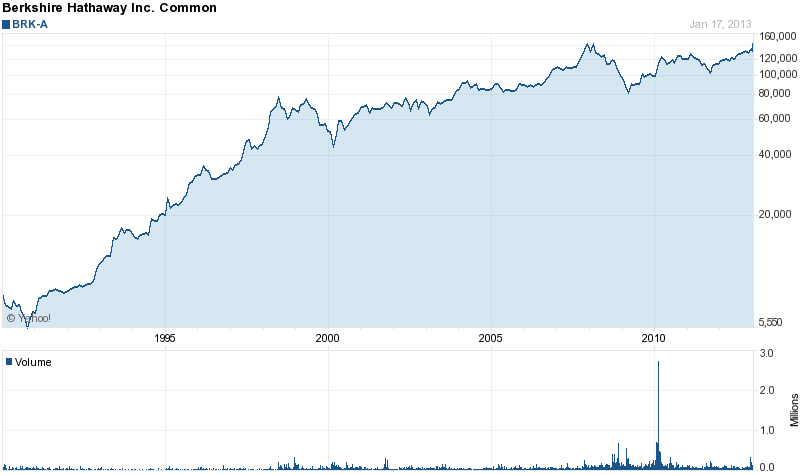

By comparison, Berkshire Hathaway A common stock went from $78,305 in June 1998 to $143,484 as of today, for a gain of only 83%.

Remember that Buffett’s holding period is “forever.” If Buffett hadn’t had his throat ripped out by Comex traders, silver would still be in his portfolio today along with Coke, Wells Fargo and other “forever” holdings. Something to think about the next time some “expert” starts snorting off about silver being in a bubble.