The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

Intense demand across Asia has resulted in shortages of gold and silver in both India and China as dealers struggle to keep up. Singapore’s largest supplier of coins and bars reports depleted stocks of silver and long delivery delays.

The surge in physical demand is also rapidly depleting U.S. gold inventories according to Reuters.

Physical gold held at CME Group’s Comex warehouses in New York have dropped to a near-five year low in a further sign that gold’s price crash unleashed a frenzy of demand as investors scramble to buy bars and coins.

U.S. gold stocks, comprised of 100-troy ounce COMEX gold bars, have fallen almost 30 percent since February, as dealers have switched to selling into the burgeoning Asian market, where prices and demand are higher than in New York.

But the pace of the outflows from vaults has accelerated since bullion’s historic sell-off, falling more than 7 percent last week for its biggest weekly drop since 2005.

The latest sales figures from the U.S. Mint for April are further confirmation of the voracious demand for physical gold and silver. Sales of both the America Eagle gold and silver bullion coins skyrocketed in April.

According to the US Mint, sales of the American Eagle gold bullion coin totaled 209,500 ounces in April, up a stunning 948% from the previous year and up 22% from the previous month. The gold bullion coins had the largest amount of sales since December 2009 when 231,500 ounces were sold.

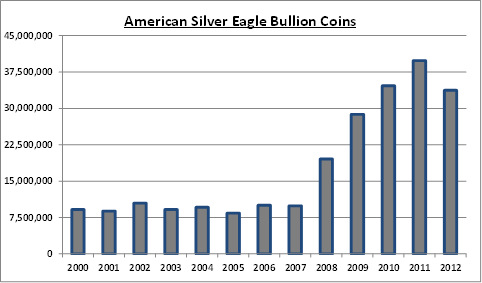

Gold and silver bullion coin sales have soared since the financial crash of 2008 and the subsequent repetitive use of the print button by the world’s central banks. In order to get a perspective on the flight to precious metals, consider that over the entire year of 2007, the US Mint sold a total of only 198,500 ounces of gold bullion coins – less than montly sales during April 2013.

Sales of the American Eagle silver bullion coins were also very strong. During April 2013, the US Mint sold 4,087,000 silver bullion coins, up 169% over April of last year and up 22% from the previous month’s sales. The US Mint has struggled to keep up with demand even before the April surge. Sales of the American silver eagles was recently suspended twice and in late April the US Mint suspended sales of the one-tenth ounce American eagle gold bullion coin due to inventory depletion.

Based on sales to date, it would not be surprising to see an all time record high amount of the American Eagle silver bullion coins sold in 2013.

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including  By: GE Christenson

By: GE Christenson

We already knew from numerous

We already knew from numerous  We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

By: GE Christenson

By: GE Christenson

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.