Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

TDV Golden Trader examines the current state of the financial system, the role of gold in wealth preservation and suggestions for protecting your gold from government confiscation.

Gold Becomes a Tier 1 Asset Class for Banks

Despite what the Main Stream Media (MSM) or “Financial Pundits” tell you, the gold bull market is far from over. In fact, it is just starting, in our opinion. While the misdirected financial world tell you that gold is in a bubble and it has burst, the central bankers and government organizations all know it is far from over. In fact, gold is moving towards the banking system and not away from it. We all know that many central banks are now net buyers of gold and their holdings are increasing as their need to diversify away from risky assets and foreign bonds only grows.

Central banks around the world are continuing to stock up on gold. We can now add Kazakhstan’s central bank to the grow list of bankers wanting to hold gold as a part of their currency reserve. The Kazakh central bank intends to have 20% of reserves in gold, this is up from the current 14-15% currently held. They plan to purchase 20 tonnes of gold this year, mostly from local producers. They also mentioned a few weeks ago that they would cut their Euro holding to 25 % from 30%. We can also add Kazakhstan to the growing number of central bankers which are building up gold holdings including China, Russia, Mexico, Colombia and South Korea.

The price of gold is now hitting all time highs in India, one of the biggest buyers of gold around the world. Prices have reached an all-time high of $544.74 US (Rs 30420) per 10 grams. With a slowing economy and low demand for the Indian rupee, it has been losing value lately and still remains weak. However, gold demand is still robust even at these elevated prices as investors in India still consider gold a safe haven as it counters the effects of inflation and exchange rate fluctuations.

Over the past five years, gold has provided Indian investors with a 27.19% annualized return versus a pathetic 2.67% in the equity market. This trend and move to gold has only grown in the last year. Gold assets under management by funds have increased almost 100% $1.83 billion by April 2012, last year the value was $981 million. In 2011, the gold ETFs in India saw a net inflow of $725 million. For thousands of years the Indian culture has had an affinity for gold, and that will never change, and neither will their demand for physical at elevated prices. Why? Indians understand that gold is money and a true form of saving. It’s the only way to protect assets and wealth from government theft, something the West is still learning.

Even the good ol’ USSA is starting to recognize gold as a tier one asset class. The Federal Deposit Insurance Corporation (FDIC) just issued a notice regarding a new policy proposal on how banks should revise the measurement of risk-weighted assets by implementing changes made by the Basel Committee on Banking Supervision (BCBS) to international regulatory capital standards and by implementing aspects of the Dodd-Frank Act. Under the proposal the following assets would carry a zero percent risk weighting, notice how gold bullion is listed as the second item:

A. Zero Percent Risk-Weighted Items

The following exposures would receive a zero percent risk weight under the proposal:

- Cash;

- Gold bullion

- Claims on certain supranational entities (such as the International Monetary Fund) and certain multilateral development banking organizations

- Claims on and exposures unconditionally guaranteed by sovereign entities that meet certain criteria (as discussed below).

So regardless of what the MSM says, we continue to see more central bankers buying and hoarding gold. New proposals by government banking agencies are being introduced into the system and gold is included as a tier one asset to hold with ZERO RISK. All the signs are in place and what the MSM hasn’t been told yet is that gold is coming back into the banking system.

We are in a world where currency wars are being fought daily, and as the system continues to collapse under its own weight of paper printing, gold will be the go to asset and possibly the last man standing. Don’t be fooled by what the MSM says, they rarely know what they are talking about and are paid to misdirect the puppets. Gold is here to stay.

European Capital Controls and a Flight to Safety

The Greek Elections are over and the pro-bailout New Democracy party won with approximately 29.7% of the vote. By winning the popular vote, they were given a 50-seat bonus. This combined with the support of the Pasok Socialist (who took 12.3% of the vote), will have 162 seats in the 300 seat parliament. Combined, they have the ability to pass government policy with a majority vote, so they can now rig policy for keeping with the Euro.

The Euro experiment may have been saved from breaking up for now, but the bailouts will continue for the foreseeable future. Since the socialists are realizing that austerity is not working, a new movement and calls for a policy of growth are afoot. We can expect lots more money printing coming out of Europe now and in the foreseeable future. While in a normal world that would hurt the Euro, the markets relief that the Euro will not collapse immediately should stop the downward pressure on the Euro. In fact, we could see a slight bounce off the recent lows from this news, but I suspect that will be short lived. None of the problems have been addressed and printing money to fund the bailout will still be the cure central bankers will prescribe to the Euro financial system mess.

Capital controls are already in place within Euroland and this trend is growing quickly as the hot days of summer go on. Recently, major Italian banks have given notice that customer’s accounts would be frozen for one month because of financial difficulties. This caught many bank customers off guard and completely unaware that they would not have access to their funds. This should not be startling news for TDV subscribers as we have been warning for months that capital controls are coming and Europe is fast out of the gates in implementation. For weeks, Europe has been planning bank withdrawal restriction to deal with Greece exit, the only one that hasn’t told you about it is the MSM.

Recently, a businessman was stopped at the Swiss border with £1.6m worth of gold in his car only to have it confiscated by the authorities and was subsequently charged with smuggling. Italians know very well that the trend of confiscation by the “Mafia” government has only grown recently. They have been exporting gold to Switzerland and this trend has grown 35% year over year in February 2012. About 120 tonnes of gold have left Italian boarder in 2011, that is up 65% from 2010. The Italian Prime Minister Mario Monti has been promising a crackdown on tax evasion as he continues to fight the trend of people wanting to avoid paying extortion fees (taxes). It was estimated that more than £96 billion [€119.6bn] in taxes were dodged in Italy during 2009.

As much as we like gold as an investment and store of wealth, you must take the necessary precaution of protecting your gold from confiscation. As desperate European governments continue to steal your wealth via inflation and outright theft, you must create a plan of protecting your gold. Keeping it close at hand where only you have access to it is the first step.

Secondly, you should consider diversifying your precious metals holding internationally, which seems to be more difficult as capital controls in Euroland become stricter. At TDV, we saw this trend coming a long time ago and have been warning subscribers to plan ahead. Earlier this year, we published a 100 page report on how to diversify and internationalize your precious metals holding called Getting Your Gold Out Of Dodge (GYGOOD). If you live in Europe and are interested in protecting your precious metals, this report is something you should consider getting right away; your time to act may be limited by your own government.

Gold Update

The price of gold is still consolidating. The price needs to stay above support at the 50 dma of $1615. If this support holds, then it could move toward resistance at $1675 and the 200 dma. A break below $1610 could trigger selling and the price could still see one more wave of selling to test support at $1530 or slightly lower again. If we do get one more wave of selling, I suggest you consider backing up the truck as this could be that last time we see prices this low, possibly forever.

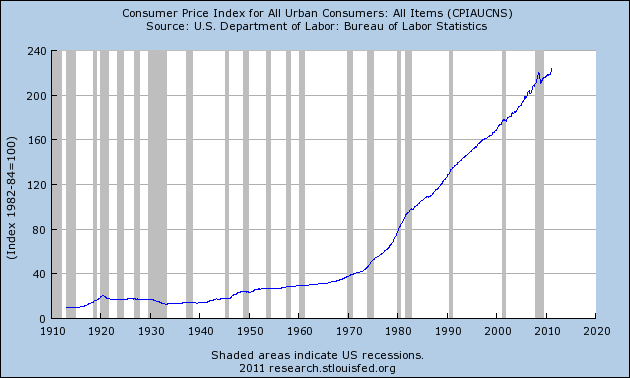

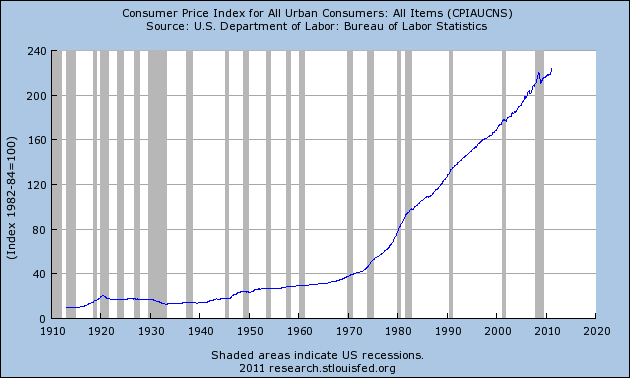

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.