By Vin Maru

By Vin Maru

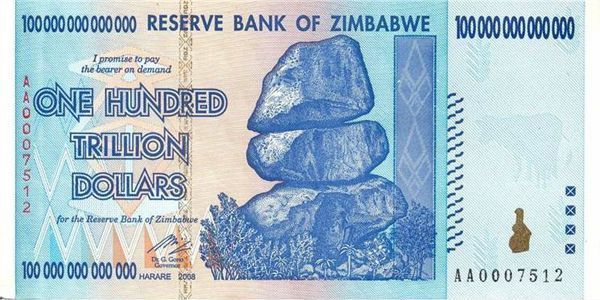

Lately we have seen many articles about China and many other central banks continuing to buy and increase their holdings of gold as part of their effort to continue diversifying out of foreign paper currencies. Who can blame them? Would you want to hold paper promises to pay off financial obligations from countries that are essentially bankrupt as a part of your currency reserve? China is doing what is the right thing and in the best interest of China, buying more gold to hold as a part of your reserves in order to make your currency more marketable. They want to make the yuan a competing currency to the other major currencies around the world and they will succeed and owning gold is part of their strategy.

There is some speculation that China is increasing its gold holding to make the yuan a gold-backed currency in an effort to make it a world currency reserve. While it is an interesting concept, it will most likely never happen. In order to back a currency, their gold holdings must increase or decrease alongside the increase or decrease in the number of currency units in the system. A gold backed currency would entail having a fixed rate of convertibility for each ounce of gold to a specific number currency units issued by that country. There is probably no country in the world that will honour convertibility on a fixed basis, it would be financial suicide and is part of the reason why Nixon closed the gold window. Also having a gold backed currency would mean the country would be continually increasing gold purchases to match the inflation of currency units issued. Tracking the amount of gold that is backing currency would also be next to impossible since there is a complete lack of transparency around the amount of currency units being issued by central banks and the amount of gold held by them. Currently currencies can be converted to gold on a floating basis at market price, but going to a gold backed currency would likely never happen.

China is making its currency more readily available for trade, thus bypassing the US dollar and making its currency the payment of choice for its export. Currently the yuan is fixed to the US dollar, but over time it will most likely have to adopt a floating currency like the rest of the world. Until then, expect China to continue adding to its gold reserve in an effort to make the yuan a competing currency for international trade. The US will lose its reserve currency status over time (most likely some time this decade) but it most likely will never go away completely and the yuan will not take over completely. We will most likely just have bi-lateral trade agreements with several national currencies being used for payments. The yuan is just the new kid on the block but there is still the Euro, British pound, Japanese yen, the US$ and probably the IMFs SDR that will also be used. Even the Canadian dollar has been strengthening lately, as the IMF said it’s considering classifying the Canuck buck and the Australian dollar as reserves currencies.

While gold may not be convertible at a fixed rate any time soon, VTB Group is Russia’s first lender to sell perpetual bonds and debt linked to the country’s benchmark equity index and is now selling the nation’s debut notes tied to the price of gold (see Bloomberg article). VTB is offering 1 billion rubles ($32 million) of securities that will be redeemed in December 2013 that will pay a rate on returns based on the gold price up to a limit of 20 percent. Being a pioneer in the Russian market, VTB is the 2nd largest bank and will provide pension funds an alternative to invest in gold without the limits placed on commodity holding by regulators. The article even talks about how even Western financial institutions such as JP Morgan, Barclays, and Credit Suisse are issuing notes tied to gold this month. This is just another example of how gold is becoming an important financial asset. The need to diversify and protect wealth becomes more apparent in an era of currency wars which will destroy the value of fiat money. Financial institutions realize that central banks will continue down the path of printing money, inflation and currency devaluation, there is no other choice. They see the writing on the wall and are now capitalizing on a new markets by providing financial assets tied to the price of gold price.

All these currencies will continue to inflate and I doubt the bankers will allow gold to become a competing currency for everyday transactions. However its role as a store of value will continue to appreciate as long as fiat money continues to exits. So we should be happy that government and central bankers will continue to use and expand fiat currency, it makes their currency worth less and gold will continue to benefit in the long run.

What we are seeing now, with short term fluctuations in the price of gold is just market noise and short term trading opportunities created by the gold market high frequency traders and bullion banks. This will come to pass as the price of gold gets smoothed out and then slowly advances higher with a two steps forward one step back dance along a rising trend. All this talk about gold by mainstream media is just market noise to try and explain very short term movements in price. They have very little understanding of gold and the role it will play in the future as a store of value. Being the good slaves and puppets for the central bankers, MSM is only good at misdirecting the public and they are paid very well for doing so. Once gold finishes this consolidation, the price should continue to advance to all time highs in 2013 and 2014 with a possibility of doubling from the current price to reach a minimum target of $3500 in the next few years.

If you enjoyed reading this article and are interested in protecting your wealth with precious metals, you can receive our free blog by visiting TDV Golden Trader. Also learn how you can purchase and protect your gold holdings by getting a copy of our special report Getting Your Gold out of Dodge or protecting the stock investments you currently own with Bullet Proof Shares.

Regards,

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t. As gold turns lower on reports of a “turning point” for the entire global economy, let’s take a look at some thought provoking gold, silver, and precious metals related stories from other news sites and blogs. This round up includes stories on the Gold ETF and Silver ETF, a call for a return to the gold standard, Fort Knox, and prospecting for gold.

As gold turns lower on reports of a “turning point” for the entire global economy, let’s take a look at some thought provoking gold, silver, and precious metals related stories from other news sites and blogs. This round up includes stories on the Gold ETF and Silver ETF, a call for a return to the gold standard, Fort Knox, and prospecting for gold.