By Axel Merk

By Axel Merk

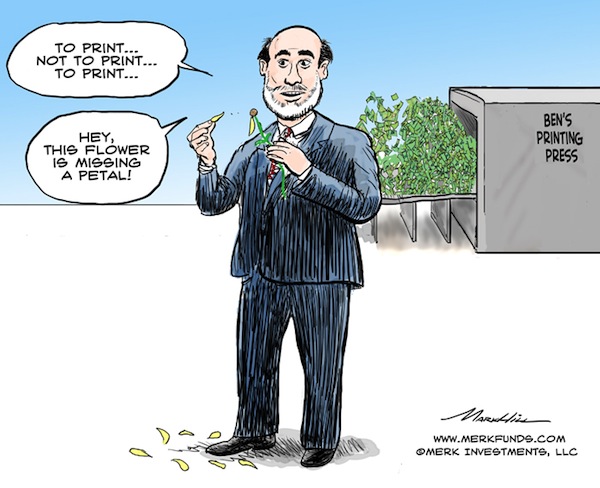

The FOMC has crossed the Rubicon: our analysis suggests that the Federal Open Market Committee is deliberately ignoring data on both growth and inflation. At best, the FOMC’s intention might have been to not rock the markets two weeks before the election. At worst, the FOMC has given up on market transparency in an effort to actively manage the yield curve (short-term to long-term interest rates):

- On growth, economic data, including the unemployment report, have clearly come in better than expected since the most recent FOMC meeting. FOMC practice dictates that progress in economic growth is acknowledged in the statement. Instead, the assessment of the economic environment is verbatim. Had the FOMC given credit to the improved reality, the market might have priced in earlier tightening. The FOMC chose to ignore reality, possibly afraid of an unwanted reaction in the bond market.

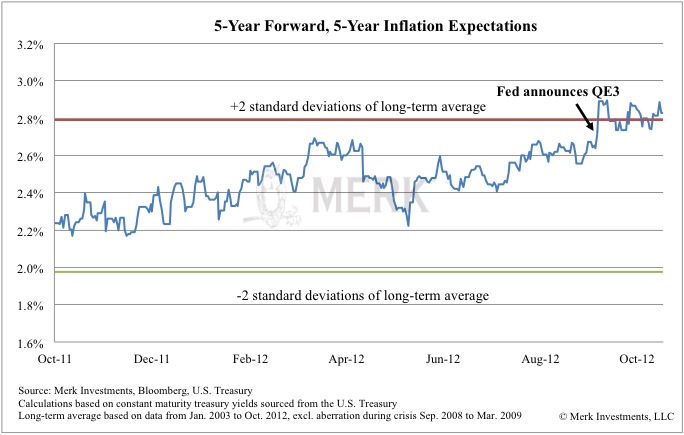

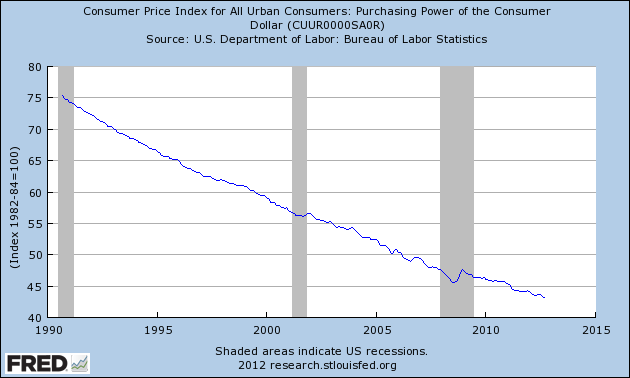

- On inflation, the FOMC correctly points out that inflation has recently picked up “somewhat.” However, it may be misleading to blame the increase on higher energy prices, and then claim that “longer-term inflation expectations have remained stable.” Not so, suggests an important inflation indicator monitored by the Fed and economists alike: 5-year forward, 5-year inflation expectations broke out when the Fed announced “QE3”, its third round of quantitative easing where the emphasis shifted from a focus on inflation to a focus on employment. This gauge of inflation measures the market’s expectation of annualized inflation over a five year period starting five years out, ignoring the near term as it may be influenced by short-term factors:

|

|---|

The chart shows that we have broken out of a 2 standard deviation band and that the breakout occurred at the time of the QE3 announcement. In our assessment, the market disagrees with the FOMC’s assertion that longer-term inflation expectations have remained stable. At best, the FOMC ignores this development because they also look at different metrics (keep in mind that the Fed’s quantitative easing programs manipulate the very rates we are trying to gauge here) or has a different notion of what it considers longer-term stable inflation expectations. At worst, however, the FOMC is afraid of admitting to the market that QE3 is perceived as inflationary.

In our assessment, inflation expectations have clearly become elevated. Ignoring reality by ignoring growth and inflation may not be helpful to the long-term credibility of the Fed. Fed credibility is important, as monetary policy becomes much more expensive when words alone don’t move markets anymore.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Axel Merk is President and Chief Investment Officer, Merk Investments

Merk Investments, Manager of the Merk Funds

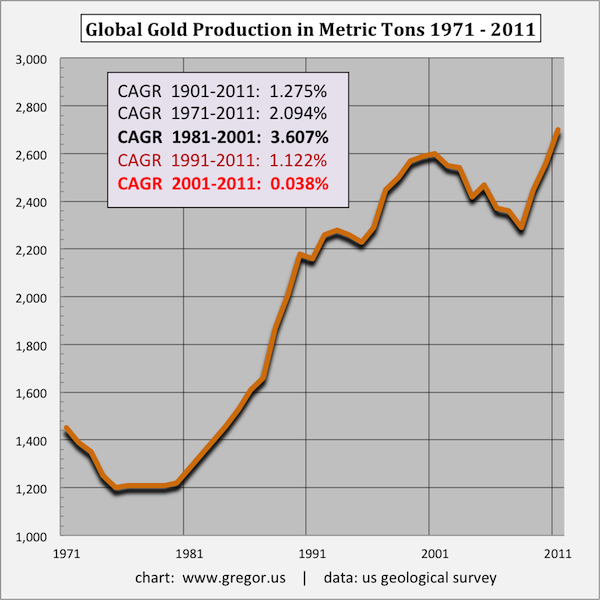

Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to

Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to

By Axel Merk & Yuan Fang

By Axel Merk & Yuan Fang

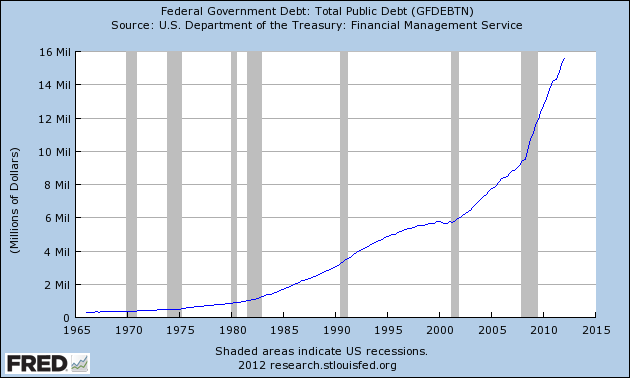

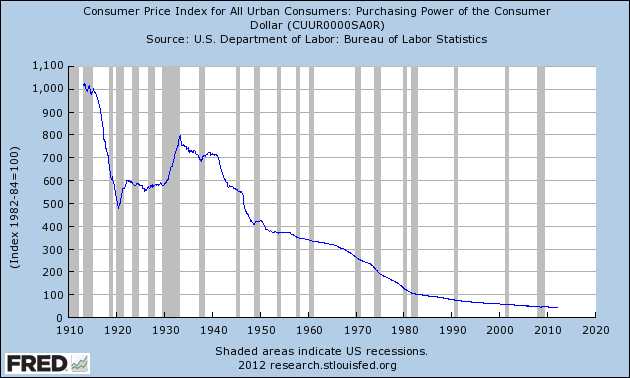

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

By Axel Merk

By Axel Merk By

By

By Axel Merk

By Axel Merk

Most Americans under 30 have a strange sense of unease that something is very wrong with the way things are going in America. If you are 60 or older and can remember with nostalgia how life in America was prior to the days of blatant and corrupt crony capitalism, you know for sure we are heading in a very wrong direction at an accelerating pace.

Most Americans under 30 have a strange sense of unease that something is very wrong with the way things are going in America. If you are 60 or older and can remember with nostalgia how life in America was prior to the days of blatant and corrupt crony capitalism, you know for sure we are heading in a very wrong direction at an accelerating pace.