Sales of the United States Mint’s American Silver Eagle bullion coins started the year in impressive fashion. For the opening day of availability for 2013-dated coins, the US Mint received orders for 3,937,000 coins from authorized purchasers.

Sales of the United States Mint’s American Silver Eagle bullion coins started the year in impressive fashion. For the opening day of availability for 2013-dated coins, the US Mint received orders for 3,937,000 coins from authorized purchasers.

This amount exceeds the opening day sales levels for recent years, which had seen 3,197,000 coins ordered to start 2012; 2,085,000 coins ordered to start 2011; and 2,440,000 coins ordered to start 2010.

The strong opening for the 2013 Silver Eagles has been driven by pent up demand for the popular one ounce silver bullion coins. The US Mint sold out of the 2012-dated coins in mid-December, creating a three week period during which no coins were available for authorized purchasers to order. The pent up demand supplemented the already typically high demand for the first release of the newly dated coins.

To put yesterday’s numbers in perspective, the sale of nearly 4 million one ounce silver coins represents more than one-tenth of annual silver production within the United States. Since the start of the program there have been two years (1996 & 1997) where annual Silver Eagle sales measured in ounces have been lower than yesterday’s sales which occurred in a single day. Measured in dollar terms, yesterday’s sales of approximately $120 million worth of Silver Eagles were higher than the annual sales total for each individual year from 1986 to 2005.

By: Axel Merk, Merk Investments

By: Axel Merk, Merk Investments

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces. According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

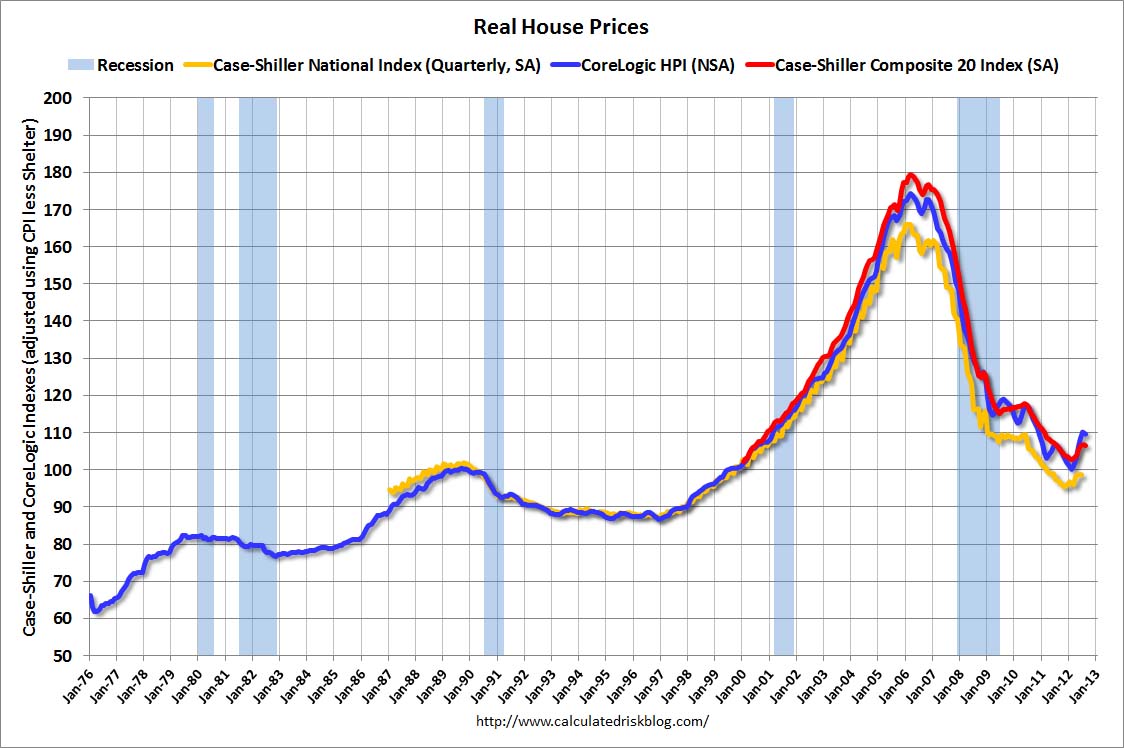

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold. Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

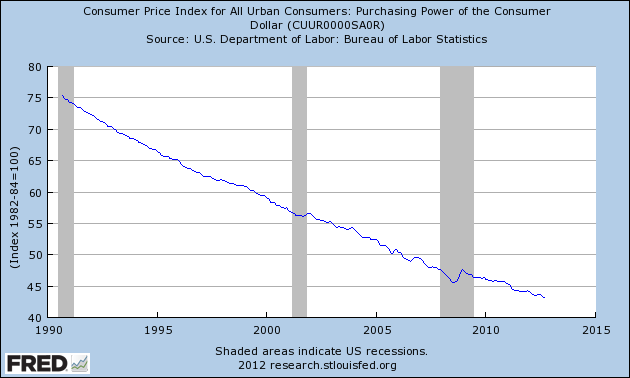

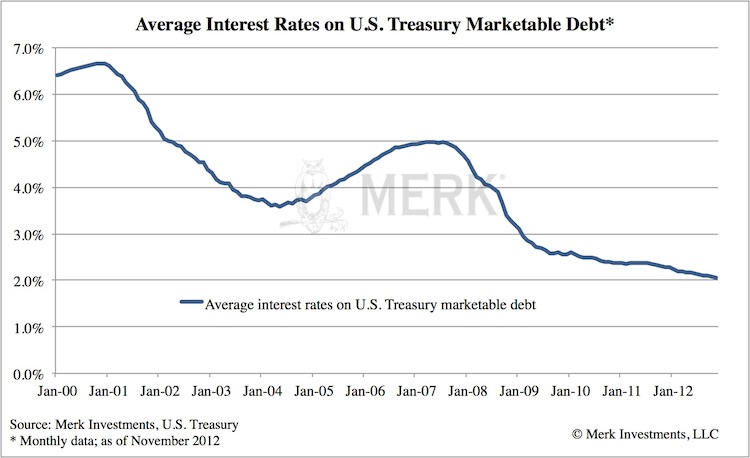

Americans need to take a serious look at how the purchasing power of the dollar is being destroyed. Rampant poverty, declining real incomes and higher prices are all the guaranteed results of a Federal Reserve that remains committed to destroying the value of the dollar. A dollar saved today that has less purchasing power a year from now equates to the “silent” destruction of the dollar, an event which has gone virtually unnoticed and unprotested by the American public.

Americans need to take a serious look at how the purchasing power of the dollar is being destroyed. Rampant poverty, declining real incomes and higher prices are all the guaranteed results of a Federal Reserve that remains committed to destroying the value of the dollar. A dollar saved today that has less purchasing power a year from now equates to the “silent” destruction of the dollar, an event which has gone virtually unnoticed and unprotested by the American public.

As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a

As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a

By

By

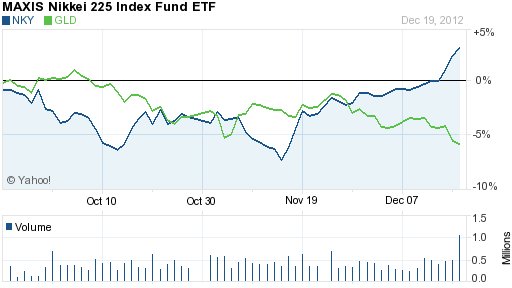

Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.

Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.