One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals.

The bull case for precious metals remains intact as central bankers worldwide have become the lenders of last resort for nations that have exhausted their borrowing capacities. Very little has changed since 2008 when the world financial system stood at the abyss of collapse. Unsustainable debt levels continue to increase even as the capacity to service the debt diminishes.

As discussed in Why There is No Upside Limit For Gold and Silver Prices, the U.S. has reached a tipping point on the road to insolvency. Despite trillions in stimulus spending, both job creation and economic growth have been extremely weak and are likely to remain so.

Economists Kenneth Rogoff and Carmen Reinhart, authors of This Time Is Different: Eight Centuries of Financial Folly, offer comprehensive statistical evidence of the dangers of excessive public debt. As documented in their book, once public sector debt reaches 90% (which the U.S. is very close to) a country has only three options, all of them bad.

According to Rogoff and Reinhart, the only way out for overleveraged nations is a restructuring through default, austerity or allowing inflation to increase while repressing interest rates at a very low level.

Default is the most drastic and least likely remedy to be used by a country such as the United States which issues its own currency and can create an unlimited number of dollars to service debt payments.

Austerity, the second option, is a highly unlikely scenario under our current democratic system. Any politician voting for austerity measures would quickly be voted out of office and replaced by another politician promising continued funding of the social welfare state. Since over half the country’s population currently depends on entitlement programs to survive, the power of the majority vote guarantees that austerity will not become a policy for putting the country back on a fiscally sound economic path. The inability to reduce unsustainable spending or impose confiscatory rates of taxation leaves the government with one bad option – print more money.

The United States is currently locked into policy options that guarantee a long term rise in gold and silver prices. The current weakness in precious metals represents a buying opportunity for those seeking to accumulate and protect their wealth over the long term.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar. The deluge of bearish articles on gold continues with a Wall Street Journal article entitled “

The deluge of bearish articles on gold continues with a Wall Street Journal article entitled “ The outlook for gold has turned profoundly negative. With prices down over 4% since the start of the year, gold is off to the worst start since 2001. Billionaire investors George Soros and Louis Moore Bacon have dramatically slashed their gold holdings and Bloomberg reports that money managers have liquidated gold and precious metal holdings for six straight weeks, the longest stretch of outflows since the first quarter of 2011.

The outlook for gold has turned profoundly negative. With prices down over 4% since the start of the year, gold is off to the worst start since 2001. Billionaire investors George Soros and Louis Moore Bacon have dramatically slashed their gold holdings and Bloomberg reports that money managers have liquidated gold and precious metal holdings for six straight weeks, the longest stretch of outflows since the first quarter of 2011.

You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice.

You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice. Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Every gold and silver investor owes a debt of gratitude to the

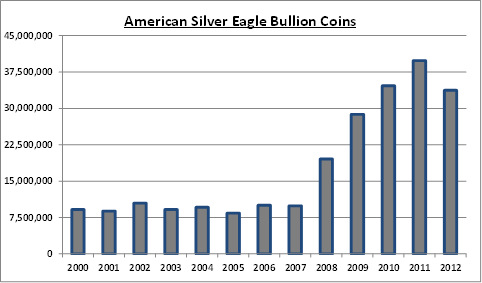

Every gold and silver investor owes a debt of gratitude to the With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.