The sale of gold bullion coins by the US Mint remained steady in May compared to the previous month but declined sharply from year ago levels. There are numerous theories on why gold demand and prices have not recovered in 2014.

The sale of gold bullion coins by the US Mint remained steady in May compared to the previous month but declined sharply from year ago levels. There are numerous theories on why gold demand and prices have not recovered in 2014.

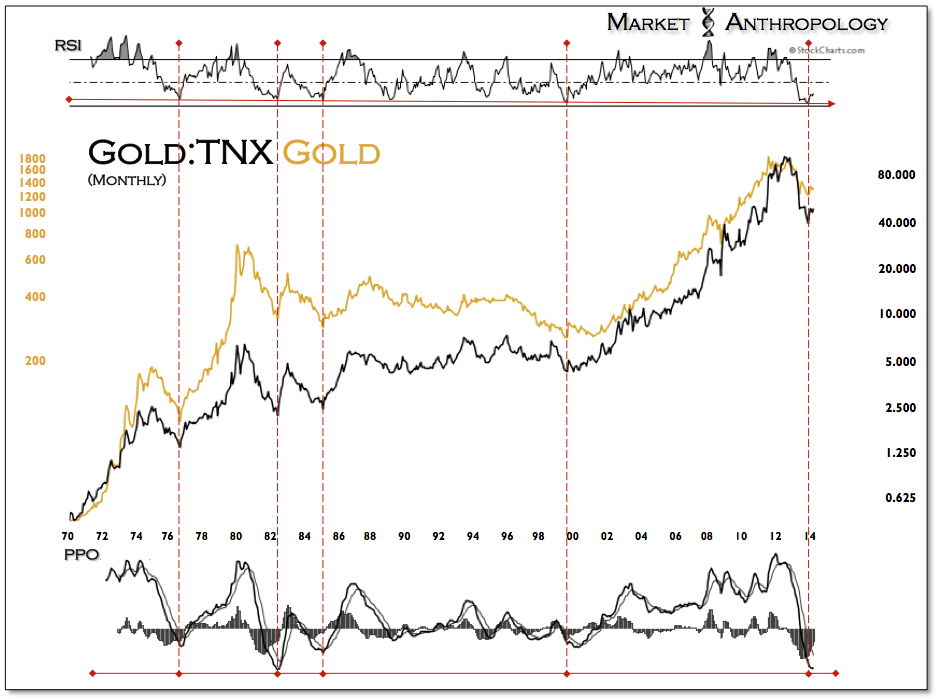

The world seems to have regained confidence in paper money despite the fact that the financial system is now more leveraged than before the financial crisis and the debt problems which caused the financial crisis have simply been papered over with more debt. Meanwhile, investors in both the stock and bond markets perceive risk to be low and the bulls outnumber the bears by a margin reminiscence of the pre-crash year of 2007.

The only asset class with a preponderance of bears seems to be precious metals. When the crowd is leaning in one direction, it’s a perfect setup for an eventual price reversal suggesting that long term precious metal investors currently enjoy the opportunity to be greedy when others are fearful.

Despite the constant bearish rants, gold has been relatively stable during 2014. After starting the year at $1,225 per ounce gold reached a high of $1,385 on March 14 and is currently at $1,244.50 for a gain of 1.6% on the year.

| Gold Bullion U.S. Mint Sales Since 2000 as of May 31, 2014 | ||

| Year | Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 753,000 | |

| 2013 | 856,500 | |

| 2014 | 217,500 | |

| TOTAL | 9,076,500 | |

During May the US Mint reported sales of 35,500 ounces of the American Eagle gold bullion coins, down from 38,500 ounces in the previous month. Gold bullion coin sales plunged from last May when the Mint sold a total of 70,000 ounces.

Since monthly gold bullion coin sales can vary dramatically a look at the average monthly and year to date sales can give a more enlightened view on demand. As of May 31, 2014 a year to date total of 217,500 ounces of gold bullion coins were sold by the Mint compared to 572,000 ounces in the comparable year ago period, a decline of 61.8%. Average monthly sales of gold bullion coins during 2014 through May 31 were 43,500 ounces compared to 114,000 ounces last year.

Based on year to date sales, annualized sales of gold bullion coins for 2014 are projected at 522,000 ounces or a decline of 39.1% from the 856,500 ounces sold during 2013.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

By: GE Christenson

By: GE Christenson

The

The