Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

Holdings in the GLD declined by 2.43 tonnes compared to a decline of 21.85 tonnes in the previous week. Since the start of the year, total holdings have declined by 4.2% or 53.57 tonnes. The GLD currently holds 39.5 million ounces of gold.

The holdings of the GLD currently have a market value of $52.7 billion, making the GDL a very significant presence in the gold market. The market cap of the GLD far exceeds that of major gold producers such as Goldcorp (GG) at $30 billion, Newmont Mining (NEM) at $27.4 billion and Randgold (GOLD) at $7.1 billion.

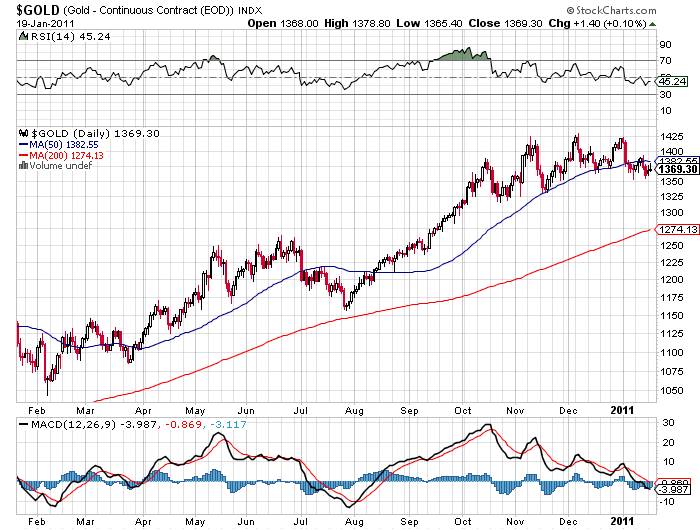

Gold has now made three failed attempts to decisively pierce the $1400 level since last November, forming a triple top in the process. The failure to breakout to new highs and the large price gain of $250 per ounce since last July has motivated some nervous selling by gold investors. A look at the one year chart shows that gold’s short term momentum has faltered as prices breached the 14 day moving average. The next important test will be at the 200 day moving average which gold has traded above for the past two years.

Despite the recent minor setback in gold prices, the long term trend of gold remains intact technically and fundamentally.

GLD and SLV Holdings (metric tonnes) |

|||

2-Feb-2011 |

Weekly Change |

YTD Change |

|

GLD |

1,227.15 |

-2.43 |

-53.57 |

SLV |

10,400.60 |

-47.10 |

-520.97 |

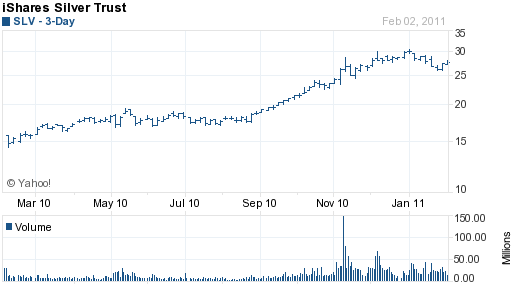

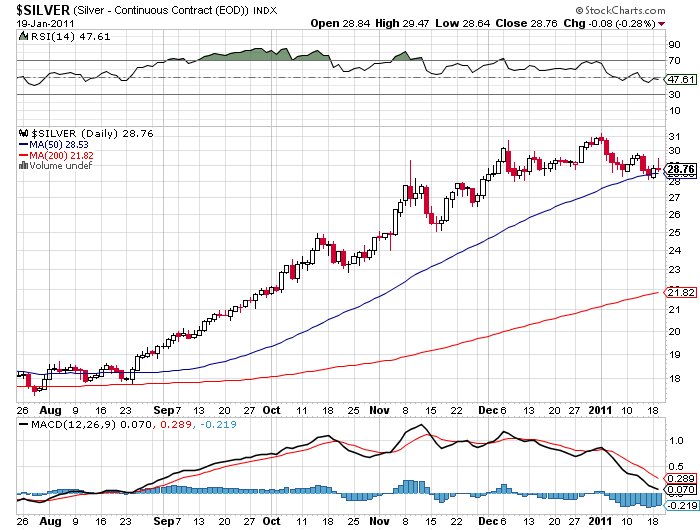

Silver holdings in the iShares Silver Trust (SLV) declined by 47.1 tonnes over the past week compared to a decline in the previous week of 127.6 tonnes. The year to date decline of 520.97 tonnes represents a 4.7% drop in silver holdings which trails the 7.8% year to date decline in the price of silver. The SLV has declined by 9% from its high of $30.40 at the beginning of the year. After a huge gain of 67% in the price of silver since late last year, it is normal to see price consolidation before another advance.

In this writer’s opinion we have not seen a parabolic blow off type price move, nor have we seen the excited entry of first time silver buyers lured by stories of rising prices. One of the sentiment gauges that I use involve noting how many of my friends and clients ask or offer unsolicited advice on a specific investment category. Thus far, not even one person has mentioned silver. Despite the huge advance in silver prices, public awareness seems minimal, implying long term bullishness.

Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade.

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade. Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term. Another Precious Week

Another Precious Week As gold turns lower on reports of a “turning point” for the entire global economy, let’s take a look at some thought provoking gold, silver, and precious metals related stories from other news sites and blogs. This round up includes stories on the Gold ETF and Silver ETF, a call for a return to the gold standard, Fort Knox, and prospecting for gold.

As gold turns lower on reports of a “turning point” for the entire global economy, let’s take a look at some thought provoking gold, silver, and precious metals related stories from other news sites and blogs. This round up includes stories on the Gold ETF and Silver ETF, a call for a return to the gold standard, Fort Knox, and prospecting for gold.