By Axel Merk

By Axel Merk

The FOMC has crossed the Rubicon: our analysis suggests that the Federal Open Market Committee is deliberately ignoring data on both growth and inflation. At best, the FOMC’s intention might have been to not rock the markets two weeks before the election. At worst, the FOMC has given up on market transparency in an effort to actively manage the yield curve (short-term to long-term interest rates):

- On growth, economic data, including the unemployment report, have clearly come in better than expected since the most recent FOMC meeting. FOMC practice dictates that progress in economic growth is acknowledged in the statement. Instead, the assessment of the economic environment is verbatim. Had the FOMC given credit to the improved reality, the market might have priced in earlier tightening. The FOMC chose to ignore reality, possibly afraid of an unwanted reaction in the bond market.

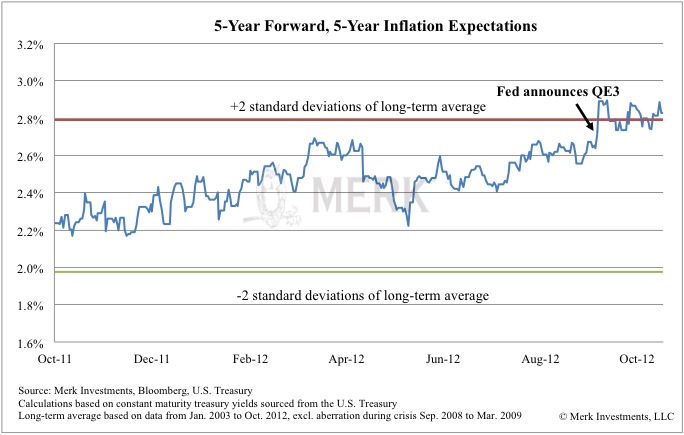

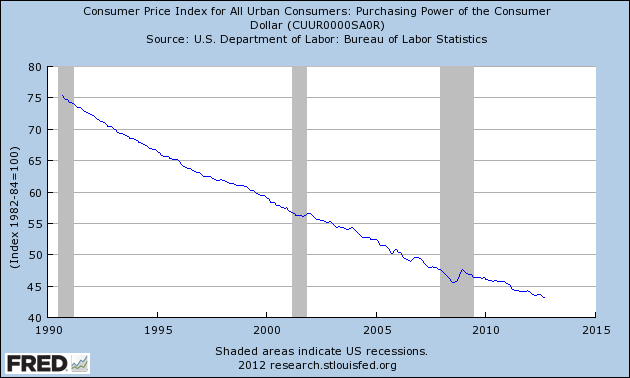

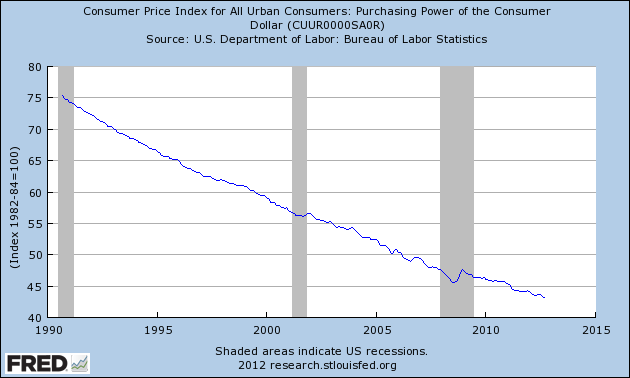

- On inflation, the FOMC correctly points out that inflation has recently picked up “somewhat.” However, it may be misleading to blame the increase on higher energy prices, and then claim that “longer-term inflation expectations have remained stable.” Not so, suggests an important inflation indicator monitored by the Fed and economists alike: 5-year forward, 5-year inflation expectations broke out when the Fed announced “QE3”, its third round of quantitative easing where the emphasis shifted from a focus on inflation to a focus on employment. This gauge of inflation measures the market’s expectation of annualized inflation over a five year period starting five years out, ignoring the near term as it may be influenced by short-term factors:

|

|---|

The chart shows that we have broken out of a 2 standard deviation band and that the breakout occurred at the time of the QE3 announcement. In our assessment, the market disagrees with the FOMC’s assertion that longer-term inflation expectations have remained stable. At best, the FOMC ignores this development because they also look at different metrics (keep in mind that the Fed’s quantitative easing programs manipulate the very rates we are trying to gauge here) or has a different notion of what it considers longer-term stable inflation expectations. At worst, however, the FOMC is afraid of admitting to the market that QE3 is perceived as inflationary.

In our assessment, inflation expectations have clearly become elevated. Ignoring reality by ignoring growth and inflation may not be helpful to the long-term credibility of the Fed. Fed credibility is important, as monetary policy becomes much more expensive when words alone don’t move markets anymore.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies.

Axel Merk is President and Chief Investment Officer, Merk Investments

Merk Investments, Manager of the Merk Funds

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

By Axel Merk & Yuan Fang

By Axel Merk & Yuan Fang

According to

According to

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison.

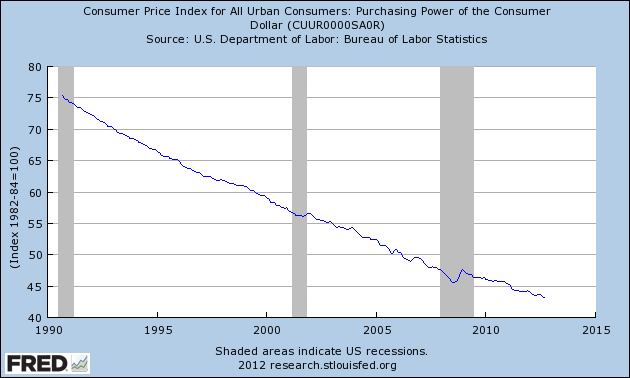

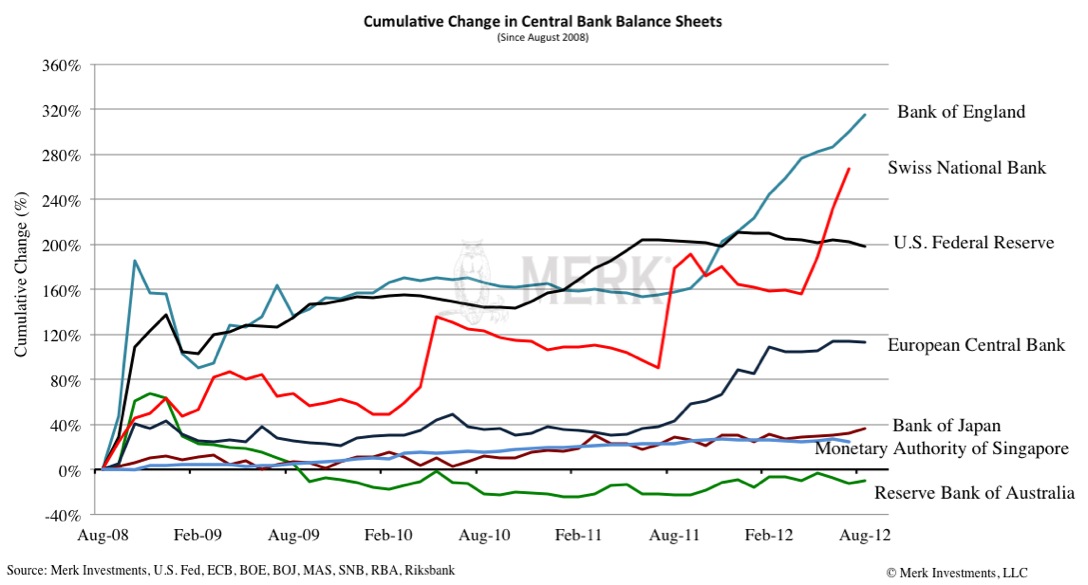

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison. In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

By

By

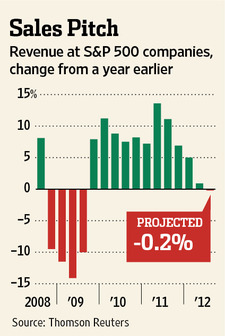

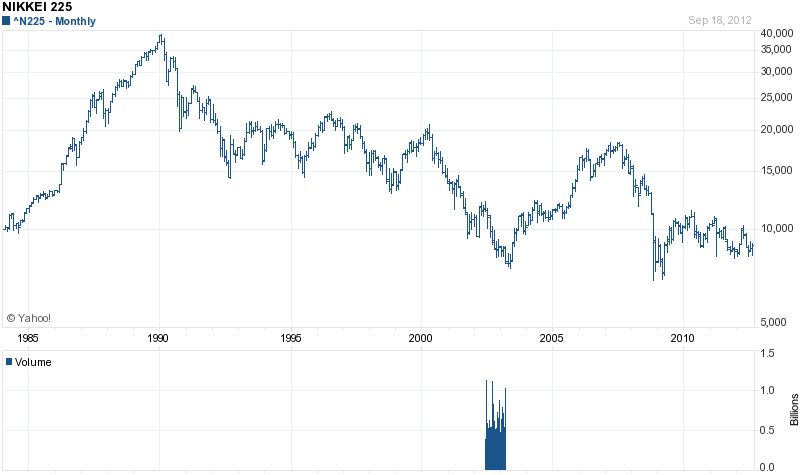

After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the

After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the

By Axel Merk

By Axel Merk By Axel Merk

By Axel Merk