Sorry for the lack of posts lately. Let’s get back into the swing of things with a round up of some gold and silver related stories for the past few days to bring things back up to speed.

Sorry for the lack of posts lately. Let’s get back into the swing of things with a round up of some gold and silver related stories for the past few days to bring things back up to speed.

Federal Reserve Will Fail with Quantitative Easing

Reaction following the Federal Reserve announcement that they will purchase $300B of long term Treasuries.

Bugs triumpant about gold, terrified about US

More reactions from gold bugs who are “triumphant — and terrified.”

Bloomberg TV archive carries Murphy interview

Catch the Bernard Lo interview with GATA Chairman Bill Murphy. It also might set the stage for another segment to debate the matter of gold price suppression.

Bank crisis spawns a new kind of gold rush

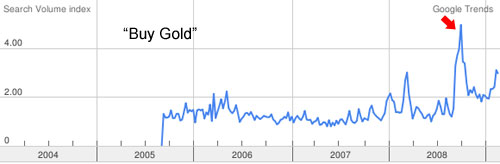

An article out of Canada describing what it calls “a bandwagon effect for investment in precious metals.” Many people are demanding physical possession and purchasing 400 ounce blocks of gold.

Japanese Young Boost Gold Buying Amid Recession

An article from Bloomberg about the growing and broadening demand for gold. It describes one firm’s gold accumulation program, which allows customers to have a certain amount automatically debited from their bank account each month and invested in gold.

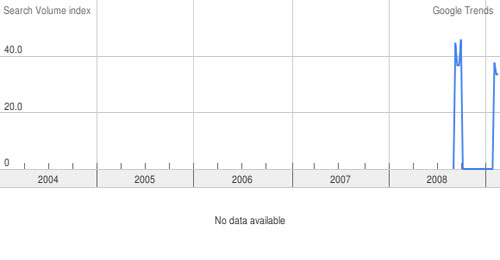

Why the price of gold is not yet soaring?

A question that is on many people’s minds, especially in light of numerous articles like the ones above. Temporarily putting aside government and central bank manipulation, here’s an excellent evaluation of some of the other forces at work.

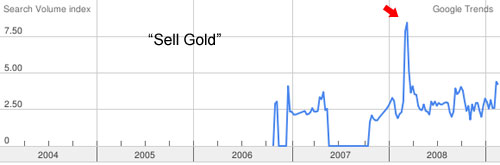

Put simply, in order for the gold price to go substantially higher, investment demand must offset declining jewelry demand and, in addition, absorb all the scrap supplies that are now hitting the market as individuals all over the world scramble for cash in a very, very bad economy.

Wealthy individuals are certainly buying the stuff but ordinary investors are still in shock.

To get a really good “gold bubble” going (not to be confused with conditions today that some journalists confuse with the real thing), you need broad participation – lots of embraces from lots of average Joes.

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins. With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites.

With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites.

Back in December

Back in December Gold, silver, and platinum have all been strong performance so far this year, but which has done the best? The table below presents the price of gold, silver, and platinum at the start of the year, today’s price, and the change. The performance of the S&P 500 is thrown in for good measure.

Gold, silver, and platinum have all been strong performance so far this year, but which has done the best? The table below presents the price of gold, silver, and platinum at the start of the year, today’s price, and the change. The performance of the S&P 500 is thrown in for good measure.