Gold’s recent move above $900 has analysts scrambling to increase their price targets.

Gold’s recent move above $900 has analysts scrambling to increase their price targets.

The last time I looked at gold price targets from analysts was in early December, when a similar flurry of activity took place. Morgan Stanley got the ball rolling by saying that gold could reach $1,000 in three years, Merrill Lynch followed with a price of $1,500 at an unspecified date, and Citigroup topped them all by mentioning $2,000.

This time around started in the same way with Morgan Stanley making a timid call for $1,075 gold in three years. From their report: “A globally synchronous and aggressive fiscal and monetary stimulus may be needed to re-inflate the global economy, and we think this continues to present significant upside to gold prices.” For their rhetoric, their target price is ridiculous, unless you consider “significant upside” to be a 6% annual gain for three years.

Merrill Lynch chimed in next with their Chief Investment Officer reiterating their prediction of $1,500 gold, but this time with a time frame of 12 to 15 months. Quote from the CIO: “With confidence in currencies shaken to the core, the yellow metal is increasingly assuming the role of “the most trusted currency. We have never seen such a rush to buy gold. It’s bringing in security and it’s still affordable.”

A few days following, both UBS and Goldman Sachs updated their previously underwater gold price targets. UBS raised their 2009 price target from $700 to $1,000. Goldman Sachs raised its forecast of $700 to $1,000 within a three month time frame.

As expressed before, I do not think we have reached the point where these periodic analyst pile ons can be used as a contrary indicator for gold. Analysts are still showing restraint, and for the most part raising their targets simply to keep up with the rising price of gold.

With gold now at a six month high, here’s a brief round up of some gold stories.

With gold now at a six month high, here’s a brief round up of some gold stories. Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009.

Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009. As gold closes above the $900 level in US Dollars and reaches new all time highs in the euro, British pound, and Canadian dollar, let’s take a look at some recent gold, silver, and precious metals related stories that are worth reading.

As gold closes above the $900 level in US Dollars and reaches new all time highs in the euro, British pound, and Canadian dollar, let’s take a look at some recent gold, silver, and precious metals related stories that are worth reading. Over the past several months, the United States Mint has announced a series of actions and policy changes that make it more difficult for the average individual to buy gold. There have always been plausible or semi-plausible explanations, but the consequence of each action has been to limit or discourage gold ownership.

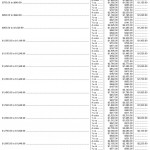

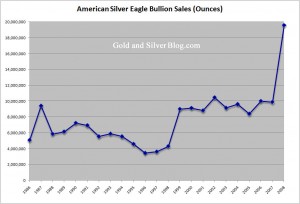

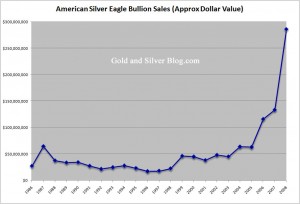

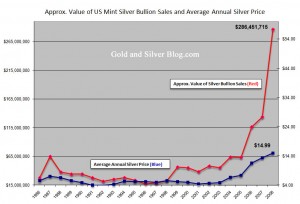

Over the past several months, the United States Mint has announced a series of actions and policy changes that make it more difficult for the average individual to buy gold. There have always been plausible or semi-plausible explanations, but the consequence of each action has been to limit or discourage gold ownership. With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces.

With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces. A brief round up of some of the more interesting gold, silver, and precious metals articles and events from the past week.

A brief round up of some of the more interesting gold, silver, and precious metals articles and events from the past week. The

The