With the second quarter behind us, let’s take a look at the performance of gold, silver, and platinum for the second quarter of 2009 and year to date.

With the second quarter behind us, let’s take a look at the performance of gold, silver, and platinum for the second quarter of 2009 and year to date.

All of the metals posted gains, but at single digit levels. The best performer for the second quarter was silver with a gain of 6.33%, followed by platinum with a gain of 5.52%, and then gold with a gain of 1.96%. The closing numbers don’t tell the full story. At the beginning of June, precious metals prices had spiked. At this recent peak, silver had been up as much as 22% for the quarter. Platinum and gold were also showing heftier gains at this time.

| 2009 Second Quarter Gold, Silver, and Platinum Performance | ||||

| 31-Mar-09 | 30-Jun-09 | Change | Percent | |

| Gold | 916.5 | 934.50 | 18.00 | 1.96% |

| Silver | 13.11 | 13.94 | 0.83 | 6.33% |

| Platinum | 1,124.00 | 1186.00 | 62.00 | 5.52% |

On a year to date basis, the top precious metal performer remains as platinum with a gain of 32.07% on the year. This is followed by silver with a gain of 29.19% and gold with a gain of 7.44%. The performance of the metals had lined up in the same manner at the close of the first quarter.

| 2009 YTD Gold, Silver, and Platinum Performance | ||||

| 30-Dec-08 | 30-Jun-09 | Change | Percent | |

| Gold | 869.75 | 934.50 | 64.75 | 7.44% |

| Silver | 10.79 | 13.94 | 3.15 | 29.19% |

| Platinum | 898.00 | 1186.00 | 288 | 32.07% |

Gains from the sale of investments in precious metals are currently subject to a tax rate of 28%. This compares to the current long term capital gains rate of 15%, which applies to other investment classes such as stocks and bonds. A bill has been introduced which seeks to tax precious metals investors at the same preferential rates afforded to other investors.

Gains from the sale of investments in precious metals are currently subject to a tax rate of 28%. This compares to the current long term capital gains rate of 15%, which applies to other investment classes such as stocks and bonds. A bill has been introduced which seeks to tax precious metals investors at the same preferential rates afforded to other investors.

The Royal Canadian Mint has revived two bullion coin programs that had been previously been suspended for a number of years. This includes the Platinum Maple Leaf, with bullion coins already available, and the Palladium Maple Leaf, which is planned for later this year.

The Royal Canadian Mint has revived two bullion coin programs that had been previously been suspended for a number of years. This includes the Platinum Maple Leaf, with bullion coins already available, and the Palladium Maple Leaf, which is planned for later this year. As gold contemplates the $1,000 barrier, here’s a roundup of gold, silver, and precious metals related stories that are interesting for one reason or another. Each headline comes with a snippet of commentary. Enjoy.

As gold contemplates the $1,000 barrier, here’s a roundup of gold, silver, and precious metals related stories that are interesting for one reason or another. Each headline comes with a snippet of commentary. Enjoy. As in the past, I wanted to write another post examining the US Mint’s monthly gold, silver, and platinum bullion coin sales. Previously these figures were a flawed method of examining demand for physical precious metals due to the rationing program in place from the United States Mint. As long as authorized purchasers of US Mint bullion coins were restricted in the quantities they could purchase, it was difficult to ascertain how much unmet demand existed behind the rationing wall.

As in the past, I wanted to write another post examining the US Mint’s monthly gold, silver, and platinum bullion coin sales. Previously these figures were a flawed method of examining demand for physical precious metals due to the rationing program in place from the United States Mint. As long as authorized purchasers of US Mint bullion coins were restricted in the quantities they could purchase, it was difficult to ascertain how much unmet demand existed behind the rationing wall. For countless months, authorized purchasers of US Mint gold and bullion coins have been subject to a rationing process, which limited the number of coins they could purchase. The rationing program had been put into place after the demand for gold and silver coins exceeded the US Mint’s ability to supply them. In a few recent posts I have provided some indications that the shortage of American Silver Eagles and American Gold Eagles

For countless months, authorized purchasers of US Mint gold and bullion coins have been subject to a rationing process, which limited the number of coins they could purchase. The rationing program had been put into place after the demand for gold and silver coins exceeded the US Mint’s ability to supply them. In a few recent posts I have provided some indications that the shortage of American Silver Eagles and American Gold Eagles  With gold now reaching it’s highest price of the year, gold related stories seem to be popping up in more places. Here are a few gold related articles and blog posts from the past week that are worth the read.

With gold now reaching it’s highest price of the year, gold related stories seem to be popping up in more places. Here are a few gold related articles and blog posts from the past week that are worth the read.

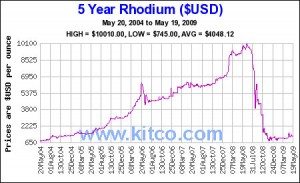

How many rhodium bullion coins are being produced and when will they be available?

How many rhodium bullion coins are being produced and when will they be available?