For the first time since Platinum Eagles were introduced, the United States Mint will not produce platinum bullion coins. This comes after nearly a year of suspension and uncertainty.

For the first time since Platinum Eagles were introduced, the United States Mint will not produce platinum bullion coins. This comes after nearly a year of suspension and uncertainty.

The American Platinum Eagle was introduced in 1997 as the first and only investment grade platinum coin issued by the United States Mint. Sales of the coin began strong, with more than 300,000 ounces of platinum sold in the first three years of the program. The US Mint offered a range of weights to accommodate different investment levels. This included one ounce, one-half ounce, one-quarter ounce, and one-tenth ounce coins. During these early years of the program, the average price of platinum was below $400 per ounce.

As the price of platinum began to move higher in the following years, the US Mint sold fewer and fewer Platinum Eagle bullion coins. Between the years 2003 to 2007, less than 10,000 of the one ounce bullion coins were sold each year. Sales figures finally perked up in 2008, after the price of platinum fell by more than half. After selling more than double last year’s level of coins, the US Mint announced the depletion of their inventory and the delayed release of the 2009 coins.

Last week, the 2009 Platinum Eagle bullion coins were finally announced as canceled. In contrast to the actions of the United States Mint, the Royal Canadian Mint actually revived their platinum bullion coin program beginning in 2009. They had previously canceled the program in 1999, citing low demand for the products. The line was quickly revived this year when the RCM recognized a high level of interest from distributors. Sales of the 2009 Platinum Maple Leaf have reportedly been strong throughout the year.

Despite the cancellation of the bullion version of the coin, the US Mint will offer a collectible proof 2009 Platinum Eagle. These coins are minted for collectors and sold at a higher premium to the precious metal value compared to the bullion coins.

The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers.

The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers. The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009.

The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009. Continuing coverage of the fallout from yesterday’s US Mint announcement, the 2009-W Uncirculated Silver Eagle has been canceled. The 2009 Annual Uncirculated Dollar Coin Set, which would have contained this coin has similarly been canceled.

Continuing coverage of the fallout from yesterday’s US Mint announcement, the 2009-W Uncirculated Silver Eagle has been canceled. The 2009 Annual Uncirculated Dollar Coin Set, which would have contained this coin has similarly been canceled. Yesterday, some very significant news broke which put to rest long standing speculation about the status of some of the United States Mint’s bullion and collector coin product offerings. Essentially, the United States Mint canceled all collectible 2009 Gold and Silver Eagle Coins, but announced the limited production of collectible proof 2009 Platinum Eagles and Gold Buffalo Coins, as well as bullion fractional Gold Eagles and one ounce Gold Buffalo coins. I will be breaking this announcement down into several posts over the next few days.

Yesterday, some very significant news broke which put to rest long standing speculation about the status of some of the United States Mint’s bullion and collector coin product offerings. Essentially, the United States Mint canceled all collectible 2009 Gold and Silver Eagle Coins, but announced the limited production of collectible proof 2009 Platinum Eagles and Gold Buffalo Coins, as well as bullion fractional Gold Eagles and one ounce Gold Buffalo coins. I will be breaking this announcement down into several posts over the next few days.

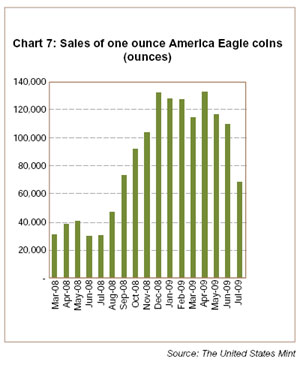

During the month of July, sales of physical bullion at the United States Mint were somewhat split. In the case of silver, sales as measured by the number of ounces sold reached the second highest level of the year. In the case of gold, sales as measured in ounces marked the second lowest total for the year.

During the month of July, sales of physical bullion at the United States Mint were somewhat split. In the case of silver, sales as measured by the number of ounces sold reached the second highest level of the year. In the case of gold, sales as measured in ounces marked the second lowest total for the year. I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.

I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.

The US Mint’s sales of gold and silver bullion coins during June 2009 showed increases from both the prior month and year ago levels. The increases came amidst two interesting developments for the US Mint’s bullion coin programs.

The US Mint’s sales of gold and silver bullion coins during June 2009 showed increases from both the prior month and year ago levels. The increases came amidst two interesting developments for the US Mint’s bullion coin programs.