April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

With investors already nervous, two mainstream news organizations today did the equivalent of yelling fire in a theater crowded with gold and silver investors.

Both Bloomberg and The Wall Street Journal published extremely bearish articles on gold which essentially proclaimed the death of the gold bull market.

“Gold is going to get crushed”

Gold will trade at $1,100 an ounce in a year and below $1,000 in five years, according to Ric Deverell, head of commodities research at the bank. Lower prices are unlikely to lure more central-bank buying, said Deverell, who worked at the Reserve Bank of Australia for 10 years before joining Credit Suisse in 2010.

“Gold is going to get crushed,” Deverell told reporters in London today. “The need to buy gold for wealth preservation fell down and the probability of inflation on a one- to three-year horizon is significantly diminished.”

Investors are losing faith in the world’s traditional store of value even as central banks continue to print money on an unprecedented scale. Bullion slumped into the bear market last month after a 12-year bull market that saw prices rise as much as sevenfold. Gold is a “wounded bull,” Credit Suisse said in a Jan. 3 report.

“When gold is going up, it looks like a great idea to buy more gold,” Deverell said. “And when it’s going down, do you really think risk-averse central bankers are going to try and catch the knife? No.”

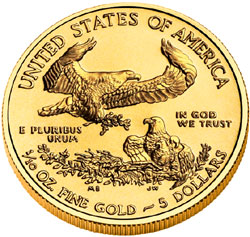

A surge in demand for bars, coins and jewelry following gold’s drop to a two-year low in April is temporary, Deverell said. The U.S. Mint said April 23 it ran out of its smallest gold coins and Australia’s Perth Mint said volumes jumped to a five-year high. India’s bullion imports may surge 47 percent to 225 tons in the second quarter to meet consumer buying, according to the All India Gems & Jewelery Trade Federation.

“This is bargain-buying,” Deverell said. “It’s like when you have cash for clunkers in autos, you bring forward activity, but it’s not a massive addition to buying.’

Courtesy: kitco.com

The metal fell for a sixth consecutive trading session on Thursday, as investors continue to flee toward assets that promise higher returns.

The characteristics beloved of “gold bugs,” the sizable army of large and small investors who swear by the metal, are precisely what bears are feasting on. Unlike most other assets, gold doesn’t offer a steady return, or yield, and it is often seen as protection against inflation or currency devaluations.

At present, however, global economic growth is sluggish, interest rates in many developed countries are at or near record lows, and investors of all stripes are scrambling to find higher-yielding assets.

“There’s basically no inflation, equities are taking off, and we’ve got a strong dollar,” said Fain Shaffer, president of Infinity Trading Corp. in Medford, Ore. “All of those are just eroding away the investment value of precious metals.” Mr. Shaffer this week recommended his clients bet on lower gold prices.

On Thursday, bears seized on a World Gold Council report showing that total demand for gold fell 13% in the first quarter, to a three-year low of 963 tons in the period.

Other investors are taking the opposite view. John Workman, chief investment strategist with Convergent Wealth Advisors, said the firm late last year recommended that clients trim their gold holdings by about 25%. He cited gold prices that have stagnated despite more stimulus from the Federal Reserve in the form of asset purchases, the same money printing that galvanized gold bugs after the financial crisis. Falling prices were a signal that many investors just weren’t concerned anymore that the stimulus measures would stoke inflation and weaken the dollar.

To sum things up –

- it no longer matters that central banks everywhere are printing money on an unimaginable scale,

- the world economy is doing fine and will continue to improve,

- gold, used as a currency and safe haven for 5,000 years, is inferior to fiat paper currency,

- returns are better in stocks and bonds,

- monetary stimulus via central bank asset purchases will propel the world into sustained economic growth,

- there is no inflation and

- investors want assets with yields.

Price fluctuations may not make much sense in the short term, but long term precious metal investors know where things are headed – see Why I Will Always Own Gold.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

By GE Christenson

By GE Christenson The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver. By: GE Christenson

By: GE Christenson Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including  We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.