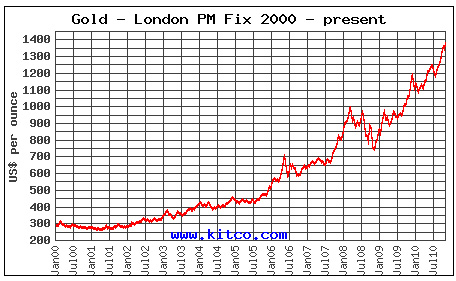

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

In fact the market has been a bit up and down. Down for two days on Tuesday and Wednesday, back up on Thursday and then gradually back on Friday. In fact the gold price for once seems to have been helped by the world not going to pot, as the Euro zone seemed to be edging towards a deal to put Ireland into run off.

| Precious Metals Prices | ||

| Fri PM Fix | Weekly Change | |

| Gold | $1,342.50 | -46.00 (-3.31%) |

| Silver | $27.07 | +0.28 (+1.05%) |

| Platinum | $1,650.00 | -62.00 (-3.62%) |

| Palladium | $695.00 | -8.00 (-1.14%) |

It seems to have affected silver as well. It only went up 1% this week. On silver’s past form this is a fall. So have they stopped competitive devaluation? You bet they haven’t. It’s just that fewer people are noticing it.

One stealth seller of gold from the official sector – which has been very quiet – has been the IMF. While the World Bank goes around telling everyone that the gold standard is something worth considering, the IMF has been ever so quietly selling gold. This has accelerated when the gold price has been relatively high as the IMF is not making an ideological statement in the same way that Gordon Brown did in the UK when he sold off a chunk of the gold reserves. This has been counteracted by equally quiet gold buying from some Central Banks, particularly Russia.

Another source of demand is the Asian consumer, and that was quite evident on the week’s trading as much of the dip was attributed to the Chinese resolve in fighting inflation. If China is successful against inflation then demand for gold will lessen. One fact on the demand, China is now approaching India as the biggest gold consumer in the world, how long before the Chinese Central Bank shares its peoples growing love of gold?

Silver is still going up, even when all the other precious metals have a bad week. There’s been relatively little action on the price fixing case, although there is now a rather bizarre campaign to bankrupt JP Morgan (one of the alleged fixers) by having everyone buying an ounce of silver which JP Morgan would have to sell back. Their target? Silver at $500 an ounce. Currently it’s $27.

During the course of the past several years, the United States Mint has implemented a rationing program for their popular American Silver Eagle bullion coins at times when demand has exceeded the available supply. Will a recent surge in demand for silver bullion cause them to reinstate the program?

During the course of the past several years, the United States Mint has implemented a rationing program for their popular American Silver Eagle bullion coins at times when demand has exceeded the available supply. Will a recent surge in demand for silver bullion cause them to reinstate the program?

Well it looks like the G20 worked. Talk of ending

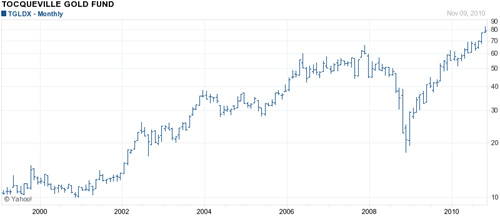

Well it looks like the G20 worked. Talk of ending  Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

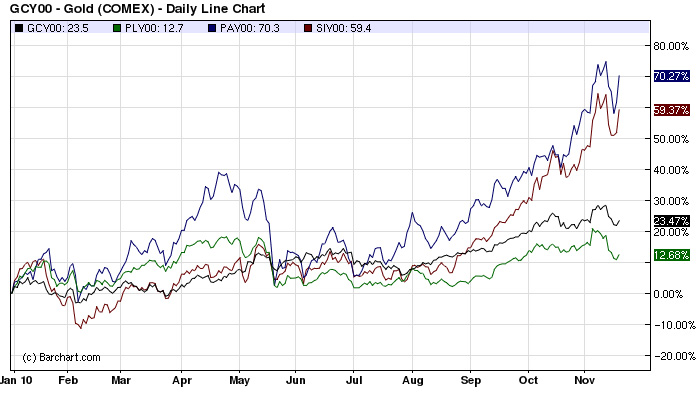

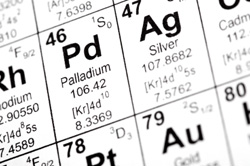

While gold and silver have dominated the media spotlight this year, the price of palladium has outperformed both. For the year to date, palladium is up $337 per ounce or more than 85%.

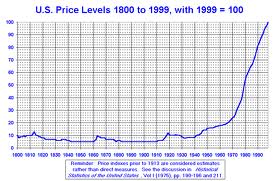

While gold and silver have dominated the media spotlight this year, the price of palladium has outperformed both. For the year to date, palladium is up $337 per ounce or more than 85%. So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely

So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely  Sales of the United States Mint’s American Silver Eagle have just moved into record territory. The most recent available sales figures show a total of 28,885,500 of the one ounce coins sold for the year to date. This edges out the annual record sales achieved in the previous year when 28,766,500 coins were sold.

Sales of the United States Mint’s American Silver Eagle have just moved into record territory. The most recent available sales figures show a total of 28,885,500 of the one ounce coins sold for the year to date. This edges out the annual record sales achieved in the previous year when 28,766,500 coins were sold. Another Precious Week in the Market

Another Precious Week in the Market