The precious metal markets caught on fire in a big way today. Gold prices surged the most in nine months by over $40 per ounce and silver closed in on $21 per ounce. After losing 28% last year as short term hot money investors sold out their holdings, gold and silver were ready for a huge rally from both a fundamental and technical standpoint (see Why Gold and Silver Could Outperform Every Other Asset Class in 2014).

The precious metal markets caught on fire in a big way today. Gold prices surged the most in nine months by over $40 per ounce and silver closed in on $21 per ounce. After losing 28% last year as short term hot money investors sold out their holdings, gold and silver were ready for a huge rally from both a fundamental and technical standpoint (see Why Gold and Silver Could Outperform Every Other Asset Class in 2014).

Precious Metals June 19, 2014

| METALS | PRICE | CHANGE | PER CENT GAIN |

| GOLD | $1319.00 | +40.50 | 3.17% |

| SILVER | $20.89 | +0.88 | 4.45% |

| PLATINUM | $1472.00 | +24.00 | 1.66% |

| PALLADIUM | $841.00 | +12.00 | 1.46% |

The reasons for today’s huge gains in precious metals varied in the mainstream press but soaring prices should have been no surprise to long term investors who understand why gold and silver should be a part of every portfolio.

Gold and silver constitute a fundamental defense for wealth preservation against the rapidly eroding value of paper currencies backed by broke governments which is Why All Governments Hate Gold.

The various governments of the world and their central banks produce and distribute a product – paper currencies. Those currencies are backed by confidence, faith, and credit, but not by gold, oil, or anything real. Those currencies are digitally printed to excess, since almost all governments spend more than their revenues. The UK, Japan, and the USA are prime examples.

Politicians want to spend more money, but they also need to maintain the illusion that the money is still valuable, that it will retain most of its purchasing power over time, and that inflation is under control. The illusion weakens when food, gasoline prices, and other consumer goods are wildly rising in price. At a more abstract level, gold indicates the same lack of confidence in the printed pieces of paper that our central banks distribute.

If last year’s price correction shattered your conviction in owning gold and silver please consider The Fundamental Reasons for Owning Gold and Silver Are Stronger Than Ever.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals.

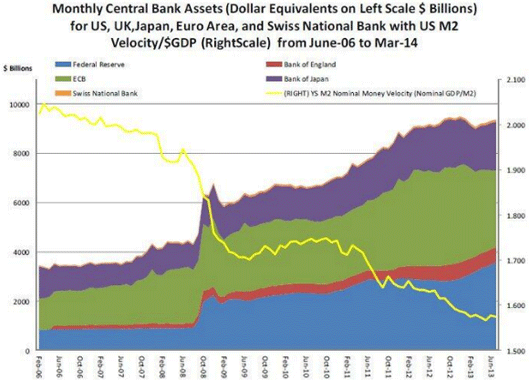

The bull case for precious metals remains intact as central bankers worldwide have become the lenders of last resort for nations that have exhausted their borrowing capacities. Very little has changed since 2008 when the world financial system stood at the abyss of collapse. Unsustainable debt levels continue to increase even as the capacity to service the debt diminishes.

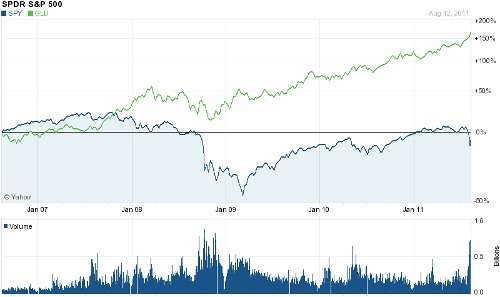

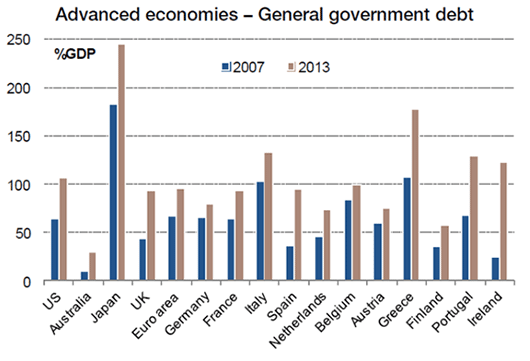

Virtually every government in the world has taken on debts and liabilities that are clearly unsustainable. Governments “don’t go broke” is the sustaining mantra for those with faith in paper currencies but governments do and will continue to print money that accelerates the loss of purchasing power of fiat currencies. Please consider the following charts courtesy of John Mauldin Economics.

Eventually, as people realize that the central bank emperors have no clothes it will become clear Why There is No Upside Limit for Gold and Silver Prices.

The increase in the value of gold and silver is due to the fiscal and monetary policies of nations struggling to deal with massive levels of debt – policies that virtually guarantee a continued rise in the price of gold and silver. Central banks, having exhausted all conventional means of monetary easing, have moved on to the last resort option of quantitative easing and currency debasement.

Government officials argue that unprecedented deficit spending and quantitative easing are necessary to stimulate economic growth, but this theory has not worked in the real world. Despite trillions in stimulus spending, job creation and economic growth have been extremely weak and are likely to remain so according to economists Kenneth Rogoff and Carmen Reinhart who wrote This Time Is Different: Eight Centuries of Financial Folly. According to Rogoff and Reinhart, economic growth is subpar when public sector debt exceeds 90% of GPD which the U.S. and many other developed nations have already surpassed. In addition, a recovery of the job and housing markets after a financial crisis take many years due to the burden of excessive levels of debt. Ultimately, Rogoff and Reinhart predict that austerity measures will need to be imposed along with some type of debt restructuring.

Is the U.S. capable of reducing spending and instituting austerity measures? Cutting deficits means cutting payments to a long list of incomeless recipients who really don’t care where the entitlement money comes from. Those still actually paying taxes will object strongly to any proposed tax increase to fund government spending. Unable to cut spending or raise taxes leaves the Government with one bad option – print more money.

Politicians, who value getting elected above all else, are likely to strong arm the reliably compliant Federal Reserve to “come to the rescue” again with additional printed dollars. In the minds of politicians and Federal Reserve officials, there will always be very compelling reasons to continue borrowing and money printing.

A nation that has reached the limits on taxation and borrowing has few viable policy options other than a continuing series of quantitative easing programs. Current government policies, if left unchanged, virtually guarantee a continued increase in the price of precious metals.