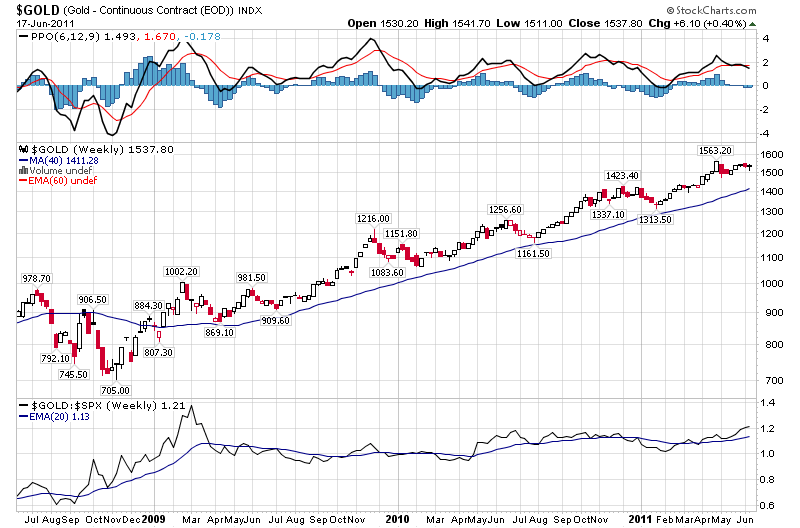

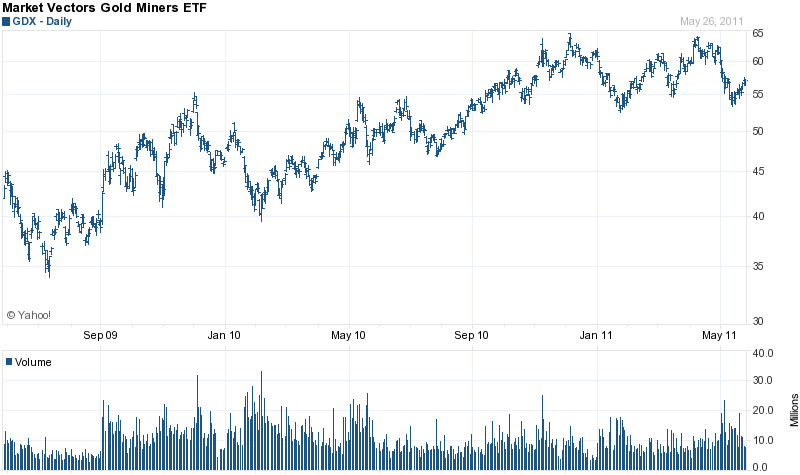

The precious metals group continued higher this week, with standout performances by gold and silver.

The precious metals group continued higher this week, with standout performances by gold and silver.

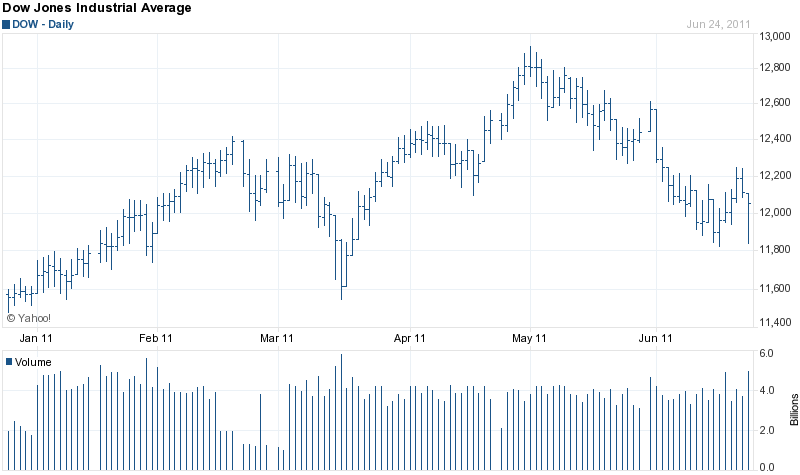

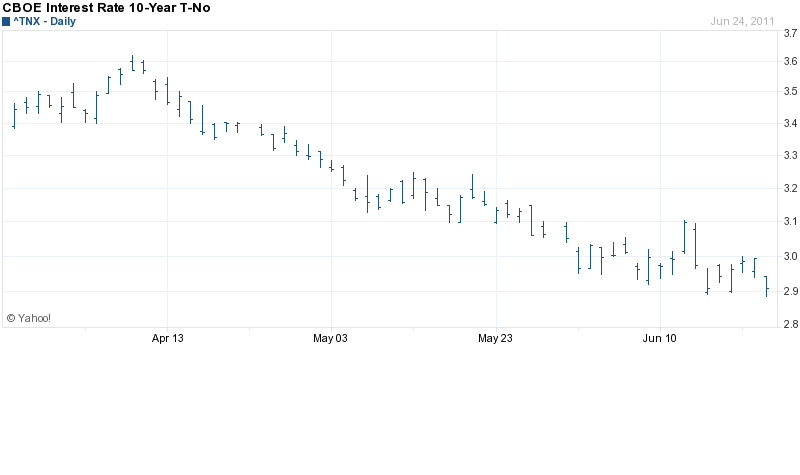

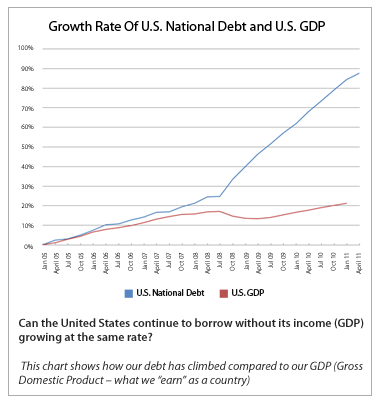

As politicians continue to engage in reprehensible scare tactics in order to increase the debt limit by another $2.5 trillion, it has become increasing clear that the policies of more debt and dollar debasement will continue. In an interview today, Ron Paul said that he expects “nothing will change” and that the U.S. is already defaulting on the debt via the devaluation of the dollar.

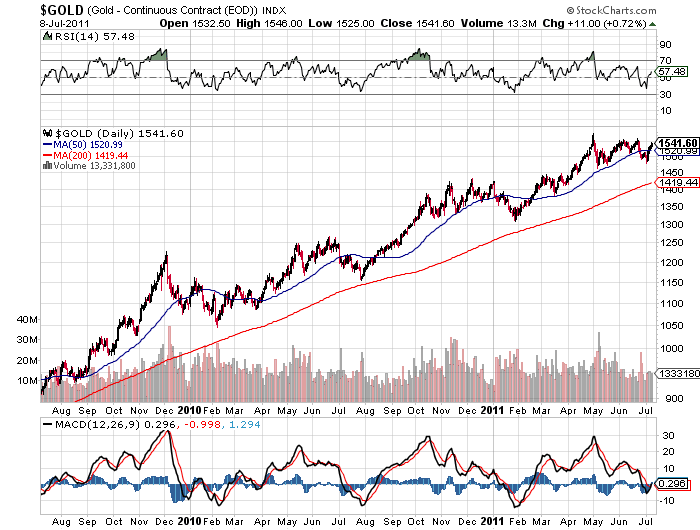

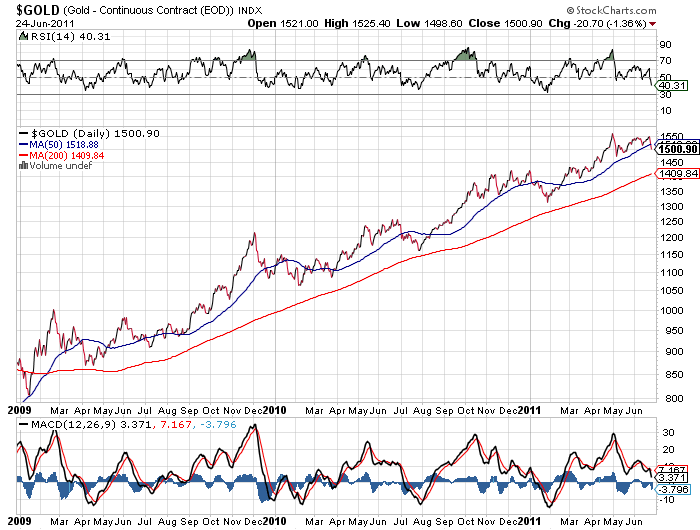

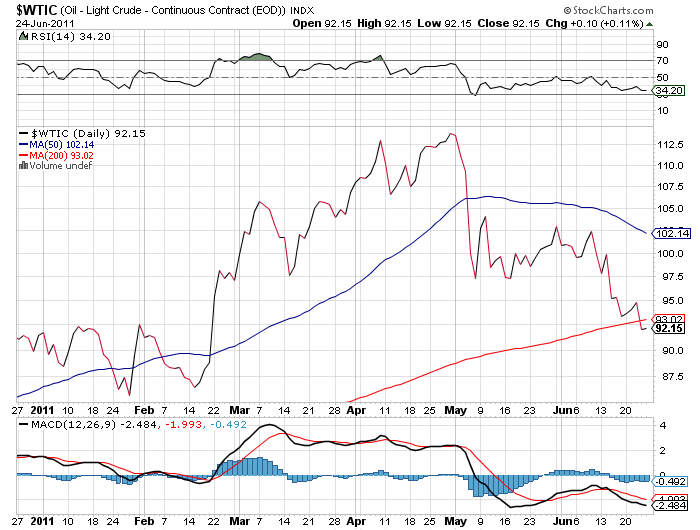

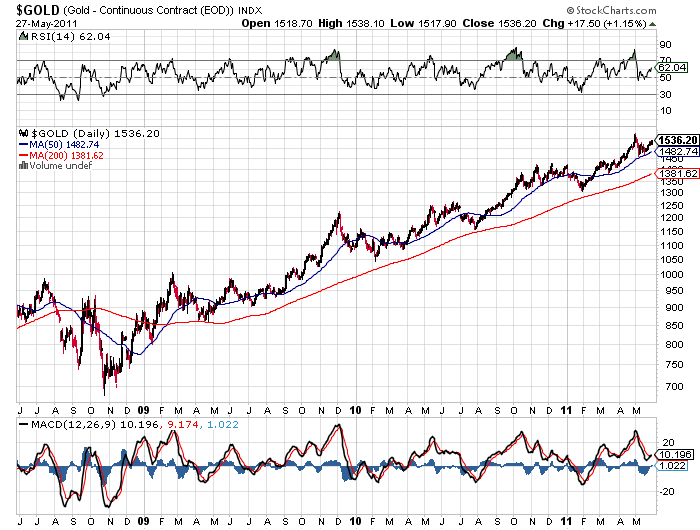

Gold and silver, which had already been strongly advancing in the prior week, soared after Fed Chairman Bernanke spoke before Congress on Wednesday. Mere days after the end of QE2, Bernanke said that he stands ready to rescue the American economy with more accommodative monetary measures. Although the exact mechanism by which future monetary easing will be deployed remains to be seen, the end result will be the further debasement of the U.S. dollar.

As measured by the London PM Fix Price, gold hit new highs, soaring by $45.50 on the week, putting its two week gain at $104.00 per ounce. Gold prices continued higher in New York trading with gold closing at $1,594.30, up another $7.30.

Gold has become the currency of last resort as it becomes clear that money printing is the only option left to prevent massive sovereign debt defaults by world governments. Accordingly, there is really no upside limit for gold and silver prices. Legendary trader Jim Sinclair told King World News that the stage has been set for gold to move up to $12,000 per ounce.

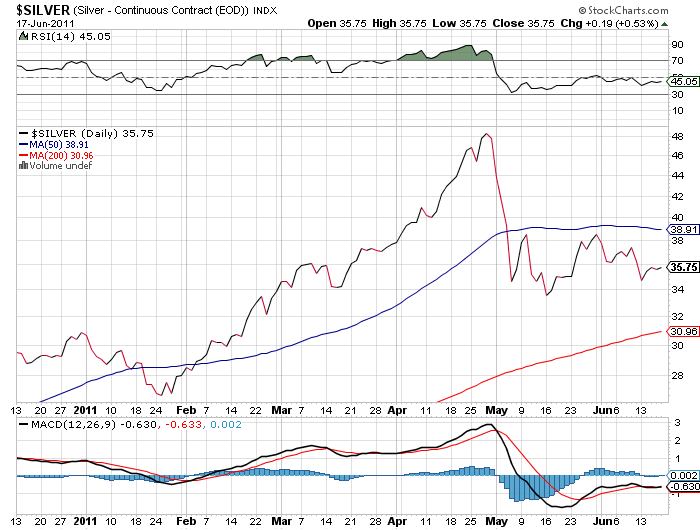

Silver has been the standout performer in the precious metals group. After basing in the mid 30’s range after the May correction, silver has exploded upwards.

After rallying by over 7% last week, silver tacked on another 5% this week. As measured by the closing London PM Fix Price of $38.17, silver has advanced by $4.32 or 12.8% over the past two weeks. After the close in London, silver continued to gain in New York trading, closing at $39.37.

Silver is in a long term super cycle advance backed by fundamentals that guarantee higher prices. The accelerating exodus from paper money will quickly push silver prices to new highs – see For Silver , This Time Is Different.

| Precious Metals Prices | |||

| PM Fix | Since Last Recap | ||

| Gold | $1,587.00 | +$45.50 | +2.95% |

| Silver | $38.17 | +$1.89 | +5.21% |

| Platinum | $1,760.00 | +$20.00 | +1.15% |

| Palladium | $777.00 | +$1.00 | +0.13% |

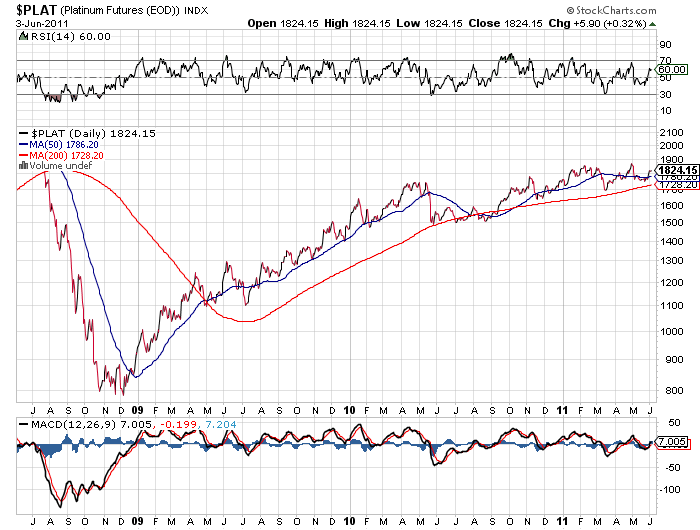

Platinum advanced by $20 on the week after a $32 dollar advance in the previous week. Palladium ended essentially unchanged on the week after an advance of $26 last week.