Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including the U.S. Mint.

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including the U.S. Mint.

Intense gold demand in India has lead to shortages as Gold Buyers Throng Indian Stores for Second Week on Rally.

Gold consumers in India, the world’s biggest importer, thronged jewelry stores across the country for a second week on speculation that bullion may extend a rally after the biggest plunge in three decades.

“We waited for sometime to see if prices will fall more but when we saw them moving up again, we decided it’s time,” said Sripal Jain, a 77-year-old silver dealer who came with his younger brother, daughter and daughter-in-law to buy gold necklaces at Mumbai’s Zaveri Bazaar. “We don’t have any wedding or occasion coming up. The rates fell, so we decided to buy.”

Bullion slumped 14 percent in two days, reaching the lowest price in two years on April 16, triggering a frenzy among coin and jewelry buyers from the U.S. to India, China and Australia. The surge in demand has helped prices rally 11 percent since April 16, and jewelers in India are paying premiums of as much as $10 an ounce to secure supplies, according to the Bombay Bullion Association.

Gold will rally to $1,800 an ounce by December as skepticism over the global recovery increases demand, billionaire Indian jeweler T.S. Kalyanaraman said on April 19.

The rush to buy has led to a shortage in India and jewelers are paying premium of as much as $10 an ounce compared with $2 just 10 days earlier, said Bipin Jain, owner of Vimalson Jewellers and a vice president of the bullion association.

The Perth Mint reports that while the media is talking about the bear market in gold, bullion buying has soared as bargain hunters move in. As gold and silver prices corrected, Perth Mint buyers viewed the situation as a perfect buying opportunity and stepped up their purchases of gold and silver. Activity on the Perth Mint website was so intense, that some buyers experienced long delays.

As the central bank of Japan continues its unprecedented experiment in massive monetary expansion, the Japanese Seek Refuge in Bullion as Yen Slumps, Inflation Looms.

Japanese consumers are poised to become net buyers of gold for the first time in eight years as the yen’s decline and looming inflation drive them to seek refuge in bullion, according to Standard Bank Plc.

Net sales of gold bars and coins by Japanese individuals shrank to 10.1 metric tons in 2012, the smallest amount since 2005, data from the World Gold Council show. A surge in purchases this month and the chance to buy after bullion slumped into a bear market foreshadow a turnaround in 2013, said Bruce Ikemizu, Standard Bank’s head of commodities trading in Tokyo.

The currency has depreciated 13 percent against the dollar this year and is trading near a four-year low after the central bank’s pursuit of unprecedented monetary easing to end deflation was unopposed by Group of 20 nations. Inflation may rise above 1 percent in the 12 months starting April 2014 and approach a 2 percent target as early as that year, Bank of Japan (8301) policy board member Ryuzo Miyao said April 18.

“The time has come for Japanese to buy gold with the government trying to engineer inflation,” Ikemizu, who has traded commodities for almost three decades, said in an interview in Tokyo yesterday. “Retail investors are turning from sellers to buyers of bullion.”

In India and China, the biggest gold-consuming nations, shoppers last week lined up in bazaars from Mumbai to Shanghai to buy the metal for brides, babies and strongboxes after prices fell. Indian consumers bought a net 312.2 tons of gold bars and coins in 2012, while purchases by individuals in China reached 265.5 tons, according to the World Gold Council.

The long term rationale for owning gold and silver remains intact. The reasons for the recent smash-down in gold and silver may never be known but it has provided a gift opportunity to increase positions in gold and silver.

Begin the analysis in 1971 when Nixon dropped the link between the dollar and gold. A pack of Marlboros cost (depending on local taxes) about $0.39. We paid about $0.36 for a gallon of gasoline. The DOW Index was about 850. Silver was priced at about $1.39.

Begin the analysis in 1971 when Nixon dropped the link between the dollar and gold. A pack of Marlboros cost (depending on local taxes) about $0.39. We paid about $0.36 for a gallon of gasoline. The DOW Index was about 850. Silver was priced at about $1.39.

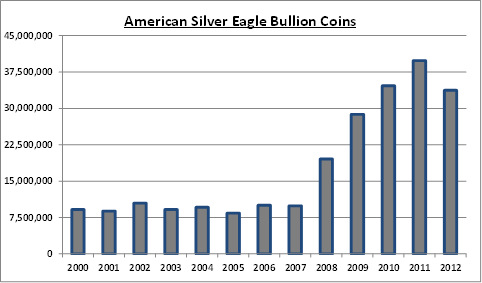

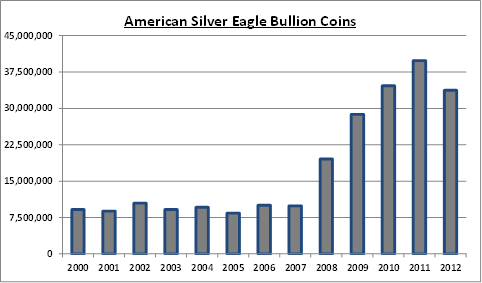

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins.

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins. By: Mike McGill of

By: Mike McGill of

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were

Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were

I think I am becoming a non-fan of infographics. Maybe it’s just me, but many infographics are getting way too long and complicated. With that in mind, the latest infographic on silver from the

I think I am becoming a non-fan of infographics. Maybe it’s just me, but many infographics are getting way too long and complicated. With that in mind, the latest infographic on silver from the

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold. The use of silver as a monetary asset in China goes back for centuries. As detailed in the latest report from the Silver Institute, China’s entire monetary system was based on a silver standard until 1935. Things changed dramatically after the Communists came to power in 1949 and effectively nationalized the entire silver stock. Private citizens were prohibited from owning silver or gold and private sales of silver and gold jewelry was banned.

The use of silver as a monetary asset in China goes back for centuries. As detailed in the latest report from the Silver Institute, China’s entire monetary system was based on a silver standard until 1935. Things changed dramatically after the Communists came to power in 1949 and effectively nationalized the entire silver stock. Private citizens were prohibited from owning silver or gold and private sales of silver and gold jewelry was banned.