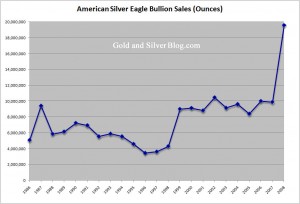

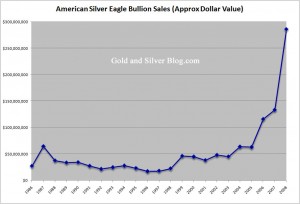

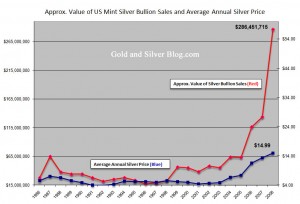

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion.

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion.

Last year through the end of April, US Mint gold bullion sales were 388,000 troy ounces, while the price of gold ranged from a low of $1,058.00 to a high of $1,179.25 per ounce. Silver bullion sales during this period were 11,531,000 with the market price ranging from a low of $15.14 to a high of $18.84 per ounce.

US Mint Gold and Silver Bullion Sales (in ounces)

| January | February | March | April | Total | |

| American Gold Eagle | 133,500 | 92,500 | 73,500 | 108,000 | 407,500 |

| American Gold Buffalo | – | – | 38,000 | 20,500 | 58,500 |

| Total Gold in ounces | 133,500 | 92,500 | 111,500 | 128,500 | 466,000 |

| American Silver Eagle | 6,422,000 | 3,240,000 | 2,767,000 | 2,819,000 | 15,248,000 |

| ATB Silver | – | – | – | 1,127,000 | 1,127,000 |

| Total Silver in ounces | 6,422,000 | 3,240,000 | 2,767,000 | 3,946,000 | 16,375,000 |

During the latest month of April 2011, the US Mint recorded sales of 128,500 troy ounces of gold bullion, comprised of 108,000 ounces worth of American Gold Eagles and 20,500 ounces worth of American Gold Buffaloes.

Meanwhile, silver bullion sales for the latest month reached 3,946,000 ounces, the second highest level of the year. For three months running, the pace of sales for the American Silver Eagles had remained approximately the same base level, despite indications of higher demand. The restrained sales are presumably the impact of the US Mint’s allocation program, which rations the available number of bullion coins amongst the authorized purchasers.

The boost in silver bullion sales seen in April was due to the release of the 2011-dated America the Beautiful Silver Bullion Coins. These coins each contain five troy ounces of silver and have a diameter of 3 inches. Sales began on April 25, 2011, and authorized purchasers immediately purchased coins accounting for 1,127,000 troy ounces of silver.

According to the just released World Silver Survey published by the

According to the just released World Silver Survey published by the  Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

The inability of the US Mint to meet public demand for gold and silver bullion products was discussed at a recent

The inability of the US Mint to meet public demand for gold and silver bullion products was discussed at a recent

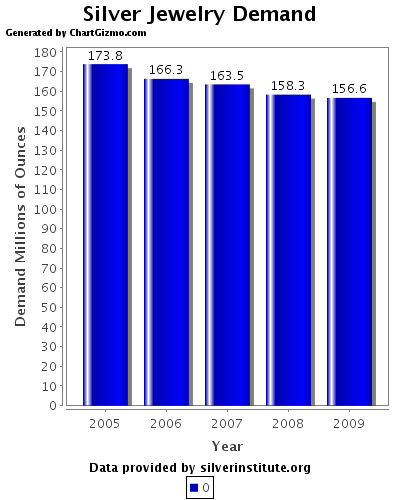

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

The Perth Mint is operated by Gold Corporation, which is wholly owned by the Government of Western Australia. The Perth Mint currently refines all of the gold mined in Australia, as well as gold from surrounding countries, and scrap gold from Asia. In addition, they refine substantial quantities of silver.

The Perth Mint is operated by Gold Corporation, which is wholly owned by the Government of Western Australia. The Perth Mint currently refines all of the gold mined in Australia, as well as gold from surrounding countries, and scrap gold from Asia. In addition, they refine substantial quantities of silver.