In an interview with Barron’s, Marc Faber, editor of The Gloom, Boom & Doom report gives his take on where the gold market is headed and why certain investments related to gold might be very risky.

In an interview with Barron’s, Marc Faber, editor of The Gloom, Boom & Doom report gives his take on where the gold market is headed and why certain investments related to gold might be very risky.

Marc Faber, never at a loss for a good soundbite, says gold is “in a correction mode” but seemed at a loss to explain why gold has dropped by over $400 per ounce over the past two years.

Faber talks about the paradox of weak physical gold prices even as demand for physical gold remains robust. Although gold has declined in price and commentary on the gold market is extremely bearish, Faber notes that countries such as China is buying 2,600 tons of gold per year “which exceeds annual production.” The gold market is currently in a “bottoming out process” and gold will see higher prices in the future according to Faber.

Courtesy: kitco.com

Many of the senior gold mining stocks represent good values but in a surprising comment Faber warns investors that many exploration companies “won’t make it so buy companies with cash reserves.” Current gold prices mean that “few projects will get done.” Faber’s bearish commentary on the smaller exploration companies seems to imply that he does not foresee a rapid short term recovery in the price of gold.

With central banks printing money at a rate that would have been unimaginable five years ago and huge demand for physical gold in Asia, the price of gold may recover to new highs faster than Faber expects.

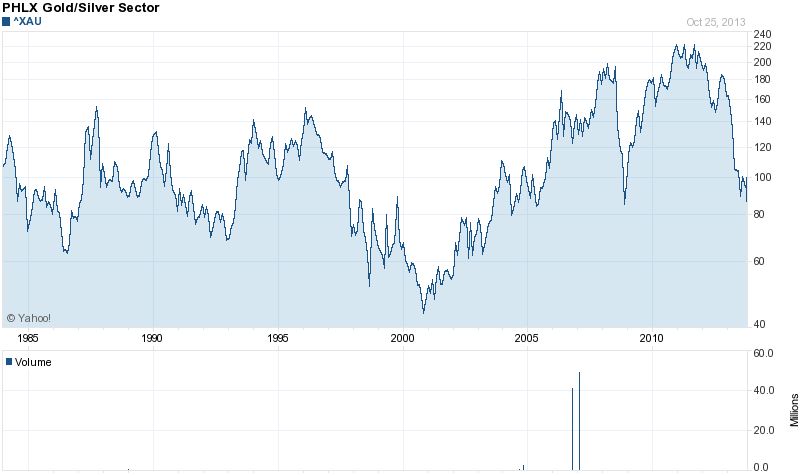

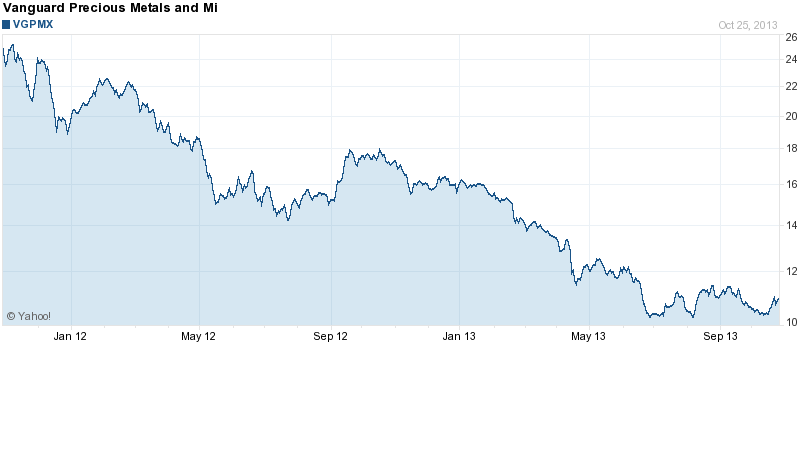

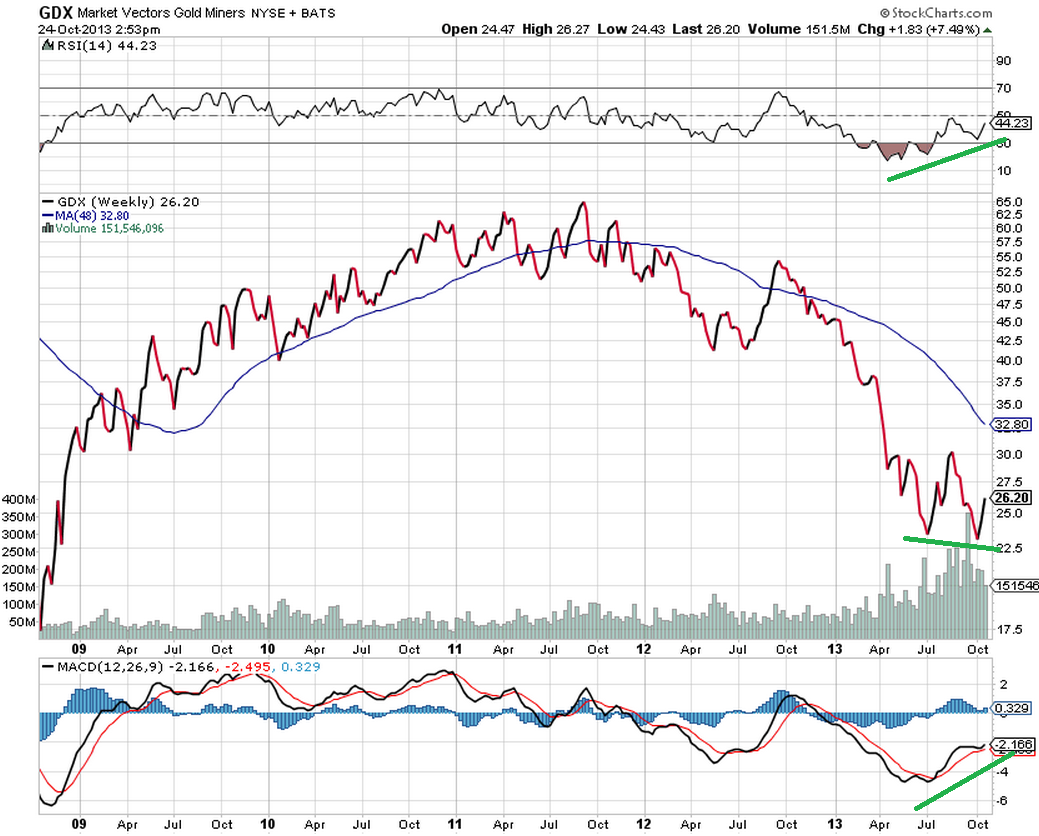

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

By: GE Christenson

By: GE Christenson

The “I won’t buy an umbrella until it rains” crowd has been dumping gold while the case for ownership of safe haven gold has never been stronger.

The “I won’t buy an umbrella until it rains” crowd has been dumping gold while the case for ownership of safe haven gold has never been stronger.

Most people can’t begin to comprehend

Most people can’t begin to comprehend

By: GE Christenson

By: GE Christenson Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression. By: GE Christenson

By: GE Christenson