Another Precious Week: Unsettled

Another Precious Week: Unsettled

Despite the general downward appearances, this was a very mixed week for precious metal prices. Business Week, that fantastic contrarian indicator has announced that gold is in a three month slump. As Christmas is coming, there does not tend to be the large buying from India and (increasingly) China that there is over the autumn wedding season. Unlike the three wise men, westerners don’t tend to give each other as much gold as the Indians do, although this may change if the expected retail gold breakthrough happens. It has not happened (if it ever does) and so it’s still cheap Chinese electronics that are waiting for you under the tree, rather than discrete pieces of gold jewelery. Sorry about that.

| Precious Metals Prices | ||

| Fri PM Fix | Weekly Change | |

| Gold | $1,368.50 | -6.75 (-0.49%) |

| Silver | $28.78 | -0.01 (-0.03%) |

| Platinum | $1,696.00 | +23.00 (+1.37%) |

| Palladium | $738.00 | +1.00 (+0.14%) |

Gold-Silver Ratio: 47.55 (was 47.77)

The Central Banks and investment funds also seem to be winding down for Christmas, and there is no discernible activity from these two sources. As they have been net buyers for the year, this is going to have a softening effect on prices. The Central Banks of countries with sovereign wealth funds still think of themselves as being underweight in non-paper money, so they are likely to kick off buying in January, or if there is a dramatic dip.

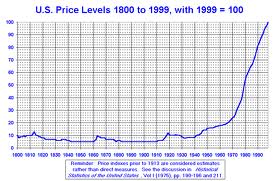

On the currency side, it must be said that the fundamentals for precious metals are looking a lot more solid. The European Central Bank is talking about printing a whole load of new Euros now that Spain looks very wobbly, and they realize that the stabilization cupboard is particularly bare. The United States is also seriously unimpressive with benefits being extended for the poorest and tax cuts being extended for the richest. This looks like a really nasty deficit in the making and so default by printing.

It must also be remembered that the Chinese are suffering some very real inflation, as even the People’s Daily has noticed. It is still a bit weird to realize that the Chinese press is quite free, by despotic communist standards, and that these pieces of news are getting reported. There is also talk of the Chinese shifting some of their massive US government bond holdings into gold, which even at the margin will be massive.

If the big Asian buyers, particularly the private buyers, start to get as interested in silver, then 2012 could be a real bull market.

Another Precious Week

Another Precious Week So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.

So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken. Another Precious Week

Another Precious Week At a recent media briefing,

At a recent media briefing,  The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely

So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely  Another Precious Week in the Market

Another Precious Week in the Market