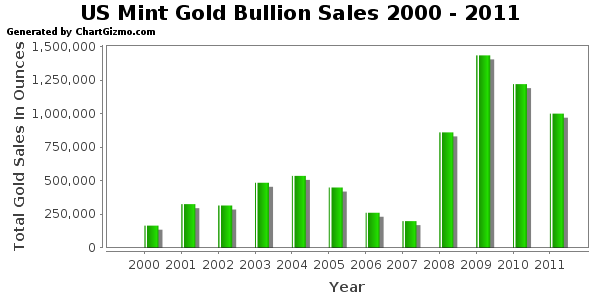

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

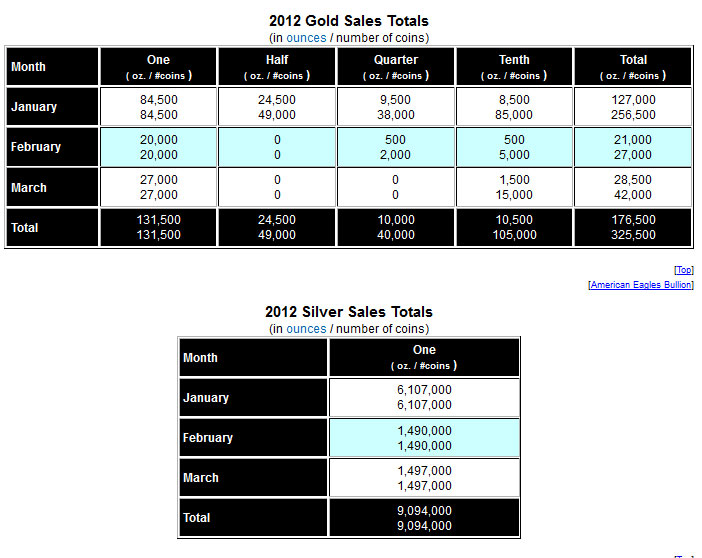

Sales of the American Gold Eagle bullion coins in April totaled only 20,000 ounces, the lowest monthly sales figure since June 2008 when 15,500 ounces were sold. Total year to date gold bullion sales of 230,500 ounces through April 2012 are down a substantial 43% from the first four months of 2011 when the U.S. Mint sold 407,500 ounces.

If sales of the American Eagle gold bullion coins continue at their present pace, 2012 could turn out to be the fourth year in a row of declining sales.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 230,500 | |

| Total | 7,480,000 | |

| Note: 2012 totals through April 30, 2012 | ||

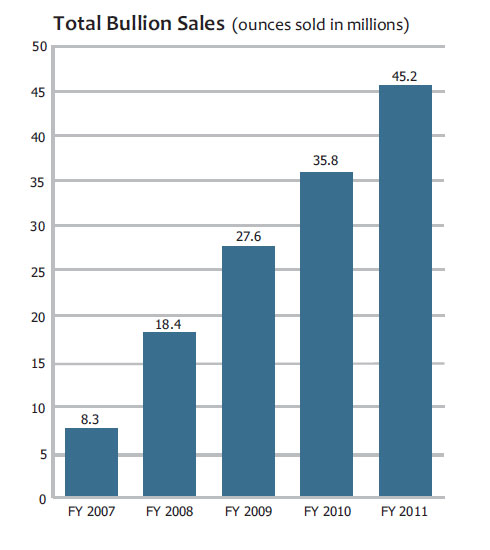

Total sales of the American Silver Eagle bullion coins for April 2012 totaled 1,520,000 ounces, down from 2,542,000 ounces in March. Year to date sales of the Silver Eagle coins through April 30 totaled 11,659,000 ounces, down by 23.5% from total sales of 15,248,000 ounces in the first four months of 2011. Sales of the American Silver Eagle bullion coins reached an all time record high of 39,868,500 ounces during 2011.

Shown below are the U.S. Mint sales figures for the American Silver Eagle bullion coins since 2000. Sales totals for 2012 are through April 30th.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| 2012 | 11,659,000 | |

| TOTAL | 210,059,500 | |

The American Gold and Silver Eagle bullion coins cannot be purchased by the public directly from the U.S. Mint. Instead, the Mint sells the coins to a network of authorized purchasers who in turn resell them to the public and secondary retailers.

Sales figures shown above do not include U.S. Mint sales of gold and silver Eagle numismatic coins. The public is allowed to purchase numismatic versions (uncirculated and proof) of gold and silver coins directly from the U.S. Mint and sales of these coins have also been declining during 2012.

According to Mint News Blog, sales of the 2011 Proof Gold Eagles declined by about 50% from 2010 and sales of the 2012 Proof Gold Eagles have declined by over 60% from the previous year. The same trend has been seen in the proof version of the American Silver Eagle with 2012 sales down 19% through April.

There are a number of factors likely contributing to the drop off in sales. Over the past few years, the US Mint has caught up with demand for bullion coins, allowing more certainty for the numismatic offerings. The sense of urgency and pent up demand that characterized the product return in 2010 has greatly diminished. There also seems to be a shift away from precious metals in recent months, with some moving back to collector coins. Sales of the US Mint’s Gold Eagle bullion coins were down 30% in the first quarter.

Gold prices may also be having an impact in various ways. For the past two years, the Proof Gold Eagles were released in an environment of rising prices. For the current year, prices have fallen over the past two months leading up to the release. Despite this recent drop, the initial prices for this year’s offerings were higher by the equivalent of $200 per troy ounce compared to last year, possibly making affordability a factor for some collectors. Finally, some collectors may have been delaying orders in anticipation of the price decrease which will take place later today.

With the world economy on the brink of collapse in 2008, Americans decided that they needed to prepare for a financial hurricane and subsequently purchased record amounts of both gold and silver. Perhaps the public has not noticed that a financial crisis potentially worse than 2008 (and certain to impact the U.S. economy) is brewing “across the pond” with European governments and banks tottering on the brink of insolvency and many countries already in full blown depressions.

With the global economy drowning in debt and facing unprecedented financial problems, it is almost comical that many Americans are avoiding the only asset class able to preserve their wealth.

Currently, the United States Mint has three bullion products available to its network of authorized purchasers. The American Silver Eagle is struck in one ounce of .999 fine silver. The American Gold Eagle is struck in 22 karat gold and comes in one ounce, half ounce, quarter ounce, and tenth ounce bullion weights. The American Gold Buffalo is struck in 24 karat gold and available in one ounce size only.

Currently, the United States Mint has three bullion products available to its network of authorized purchasers. The American Silver Eagle is struck in one ounce of .999 fine silver. The American Gold Eagle is struck in 22 karat gold and comes in one ounce, half ounce, quarter ounce, and tenth ounce bullion weights. The American Gold Buffalo is struck in 24 karat gold and available in one ounce size only.