Here’s a great infographic from the Visual Capitalist showing the supply and demand statistics for silver. Interestingly, most of the silver produced each year is consumed in thousands of different industrial applications, leaving a relatively small amount available for investment in coins, bars and jewelry. Unlike gold, the vast majority of silver produced over the years has been consumed, with much of it lost to landfills, leaving a relatively small above ground supply.

Here’s a great infographic from the Visual Capitalist showing the supply and demand statistics for silver. Interestingly, most of the silver produced each year is consumed in thousands of different industrial applications, leaving a relatively small amount available for investment in coins, bars and jewelry. Unlike gold, the vast majority of silver produced over the years has been consumed, with much of it lost to landfills, leaving a relatively small above ground supply.

By

By

According to

According to

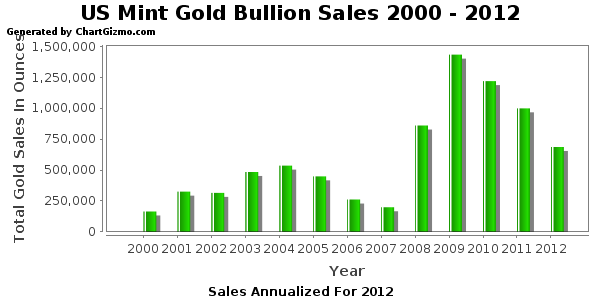

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January. The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

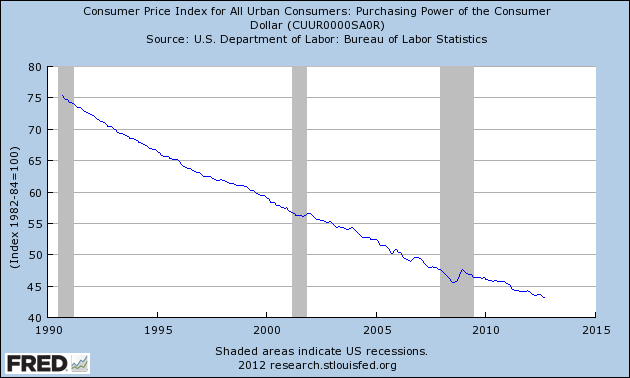

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May. Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.