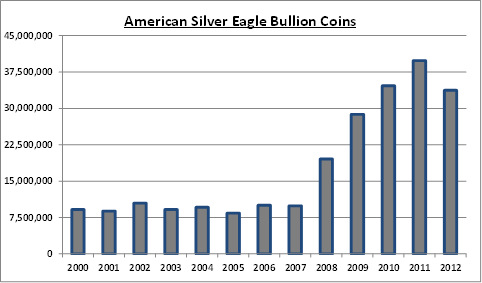

Sales of the American Eagle silver bullion coins soared in March, continuing a trend of record breaking sales that has been in force for the past five years.

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins.

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins.

According to the U.S. Mint, sales of the American Eagle silver bullion coins totaled 3,356,500 ounces in March, up 32% from comparable sales of 2,542,000 ounces during March 2012. Total sales of 14,223,000 ounces through March 31, 2013 soared by 40.3% over the comparable prior year period.

The previous record year for silver bullion coins was in 2011 when 39,868,500 coins were sold. The 2011 record may wind up looking like a low number compared to projected total sales for 2013. Based on sales for the first three months of the year, annualized sales for 2013 could hit a record shattering 57 million ounces although even this estimate may be too low. As the slow motion collapse of the European banking system speeds up, the looming specter of huge losses by bank depositors could create a total loss of confidence in paper money and ignite a panic move into gold and silver.

The U.S. Mint has vastly underestimated demand for the American Eagle silver bullion coins and was recently forced to suspend sales twice as physical demand for silver soared (see U.S. Mint Sold Out).

Since 2000, investors have purchased almost a quarter billion ounces of silver bullion coins from the U.S. Mint, worth almost $7 billion based on the current price of silver.

| American Silver Eagle Bullion Coins | ||

|

YEAR |

OUNCES SOLD |

|

|

2000 |

9,133,000 |

|

|

2001 |

8,827,500 |

|

|

2002 |

10,475,500 |

|

|

2003 |

9,153,500 |

|

|

2004 |

9,617,000 |

|

|

2005 |

8,405,000 |

|

|

2006 |

10,021,000 |

|

|

2007 |

9,887,000 |

|

|

2008 |

19,583,500 |

|

|

2009 |

28,766,500 |

|

|

2010 |

34,662,500 |

|

|

2011 |

39,868,500 |

|

|

2012 |

33,742,500 |

|

|

2013 |

14,223,000 |

|

|

TOTAL |

246,366,000 |

|

Total sales for 2013 are through March 31, 2013.

By: Mike McGill of

By: Mike McGill of  Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

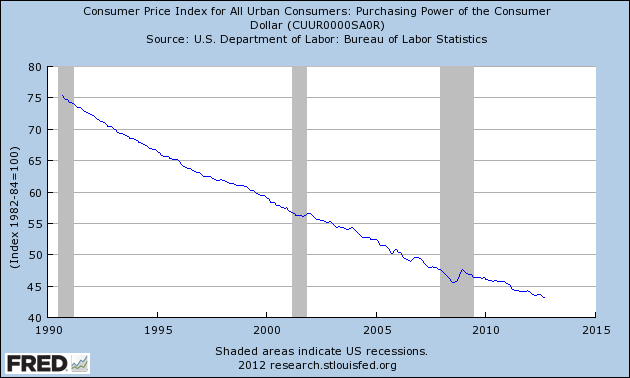

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins. With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces. According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold. According to

According to

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.