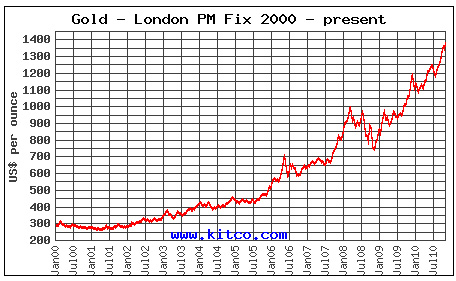

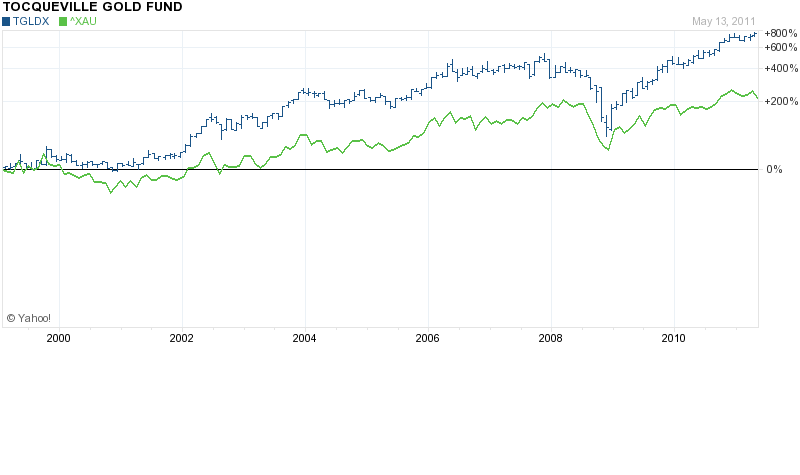

Gold stocks have been under performing gold bullion for the past three years.

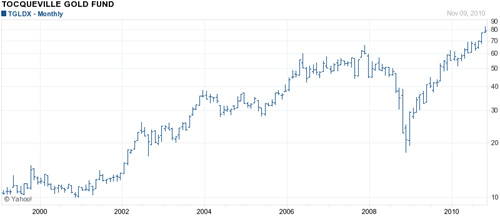

The poor performance of gold stocks is reflected in the sub par returns of gold mutual funds run by two of the countries largest investment companies. The three year return on Vanguard’s Precious Metals Fund (VGPMX) has actually had a negative return over the past three years as the price of gold has soared by 80%. The Fidelity Select Gold Portfolio (FSAGX) has returned only 16.2% over the past three years. (See Physical Gold Outperforms Vanguard and Fidelity Gold Mutual Funds).

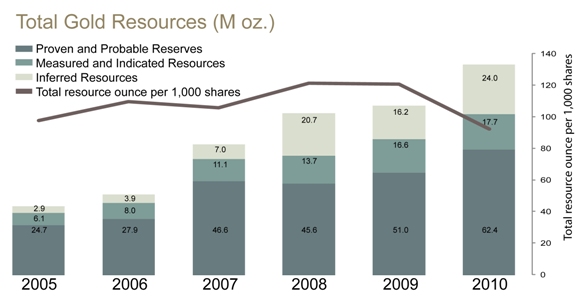

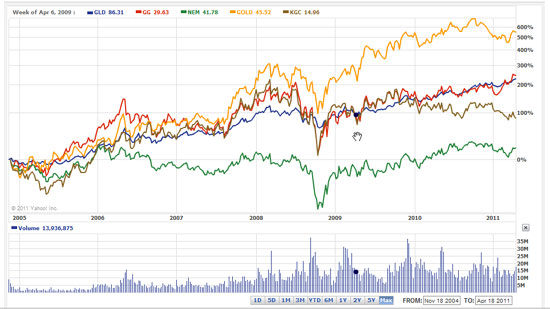

Senior gold producers such as Newmont and Kinross Gold are increasing gold production and solidly positioned for significant earnings increases but their stock prices have not been able to match the returns of gold bullion.

Although there are many reasons to expect that gold stocks will catch up to gold and deliver large gains to investors, so far this has not been the case.

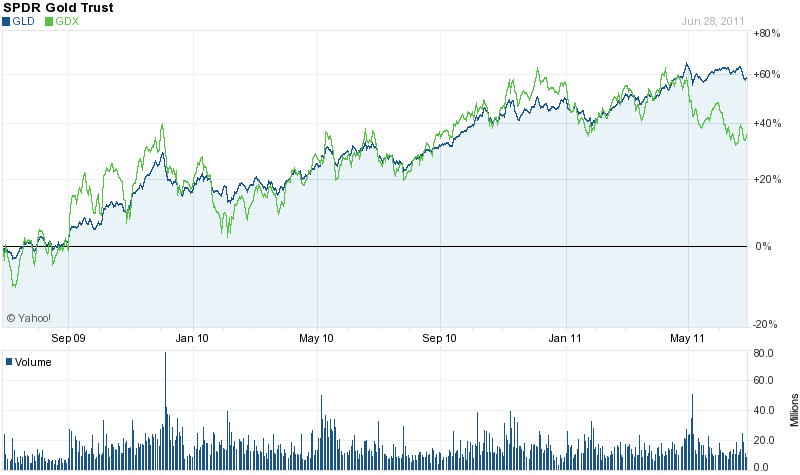

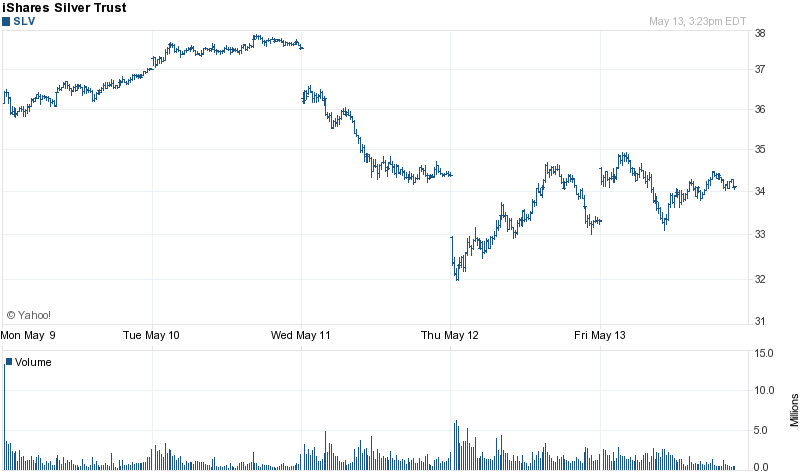

Adding fuel to the investor debate over the relative merits of gold stocks versus gold bullion has been the drastic price divergence exhibited since the beginning of 2011. While gold has held virtually all of its gains, the price of many gold stocks has plunged. An investor in gold stocks not tracking the price of gold would probably conclude that the price of gold had collapsed during 2011.

Since January 1st, the price of gold has gained $116 per ounce or 8.3%. From January lst to recent June lows, the price of Newmont Mining is down by $9.27 (15.2%), Kinross Gold is down by $3.96 (20.8%) and Agnico-Eagle Mines is down by $16.01 (20.9%). A broad basket of gold stocks, as measured by the Gold Miners ETF (GDX) has declined by $9.69 or 15.8%.

Adding to concerns about the recent sell off in gold stocks is the especially wide price divergence seen since May lst. Although many individual gold stocks have long lagged the returns of gold, the GDX, a broad based index of gold stocks has generally tracked the price movement of gold over the past several years. Since the beginning of May, however, the linkage between gold stocks and gold completely broke down, leaving investors to ponder the significance of such a wide divergence.

On past occasions, weakness in the gold mining shares has been a harbinger of a sell off in the gold market. Is the current weakness in gold stocks currently forecasting a decline in the price of gold? The end of the Fed’s money printing campaign, the world wide debt crisis, concerns about deflation, a weakening economy and the decline in commodity prices lead some to believe that a liquidity driven crisis could result in lower gold prices.

Despite short term concerns over the price of gold, the reasons for remaining long term bullish on gold are numerous. The fundamental problems of excessive debt, debased currencies, widespread insolvency among sovereign states and out of control spending by the U.S. government all suggest that we remain on the precipice of another economic crisis. Governments and central banks have no solutions except for the printing presses, which will be turned up to full speed at the inception of the next financial crisis.

At the margin selling may temporarily drive down gold prices in the short term, despite the solid long term bullish fundamentals for gold. The long term trend for gold remains higher and any temporary price weakness would be a buying opportunity for gold investors.

The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.

The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.

Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.

Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.