“Those who cannot remember the past, are condemned to repeat it.” George Santayana.

1. What mistakes from the past are we condemned to repeat?

2. Since unbacked paper currency systems have always failed in the past, why have bankers and economists promoted an unbacked paper currency system since 1971?

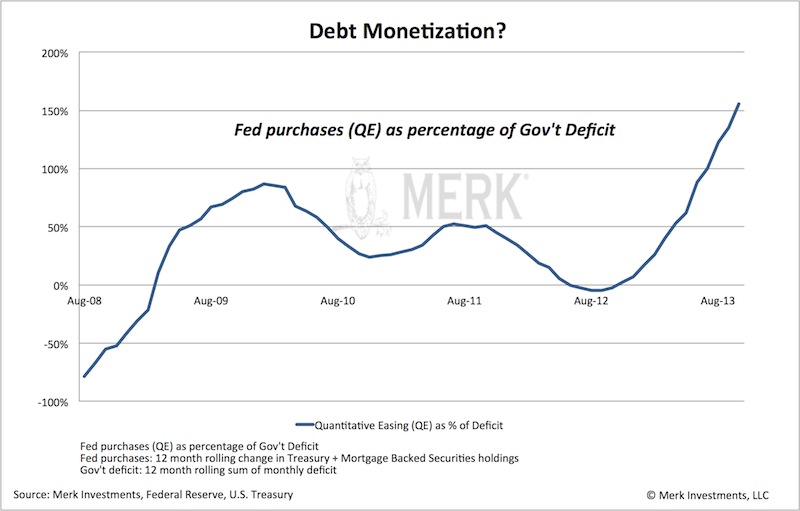

3. Would the Federal Reserve, which is owned by private banks, seek to enrich its member banks and the financial elite by implementing monetary policies such as QE that purchase distressed bank assets and boost the stock and bond markets?

4. Janet Yellen is the new leader of the Fed and new leaders are almost always confronted with a financial crisis early in their term. What should we expect during the next 18 months?

5. ALL paper money systems have eventually failed due to excessive “printing” of the paper currency. How many years of “printing” $85 Billion per month qualifies as excessive “printing”?

6. Human nature changes very slowly if at all. Politicians have lied to most of the people most of the time during the past several thousand years to serve their own self-interest. Are politicians currently lying about ObamaCare, strength of the economy, employment, the NSA, big banks, the IRS, Syria, and so much more?

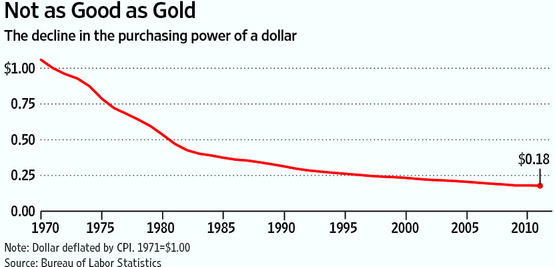

7. Why does gasoline currently sell for approximately $3.50 per gallon even though it cost only $0.15 per gallon about 50 years ago? Why does a cup of restaurant coffee no longer sell for $0.10? Why do $20 gold coins containing nearly an ounce of gold now sell for over $1,250?

8. The S&P 500 Index is trading near an all-time high and is by most measures and sentiment severely over-bought on a weekly and monthly basis. Is it ready to correct downward?

9. Why is the official unemployment rate falling even though fewer Americans are working and the labor participation rate is at 30 year lows?

10. The Federal Reserve has been levitating the stock market and bailing out banks. Is it possible the Fed policies will backfire and those policies will eventually accomplish the opposite of what the Fed wants?

11. If the national debt of $17 Trillion can never be repaid, and if the U.S. government must borrow to pay the interest every year, and if the Federal Reserve must “print” those dollars, what is the real value of that debt? Is it $17 Trillion or perhaps a great deal less? The economist Hyman Minsky called this “Ponzi Finance” – the final stage of a debt based economic system when payments on the debt must be made from additional borrowing.

12. If a soaring gold price encouraged people to question the value of the U.S. dollar, and if the U.S. government had the means to suppress the price of gold, would the U.S. government manipulate the price of gold lower?

13. Germany requested their gold be returned from the NY Federal Reserve vaults about a year ago. It has NOT been returned. What happened to the German gold? Further, how much, if any, of the gold supposedly stored in Fort Knox is physically there and not “leased” or otherwise encumbered?

14. Gold has been money – a store of value, divisible, a medium of exchange, a unit of accounting, and intrinsically valuable – for 5,000 years. Paper money has usually been little more than a politician’s promise of integrity and responsibility. Which do you trust – gold or a politician’s promise?

These questions and their answers suggest that:

Drastic restructuring of the current monetary system seems inevitable, whether or not it is imminent.

Before the system resets it seems likely that governments around the world will scramble to locate and nationalize assets in order to maintain their power for a while longer. Capital controls and financial repression via artificially lowered interest rates are already in place. Pension plans, savings accounts, and IRA and 401(k) plans seem vulnerable to partial confiscation, bail-ins, or mandatory investment in government bonds. Such confiscations and bail-ins have already occurred in other parts of the world and could easily happen in the United States.

Gold and silver have protected purchasing power and assets for 5,000 years. In this twilight period of the current debt based monetary system it seems likely gold and silver will increasingly be necessary for protection of purchasing power and assets. Are you prepared?

GE Christenson

aka Deviant Investor

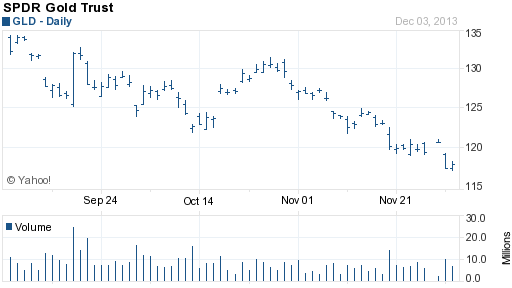

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.