The Week in Precious Metals

The Week in Precious Metals

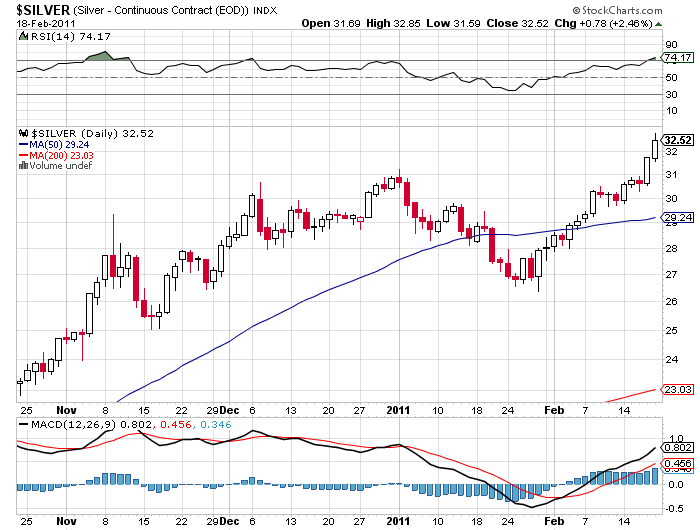

Gold and silver continued their winning ways this week. Measured by the closing London PM Fix prices, gold gained $24.50 or 1.75%, while silver rose $1.89 or 5.81%. On an intraday basis, the gold price hit an all time high of $1,440.31 while silver traded to a new 31 year high at $35.55.

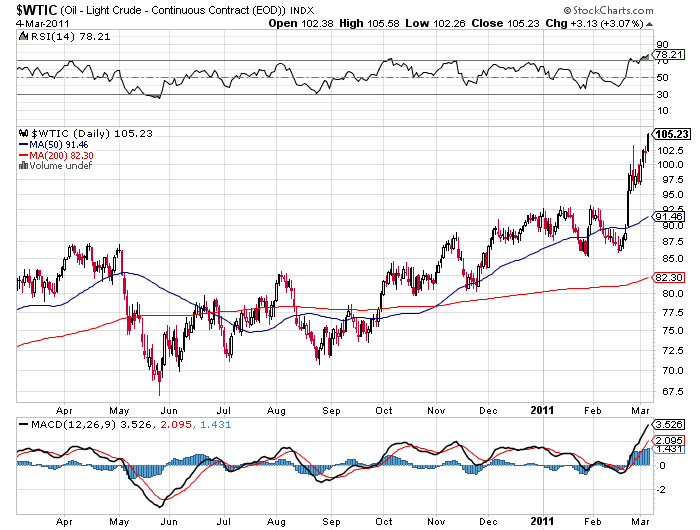

Gold’s advance for the week came after solid gains of $19 per ounce in the previous week. Concerns about a weak dollar, skyrocketing oil prices and continuing turmoil in oil producing nations in the Middle East all contributed to reinforce the importance of gold for wealth diversification and as a hedge against a range of adverse economic conditions.

The ongoing surge in oil prices does not reflect an actual shortage in crude production. Inventories remain robust and excess producing capacity seem adequate to replace all of Libya’s roughly 2 million barrels a year of production. Rising oil prices reflect the fear that social unrest will spread to Saudi Arabia, the King of oil producers.

Saudi Arabia is surrounded by countries that are in massive social, religious and economic upheaval. The contagion of violence and revolution has spread throughout the area included Algeria, Libya, Tunisia, Iran, Yemen and Bahrain. If Saudi Arabia follows the path of its neighbors, the price of oil would quickly be on its way to $200 a barrel. Small protests in the Saudi Kingdom this week may be a prelude to much larger upheaval in the months ahead.

Oil - Stockcharts.com

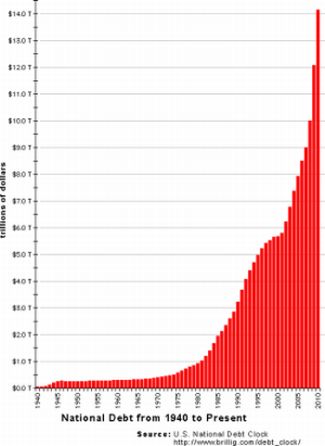

The money printing and inflation creation campaigns of the Federal Reserve seem to be giving the struggling U.S. economy some traction and there have been discussions by Fed members regarding the termination of quantitative easing after the current $600 billion round of money printing ends in June of this year. However, much higher oil prices would quickly put the U.S. economy back into recession since consumer disposable incomes would be drastically reduced.

The Fed’s only easing option to fight another recession is to institute another round of money printing, which at some point leads to an inflationary spiral. In Senate testimony this week, Fed Chief Bernanke admitted that “sustained rises in the prices of oil or other commodities would represent a threat both to economic growth and to overall price stability.” It is no surprise that gold is looking like a sensible option to more and more investors.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,427.00 | +24.50 (+1.75%) |

| Silver | $34.43 | +1.89 (+5.81%) |

| Platinum | $1,828.00 | +37.00 (+2.07%) |

| Palladium | $811.00 | +26.00 (+3.31% |

Platinum regained some of its luster with a gain of $37 after last week’s loss of $45, while palladium was up $26 following last week’s loss of $62.

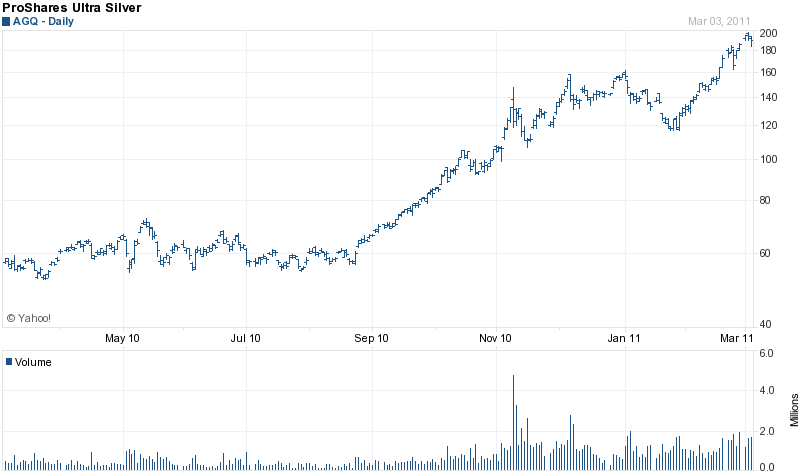

After a gain of almost 2% last week, silver continued its sharp upward price movement and gained $1.89 or almost 6% on the week. On a percentage basis, silver’s gain on the week was almost three times the gain seen by gold. Since last summer, silver has vastly outperformed gold, a trend that may continue.

If the gold to silver ratio returns to its long term historical trend of 16, the price of silver would approach $100 per ounce at the current price of gold.

The price of the ProShares Ultra Silver (AGQ) jumped $23 points on the week to close at $204.19 while the popular iShares Silver Trust (SLV) jumped $2 dollars or 6.2%, closely tracking the price of the metal.

AGQ - Yahoo Finance

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

Another Precious Week

Another Precious Week Another Precious Week

Another Precious Week So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.

So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken. Another Precious Week

Another Precious Week The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.

The excitement seems to generally be wearing off. It could be the end of the bull market in precious metals. I don’t think so, but if I call it now and it does happen I will look like a prophet as every one else (including me) thinks that gold is going up. Words are cheap. Silver certainly isn’t.