Sales of the US Mint American Eagle gold bullion coins slumped again in August following the fall off in demand seen in July. August sales of 25,000 ounces dropped by 16.6% or 5,000 ounces from July’s total of 30,000 ounces.

Sales of the US Mint American Eagle gold bullion coins slumped again in August following the fall off in demand seen in July. August sales of 25,000 ounces dropped by 16.6% or 5,000 ounces from July’s total of 30,000 ounces.

Although August 2014 sales of the gold bullion coins was more than double the 11,500 ounces sold in August 2013 the overall sales trend of American Eagle gold bullion coins has been in a steep slump during 2014 compared to the previous year. Year to date sales of the gold American Eagle bullion coins as of August 31, 2014 totaled 321,000 ounces, a decline of almost 54% from comparable year sales of 691,000 ounces.

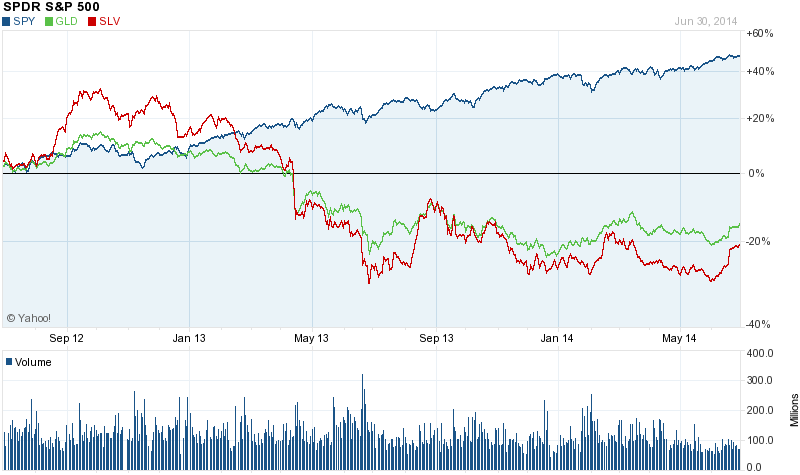

The price weakness in gold prices seen during 2013 continued this year as Gold Demand Falls 16% as Jewelry Purchases Decline 30%.

Gold demand fell 16 percent in the second quarter, led by declines in India and China, the World Gold Council said.

Global demand slipped to 963.8 metric tons from 1,148.3 tons a year earlier as jewelry purchases fell to the lowest since the fourth quarter of 2012, the London-based council said today in a report. China fell behind India as the largest consumer, with global jewelry buying dropping 30 percent and bar and coin demand down 56 percent. Mining companies hedged 50 tons as they continued selling future output.

Gold slid 28 percent in 2013, the most in three decades, as investors lost faith in the metal amid expectations U.S. policy makers would cut stimulus as the economy strengthens. Last year’s price drop spurred jewelry, coin and bar demand, particularly in China. Indian bullion buying has slowed as the government restricted imports to curb a current account deficit.

Global jewelry demand declined to 509.6 tons in the latest quarter, the least since the final three months of 2012. China’s purchases slipped 45 percent and those in India fell 18 percent, with the countries together accounting for almost 60 percent of world jewelry consumption. Buying rose 15 percent in the U.S. and 21 percent in the U.K. as consumer confidence rose, it said.

Global bar buying slumped 57 percent to 212.1 tons in the three months through June and coin demand slid 50 percent to 46.3 tons. Global consumer demand was down 42 percent to 784.9 tons, according to the report.

Total consumption in China, which overtook India as the biggest user last year, dropped 52 percent to 192.5 tons, the council said. Indian demand fell 39 percent to 204.1 tons, returning as the largest purchaser on a quarterly basis for the first time since the end of 2012.

The decline in demand for gold seems to be feeding upon itself as lower prices beget lower demand. As gold prices climbed towards $2,000 an ounce during 2011 buyers tripped over each other to get into gold. Ironically, buyers have now gone on strike as gold has become available at bargain prices.

The sale of gold bullion coins has been in a downward slump since 2009 when sales soared to record levels during the height of the financial meltdown. There are many things happening in the world today that cause serious people to think that 2009 was just a warm up for what’s to come next – if this is correct, the demand for gold could turn sharply higher in a very short period of time.

Total gold bullion coin sales through August 2014 are shown below.

Based on the year to date figures, gold bullion coin sales could well end the year at about half of 2013 totals.