Holdings of the iShares Silver Trust (SLV) declined again this week by 106.14 tonnes after a decline of 248.69 tonnes in the previous week. The year to date decline in silver holdings by the SLV now totals 1,362.19 tons.

Holdings of the iShares Silver Trust (SLV) declined again this week by 106.14 tonnes after a decline of 248.69 tonnes in the previous week. The year to date decline in silver holdings by the SLV now totals 1,362.19 tons.

The decline in holdings of the SLV from its all time high of 11,390.06 tonnes on April 25, 2011 now totals 1,830.68 tonnes, or a decline of 16.1%. There is not a direct and timely correlation between the price of silver and the holdings of the SLV as evidenced by the fact that silver has declined in price by a much larger percentage than holdings in the iShares Silver Trust. From its high of $48.70 on April 28th, silver has had a price correction of 35.6%.

The holdings of silver by the SLV are structured in a complex manner. The trust is set up so that the SLV price correlates closely to the price of silver. This is accomplished by allowing Authorized Participants to arbitrage against a premium or discount of the SLV to the trust’s underlying net asset value (see How Wall Street Made Huge Profits On Silver ETF Crash As Small Investors Sold).

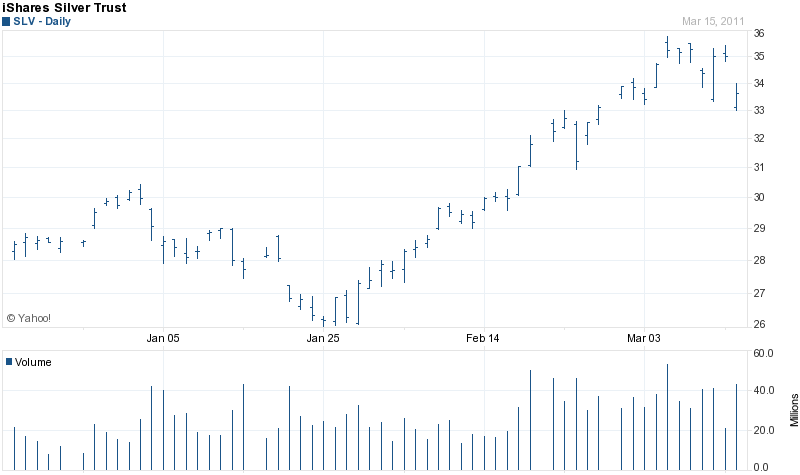

As measured by the closing London PM Fix Price, silver closed today at $35.91, up slightly from last Wednesday’s close of $35.26. Silver has been consolidating in the mid 30 range after the early May sell off.

As of June 22, 2011, the SLV held 307.3 million ounces of silver valued at $11.0 billion.

Silver seems to be building a base in the mid $30’s and presents a buying opportunity for long term investors.

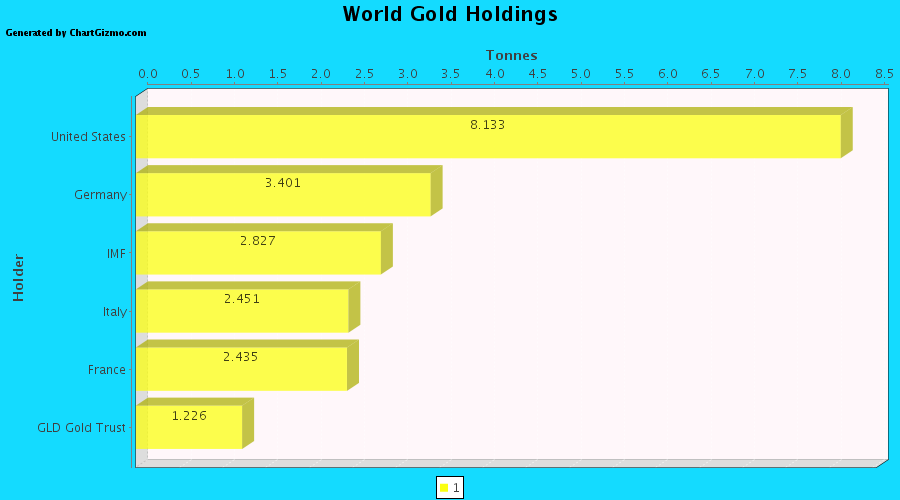

GLD and SLV Holdings (metric tonnes)

| June 22-2011 | Weekly Change | YTD Change | |

| GLD | 1,209.14 | +9.09 | -71.58 |

| SLV | 9,559.38 | -106.14 | -1,362.19 |

Holdings of the SPDR Gold Shares Trust (GLD) gained by 9.09 tonnes on the week after a decline of 11.52 tonnes in the previous week. The GLD currently holds 38.88 million ounces of gold valued at $60.3 billion.

As measured by the closing London PM Fix Price, gold closed on Wednesday at $1,552.50, a new closing high on the year. The price of gold remains in a solid uptrend supported by huge physical demand from investors and central banks.

Silver holdings of the iShares Silver Trust (SLV) jumped to another new record high this week while holdings of the SPDR Gold Shares Trust (GLD) dropped slightly.

Silver holdings of the iShares Silver Trust (SLV) jumped to another new record high this week while holdings of the SPDR Gold Shares Trust (GLD) dropped slightly.

The holdings of the iShares Silver Trust (SLV) soared to an all time high this week, while the holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

The holdings of the iShares Silver Trust (SLV) soared to an all time high this week, while the holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade.

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade.