Silver holdings of the iShares Silver Trust (SLV) jumped to another new record high this week while holdings of the SPDR Gold Shares Trust (GLD) dropped slightly.

Silver holdings of the iShares Silver Trust (SLV) jumped to another new record high this week while holdings of the SPDR Gold Shares Trust (GLD) dropped slightly.

The SLV holdings increased by 22.93 tonnes to surpass last week’s record high. Holdings of the SLV now total 11,162.45 tonnes or 358.9 million ounces of silver valued at $14.2 billion. Since silver began its nonstop advance in late January, holdings of the SLV have increased by a substantial 757.28 tonnes.

GLD and SLV Holdings (metric tonnes)

| 6-April-2011 | Weekly Change | YTD Change | |

| GLD | 1,205.47 | -6.37 | -75.25 |

| SLV | 11,162.45 | +22.93 | +240.88 |

The London Fix Price for silver increased by $2.10 (5.6%) over the past week, closing today just below $40 at $39.63. The price of silver has now reached levels last seen 31 years ago in 1980. Patient silver investors who took the opportunity to increase holdings when the metal was below $10 per ounce are now enjoying the profit of patience.

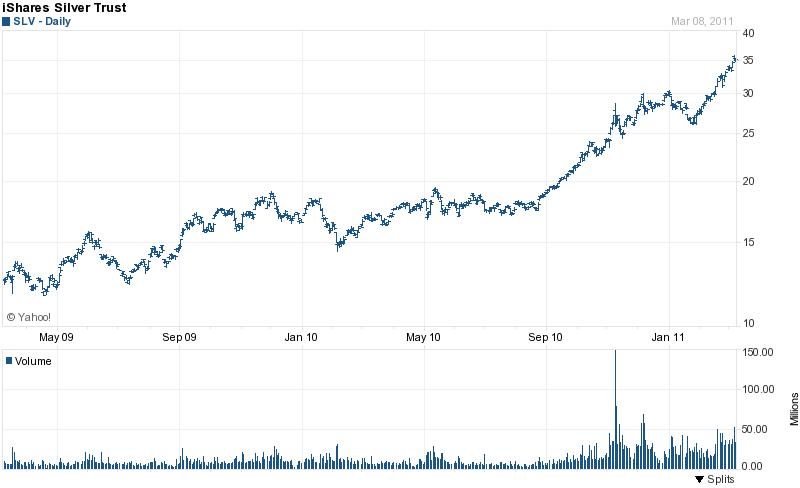

The astonishing rally in silver prices since late last August has resulted in a gain of 114% for the SLV. Profits from owning the ProShares Ultra Silver ETF (which does not hold physical silver) have been even more dramatic for silver bulls with a gain of over 400% since last August.

Despite the large price gains in silver since late January, we have not yet witnessed a large volume price spike as was seen in early November 2010 which lead to a 3 month price consolidation. The next logical resistance level for silver would be on its approach to $50. Besides the psychological resistance of round numbers, the all time high of silver is $48.70 reached in January 1980.

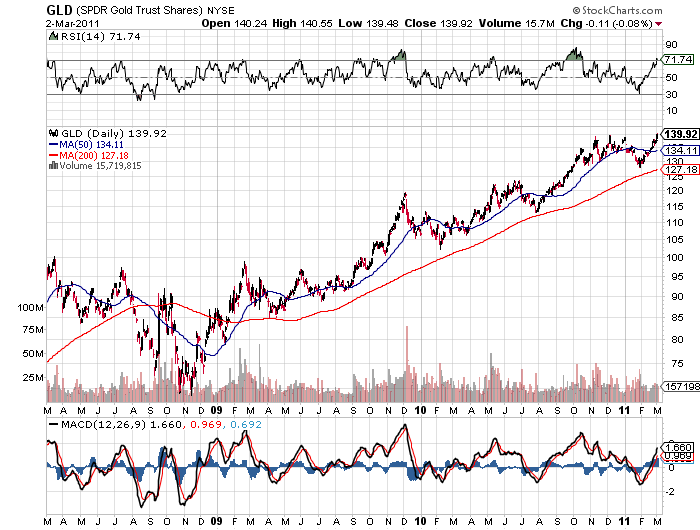

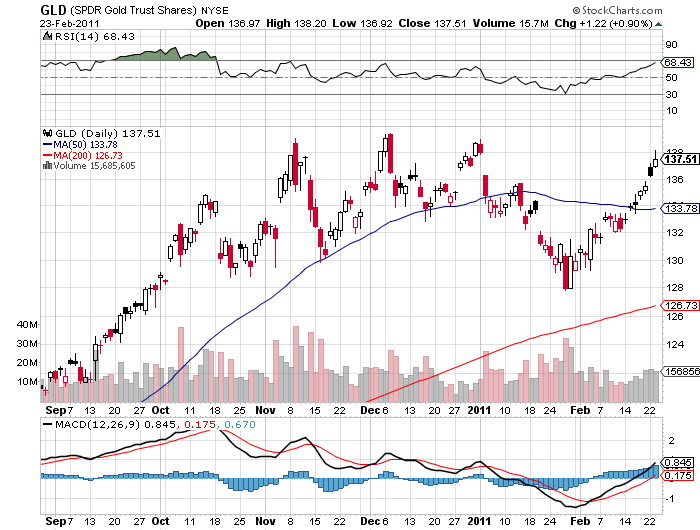

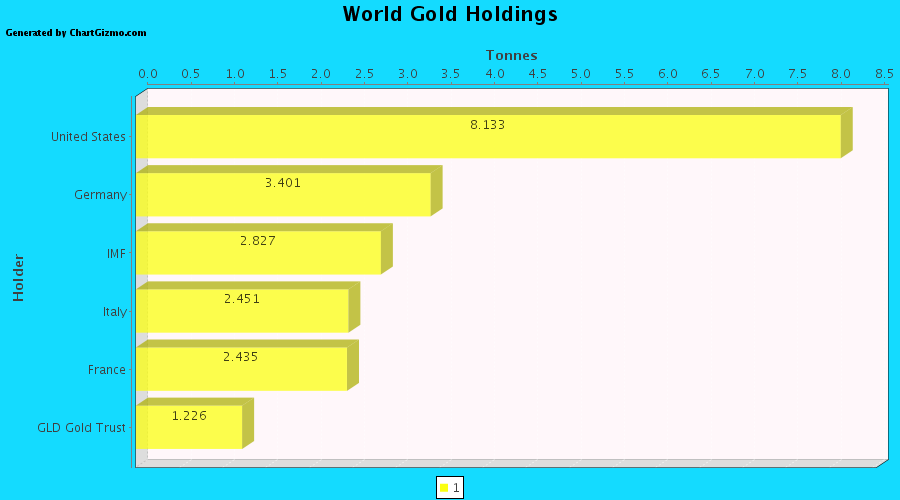

Holdings of the GLD declined by 6.37 tonnes on the week, bringing the decline in gold bullion holdings to 75.25 tonnes since the beginning of the year. The all time record holdings of the GLD reached 1,320.47 tonnes on June 29, 2010. The SPDR Gold Shares Trust (GLD) now holds a total of 38.8 million ounces of gold valued at $56.6 billion.

The price of gold, as measured by the closing London PM Fix Price hit an all time high today of $1,461.50 and has now broken through resistance at the $1,450 level. Many analysts are now targeting $1,500 as their next price objective. Fundamentals favoring the gold market continue to be strong, especially as the U.S. continues inexorably towards a debt crisis at some point in the future (see Gold and Silver Soar As Budget Fiasco Sends Wrong Message to U.S. Creditors).

The holdings of the iShares Silver Trust (SLV) soared to an all time high this week, while the holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

The holdings of the iShares Silver Trust (SLV) soared to an all time high this week, while the holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

The holdings of the iShares Silver Trust (SLV) increased on the week while holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

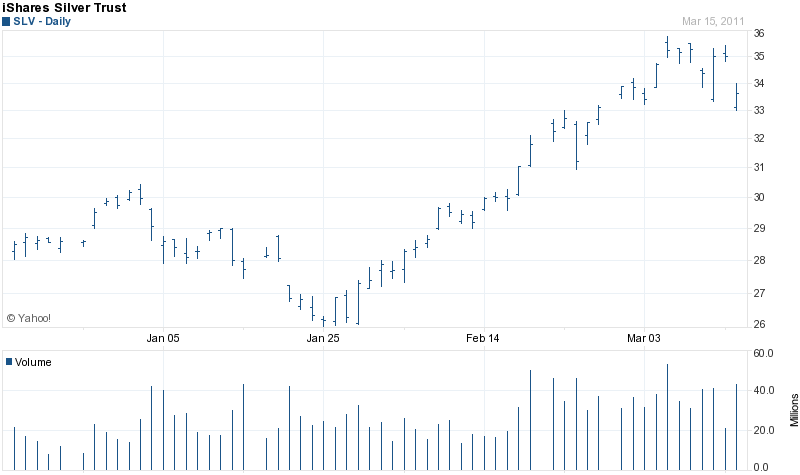

The holdings of the iShares Silver Trust (SLV) increased on the week while holdings of the SPDR Gold Shares Trust (GLD) declined slightly. During Wednesday trading, the iShares Silver Trust (SLV) reached an all time high price. At the time of this post, shares were trading up 78 cents to $36.32, which exceeds the previous high of $35.27 reached in early March.

During Wednesday trading, the iShares Silver Trust (SLV) reached an all time high price. At the time of this post, shares were trading up 78 cents to $36.32, which exceeds the previous high of $35.27 reached in early March.