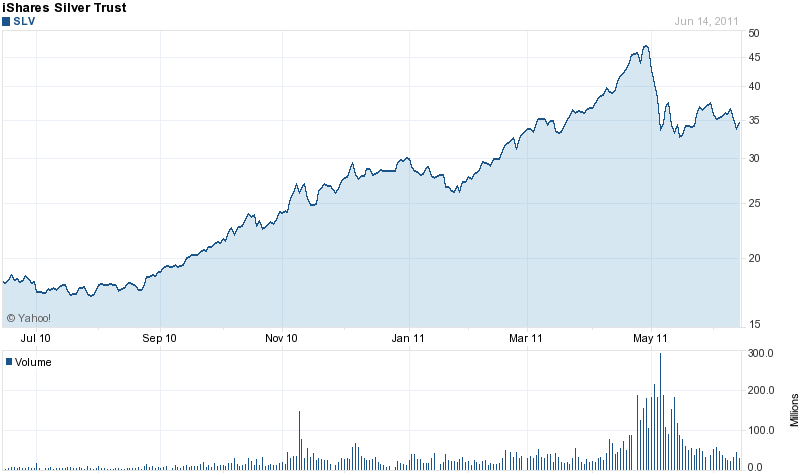

Holdings of the iShares Silver Trust (SLV) declined by 248.69 tonnes for the week after declining by 27.12 tonnes in the previous week. The year to date decline of silver held by the SLV is 1,256.05 tonnes.

Holdings of the iShares Silver Trust (SLV) declined by 248.69 tonnes for the week after declining by 27.12 tonnes in the previous week. The year to date decline of silver held by the SLV is 1,256.05 tonnes.

The holdings of the SLV hit an all time high on April 25, 2011 at 11,390.06 tonnes and the decline from this high now totals a substantial 1,724.54 tonnes. Total holdings of the SLV have declined by 15.1% from the high of April 25, while the price of silver has declined by 27.6% from its high of $48.70 reached on April 28th.

Silver closed today at $35.26 (as measured by the closing London PM Fix price), up $8.58 from the low of the year at $26.68 reached on January 28th. Shares of the SLV closed today at $34.88, down $13.47 from the high of the year at $48.35.

The iShares Silver Trust currently holds 310.8 million ounces of silver valued at $10.95 billion. At the start of 2011, the SLV held 351.1 million ounces of silver valued at $10.9 billion. The holdings of the iShares Silver Trust does not directly track the price movement in silver due to the manner in which it is structured. For a discussion of how SLV shares are created or redeemed by Authorized Participants, see How Wall Street Made Profits On Silver ETF Crash.

According to the iShares website, the SLV closed yesterday at a premium of 2.54% to the fund’s net asset value. On rare occasions when silver is exhibiting large price swings, the premium or discount to net asset value has been as large as 6%.

GLD and SLV Holdings (metric tonnes)

| June 15-2011 | Weekly Change | YTD Change | |

| GLD | 1,200.05 | -11.52 | -80.67 |

| SLV | 9,665.52 | -248.69 | -1,256.05 |

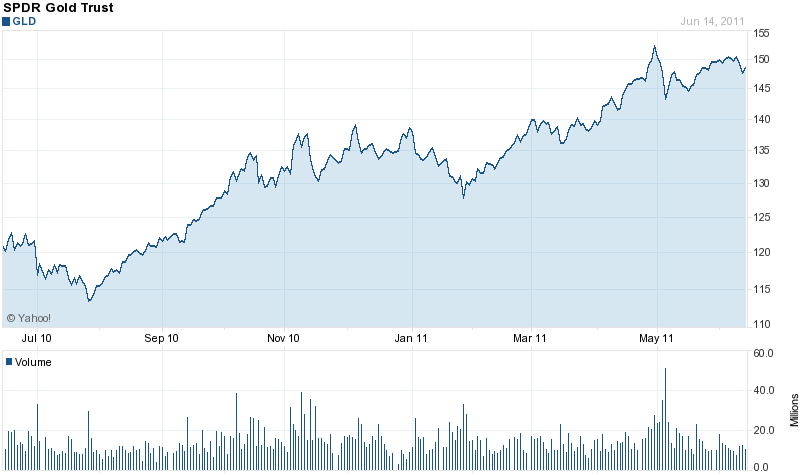

Holdings of the SPDR Gold Shares Trust (GLD) declined on the week by 11.52 tonnes, after declining in the previous week by 1.30 tonnes. The GLD currently holds 38.58 million ounces of gold valued at $59.0 billion. The all time record holdings of the GLD was 1,320.47 tonnes on June 29, 2010.

Gold traded in a narrow range over the past week, declining by $8 per ounce. Gold has stayed above the $1,500 level since May 20th and has gained $141.25 since the beginning of the year.

Shares of the SPDR Gold Trust closed at $149.12, up $0.45, not far off the year’s high of $153.61.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

The iShares Silver Trust (SLV) saw silver holdings slump on the week while holdings of the SPDR Gold Shares Trust (GLD) increased.

The iShares Silver Trust (SLV) saw silver holdings slump on the week while holdings of the SPDR Gold Shares Trust (GLD) increased.