It wasn’t supposed to be like this.

It wasn’t supposed to be like this.

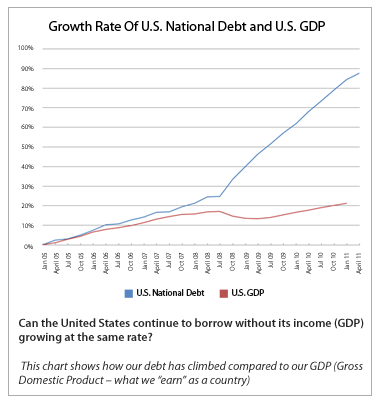

A default on Greek debt was supposed to have set off a chain reaction collapse of other weak sovereign debtors including Ireland, Spain, Portugal and Italy. European banks holding huge amounts of Greek debt would be rendered insolvent pushing Europe into a banking crisis. U.S. banks, holding large positions in credit default swaps and derivatives would follow the European banks into a downward spiral as both confidence and liquidity evaporated.

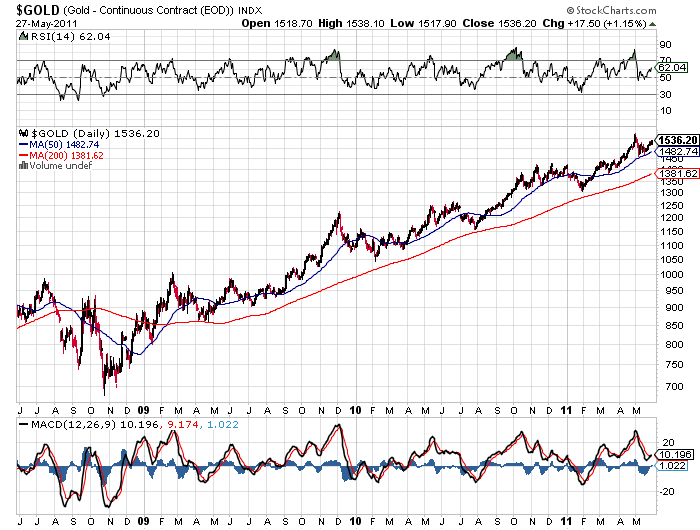

Money market funds, piled high with toxic debt securities issued by insolvent European banks would be facing a massive run by nervous shareholders. Central banks, the last great hope of insolvent nations, would be forced to come to the rescue with oceans of printed money. Nervous holders of paper currencies would rush into gold driving prices sharply higher.

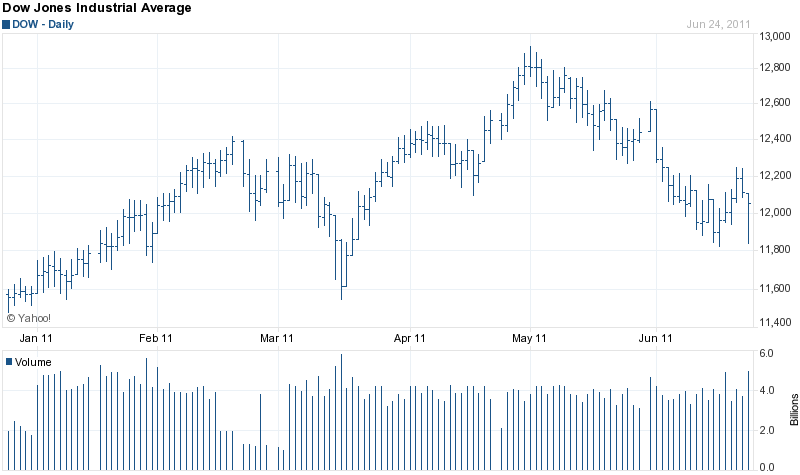

The plausible scenario of default by insolvent members of the European Union suddenly got turned upside with stocks exploding higher and gold prices hitting a six week low.

Bloomberg – Gold Falls to Six-Week Low Amid Reduced Concern Greece May Default On Debt

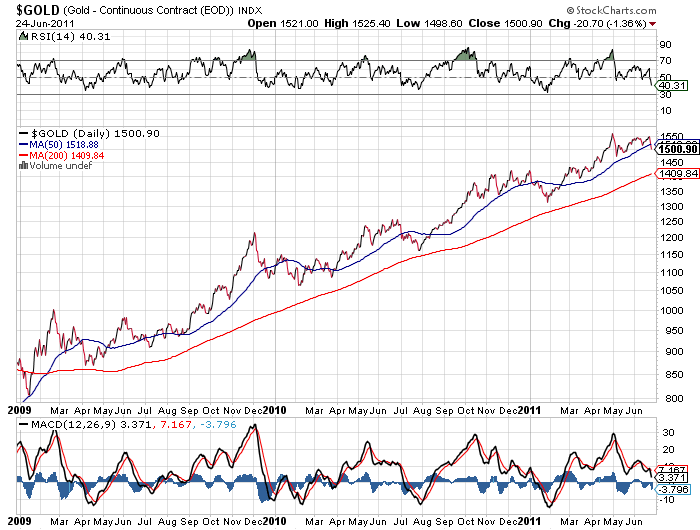

Gold futures tumbled to a six-week low as Greece progressed in staving off a default, curbing demand for the metal as an investment haven.

Greece may get as much as 85 billion euros ($124 billion) in new financing, including a contribution from private investors, in a second bailout aimed at preventing default and ending the euro region’s debt crisis, according to an Austrian Finance Ministry official. Gold dropped 2.2 percent last month.

“Gold’s inability to extend further gains in recent sessions, despite a weaker dollar, could be a warning sign heading into the third quarter,” Australia & New Zealand Banking Group Ltd. (ANZ) said in a report.

The Austrian finance official effectively said that the euro region’s debt crisis was solved by extending further credit to a blatantly insolvent Greece – too much debt was cured with more debt.

The extend and pretend policies, used extensively by policy makers in every past crisis would be employed again, this time to a nation with the lowest rated sovereign debt in the world.

The success of extending further loans to Greece would be guaranteed by the sale of Greek national assets and forcing every citizen of Greece to endure a depressionary lifestyle. Other members of the EU facing a debt crisis could be handled in the same manner. The European Central Bank and Wall Street popped the champagne corks and celebrated the end of the debt crisis.

The surreal events of the past two weeks only reinforce the certainty of a greater debt unwind at a fast approaching future date. Expecting Greece to repay its obligations is simply not economically feasible. Greek citizens, rioting against austerity measures, have made it clear that default is the best option. Political leaders of Greece, the birthplace of democracy, must eventually accept the public will.

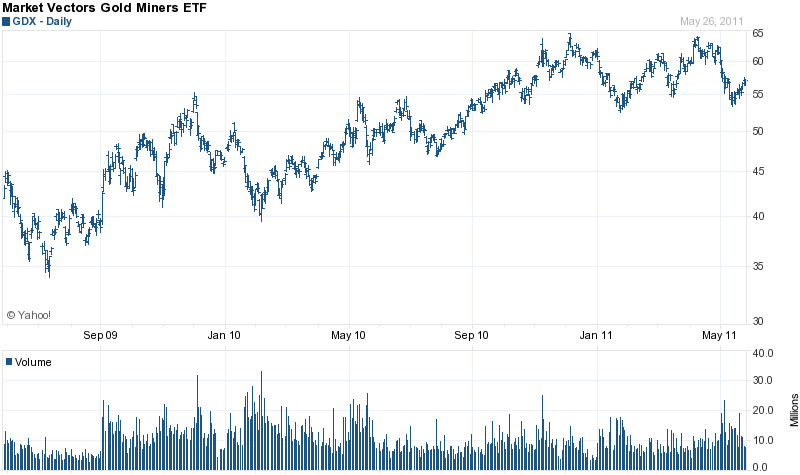

The debt crisis has not been resolved, it has been expanded. Investors foolish enough to convert precious metal holdings back into paper currency are giving serious long term gold and silver investors a gift opportunity to accumulate at bargain prices.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,483.00 | -31.75 (-2.10%) |

| Silver | $33.85 | -0.88(-2.53%) |

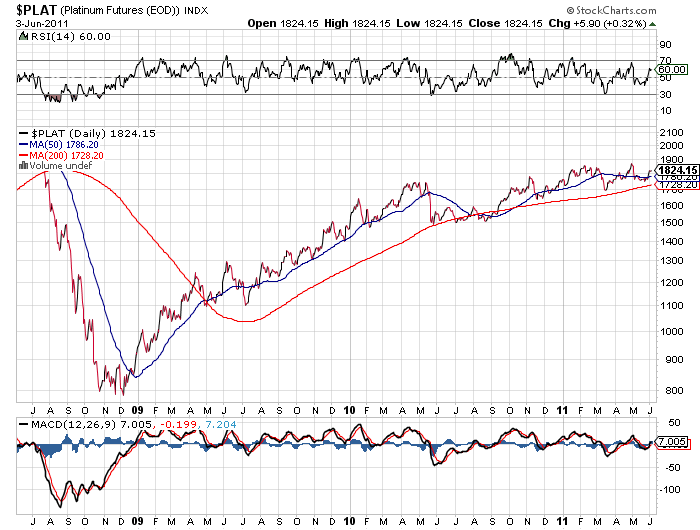

| Platinum | $1,708.00 | +12.00 (+0.71%) |

| Palladium | $750.00 | +11.00 (+1.49%) |

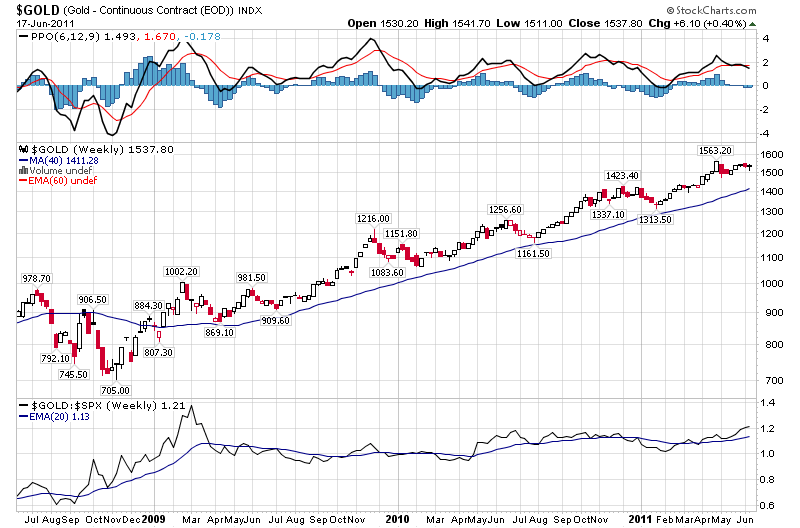

Gold and silver both declined on the week by over 2%, while platinum and palladium saw modest gains.

As measured by the closing London PM Fix Price, gold has declined by $69.50 since June 22.

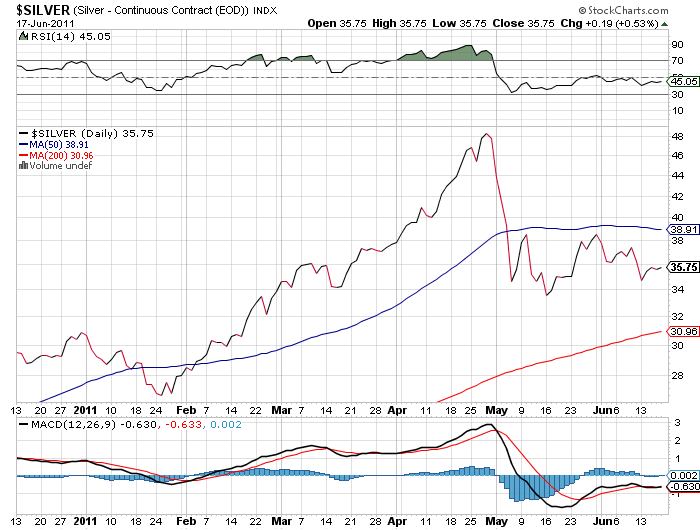

Silver has now declined three weeks in a row. Since June 1st, as measured by the London PM Fix Price, silver has declined by $4.10 per ounce or 10.8%.

As predicted on Monday, the Federal Reserve policy meeting and subsequent press conference by Fed Chief Ben Bernanke had the potential to cause an explosive move up in the precious metal markets. (see

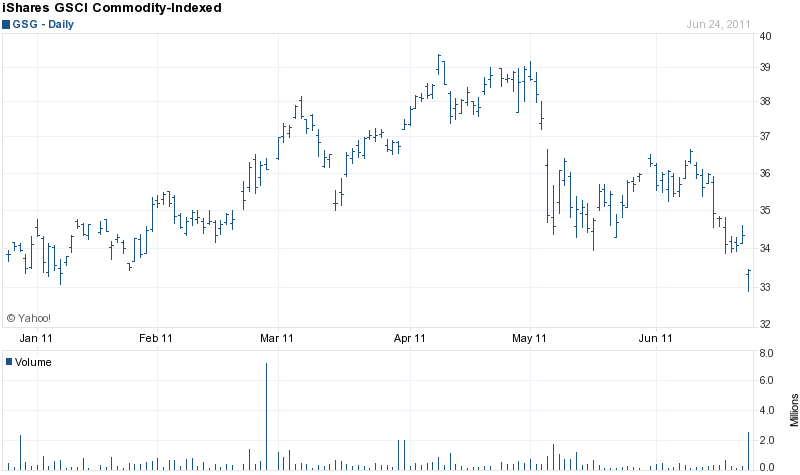

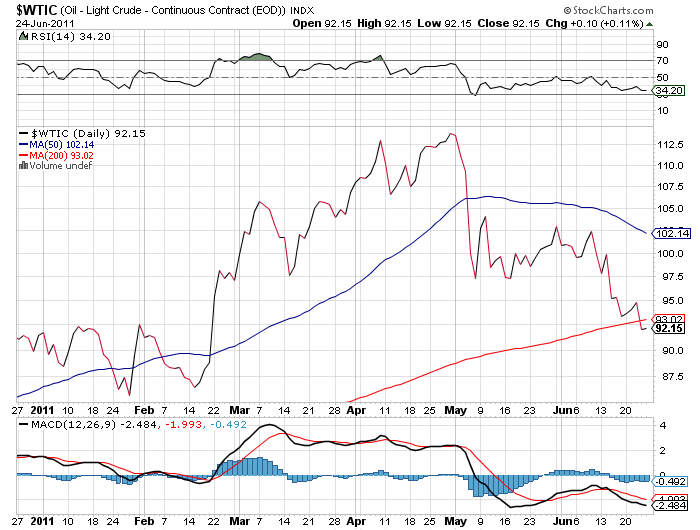

As predicted on Monday, the Federal Reserve policy meeting and subsequent press conference by Fed Chief Ben Bernanke had the potential to cause an explosive move up in the precious metal markets. (see  Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.

Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.