Gold and silver prices, as measured by the London PM Fix Price, moved to new highs on the week.

Gold and silver prices, as measured by the London PM Fix Price, moved to new highs on the week.

Gold, as measured by the closing London PM Fix Price, gained $16 per ounce on the week and hit an all time high of $1,447 on Thursday. After soaring 30% last year, investors still have plenty of reasons to allocate part of their portfolio to precious metals.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,436.00 | +16.00 (+1.13%) |

| Silver | $37.68 | +2.53 (+7.20%) |

| Platinum | $1,752.00 | +32.00 (+1.86%) |

| Palladium | $754.00 | +27.00 (+3.71%) |

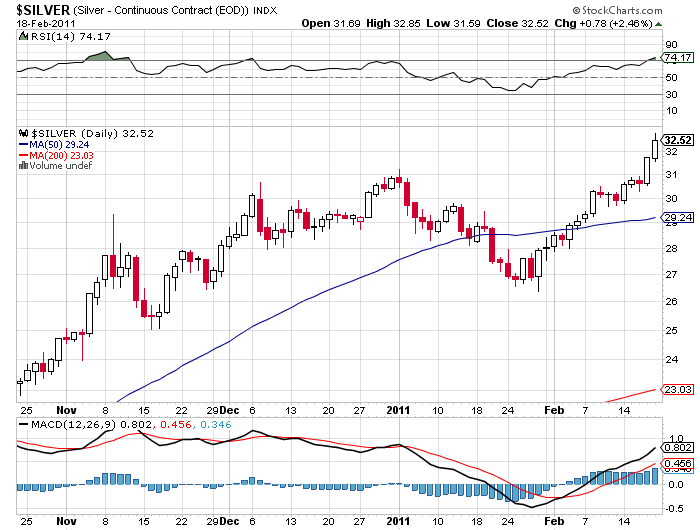

Silver was once again the standout performer among the precious metals, gaining $2.53 per ounce on the week. The price of silver has now risen by over 10% in the past two weeks and is up from a yearly low of $27 in late January. Silver has far outpaced the gains in gold, which has resulted in a decline in the gold/silver ratio to 38, which is the lowest since late 1983. A return to the long term historical gold/silver ratio would result in silver prices approaching $100 per ounce.

SILVER - COURTESY STOCKCHARTS.COM

The surge in silver prices caused the CME to increase margin requirements on silver futures, which contributed to a pullback in prices on Thursday. The move by the CME was seen by some as a manipulation tactic to bring down the price of silver, but increased margin requirements are common when prices are rapidly increasing. Small and underfunded speculators may have to liquidate, but in the long term silver will merely move from weak hands to strong hands. Increased margin requirements on highly leveraged positions can produce a short term sell off, but it does nothing to change long term fundamentals.

Platinum and palladium, which both lost over 3% last week, gained on the week as fears of reduced industrial demand were eased by estimates of the huge reconstruction cost in Japan. The rebuilding of Japan is likely to result in higher prices for all types of commodities and an increased rate of global inflation.

As measured by the London PM Fix price, gold and silver prices gained on the week after declining approximately 1% each in the previous week. Gold gained $8.50 per ounce on the week to $1,420.00. Silver was the stand out gainer on the week with a 3% or $1.05 per ounce gain. As the situation in Japan and Libya stabilized somewhat, the recent panic selling in financial markets subsided as bargain hunters moved in, although in late trading, stocks gave up much of their gains. Gold and silver also pulled back slightly in New York trading with gold at $1417.80 and silver at $35.10.

As measured by the London PM Fix price, gold and silver prices gained on the week after declining approximately 1% each in the previous week. Gold gained $8.50 per ounce on the week to $1,420.00. Silver was the stand out gainer on the week with a 3% or $1.05 per ounce gain. As the situation in Japan and Libya stabilized somewhat, the recent panic selling in financial markets subsided as bargain hunters moved in, although in late trading, stocks gave up much of their gains. Gold and silver also pulled back slightly in New York trading with gold at $1417.80 and silver at $35.10.

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

As turmoil reigned in the Middle East and worries mounted over the reduction of oil supplies, gold and silver proved their safe haven status as both moved higher in price.

Another Precious Week

Another Precious Week

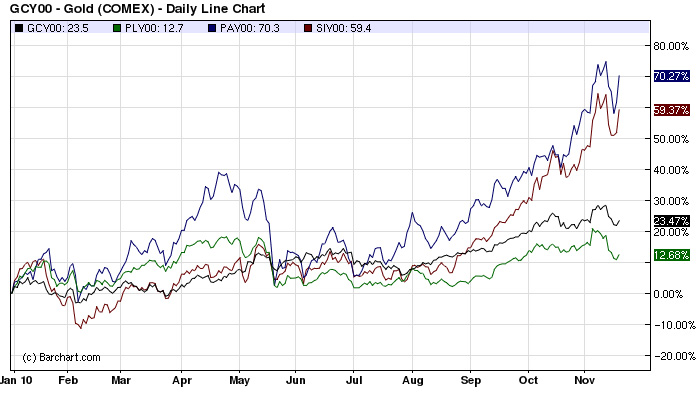

While gold and silver have dominated the media spotlight this year, the price of palladium has outperformed both. For the year to date, palladium is up $337 per ounce or more than 85%.

While gold and silver have dominated the media spotlight this year, the price of palladium has outperformed both. For the year to date, palladium is up $337 per ounce or more than 85%. Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date.

Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date.