According to the just released World Silver Survey published by the Silver Institute, global investment and fabrication demand were the primary factors that pushed silver prices higher in 2010. Of major note among the many statistics released by the Institute, is the fact that despite rising prices and increased demand, mine production of silver rose by only 2.5% during 2010.

According to the just released World Silver Survey published by the Silver Institute, global investment and fabrication demand were the primary factors that pushed silver prices higher in 2010. Of major note among the many statistics released by the Institute, is the fact that despite rising prices and increased demand, mine production of silver rose by only 2.5% during 2010.

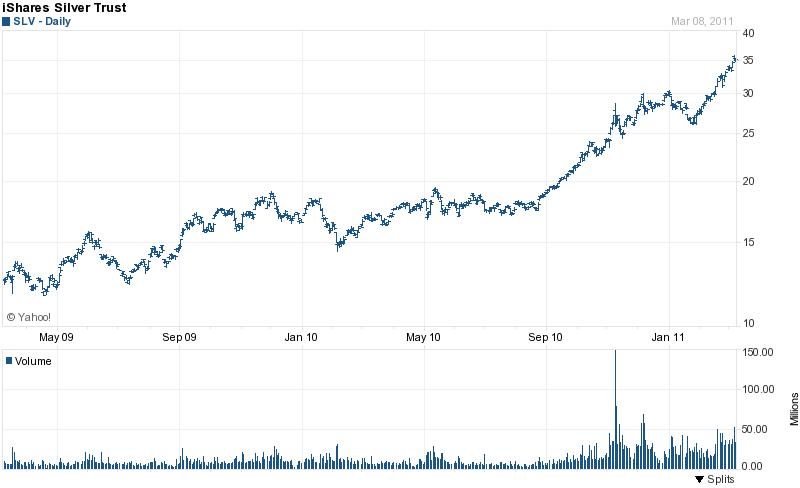

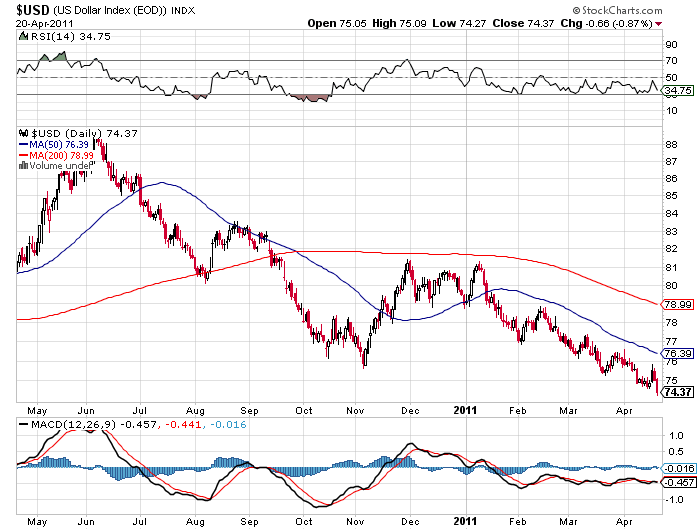

The Silver Institute survey showed increased demand during 2010 despite a 38% average increase in the price of silver to $20.19. The increase in silver prices during 2010 was the largest price gain since 1980.

Silver investment, one of the largest categories of silver demand, rose by 40% during 2010 to 279.3 million ounces, almost double the amount for 2009.

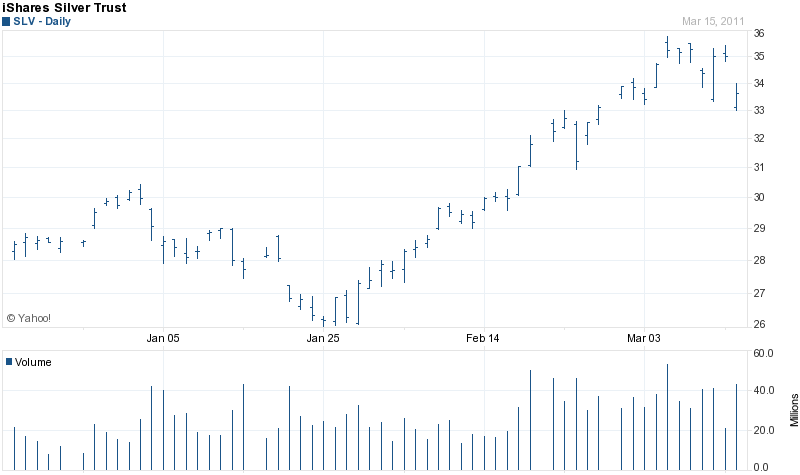

The amount of silver held by silver ETFs rose to 582.6 million ounces during 2010, an increase of 114.9 million ounces over 2009. The largest increase in silver holdings was by the iShares Silver Trust (SLV) which accounted for 40% of the total increase.

Demand for physical silver reached new milestones in 2010. Silver used in coin and medal production rose by 28% to 101.3 million ounces. Sales of U.S. Silver Eagles reached 34.6 million, far ahead of the previous record of 29 million reached in 2009. Sales of bullion coins by mints in Australia and Canada also hit new highs. Investors also purchased 55.6 million ounces of silver in the form of bullion bars during 2010.

Silver fabrication demand hit a ten year high of 878.8 million ounces, an increase of almost 13% over 2010. Industrial applications increased by almost 21% to 487.4 million ounces. Jewelry increased by 5%, showing the biggest increase in demand since 2003. Photography was the only category that experienced a decline with usage falling by 6.6 million ounces.

The Silver Institute notes that demand for silver in industrial application is particularly strong in electronics and thermal applications. New industrial applications using silver are expected to account for an additional 40 million ounces of demand by 2015. Silver’s unique chemical properties are constantly leading to new industrial demand, one example being the development of products using silver as an antibacterial agent.

The increased demand for silver has encouraged new mine exploration and production. Nonetheless, despite efforts by mining companies, silver production increased by a very modest 2.5% during 2010 to 753.9 million ounces. The largest silver producer in 2010 was Mexico, followed by Peru, China, Australia and Chile.

Silver from above ground stocks increased to 142.9 million ounces due to a 14% higher scrap supply, net producer hedging and a significant increase in sales from government stocks to 44.8 million ounces. The primary seller of government silver stocks was Russia.

Silver has had a recent pullback after extraordinary gains over the previous two years. Some experts see a buying opportunity. Michael Haynes, CEO of AMPEX, one of the country’s largest precious metals dealers, commented on the silver pullback in an interview with CNBC. According to Mr. Haynes “The Middle America, the individual investor across the world is just now beginning to take hold of this concept and they’re not day traders. They’re not looking to buy today and sell this afternoon, sell next week. They have a long time frame; 3 to 5 years. So they’re purchasing this asset, not because they want to make money today, but they are looking at it almost like an insurance policy or a hedge against the rest of their portfolio.”

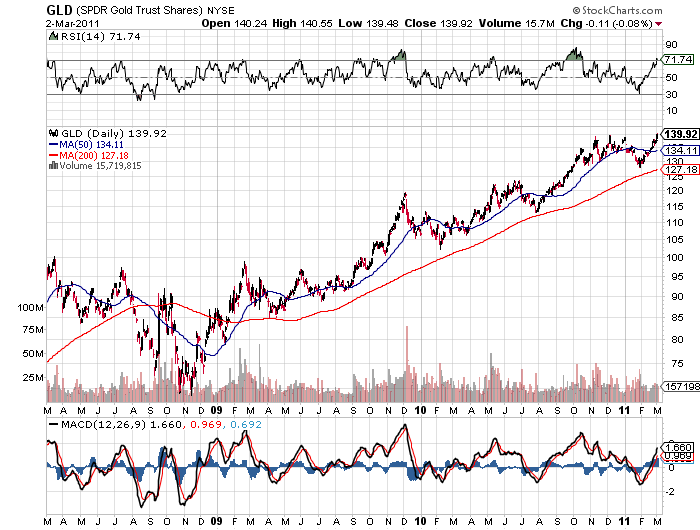

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

The iShares Silver Trust (SLV) saw silver holdings slump on the week while holdings of the SPDR Gold Shares Trust (GLD) increased.

The iShares Silver Trust (SLV) saw silver holdings slump on the week while holdings of the SPDR Gold Shares Trust (GLD) increased.

The holdings of the iShares Silver Trust (SLV) increased on the week while holdings of the SPDR Gold Shares Trust (GLD) declined slightly.

The holdings of the iShares Silver Trust (SLV) increased on the week while holdings of the SPDR Gold Shares Trust (GLD) declined slightly. During Wednesday trading, the iShares Silver Trust (SLV) reached an all time high price. At the time of this post, shares were trading up 78 cents to $36.32, which exceeds the previous high of $35.27 reached in early March.

During Wednesday trading, the iShares Silver Trust (SLV) reached an all time high price. At the time of this post, shares were trading up 78 cents to $36.32, which exceeds the previous high of $35.27 reached in early March.

Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.

Holdings of silver in the iShares Silver Trust (SLV) declined slightly on the week, while holdings in the SPDR Gold Shares Trust (GLD) remained unchanged.